Indian corporates are increasingly gravitating back toward bank financing as the cost gap between bank loans and bond market rates...

India remains confident it will meet its fiscal deficit target of 4.4% of GDP for FY26 despite introducing major consumption...

The latest ET Editorial — “GST 2.0: Great Sense (of) Timing” by MS Mani — applauds the government’s decision to...

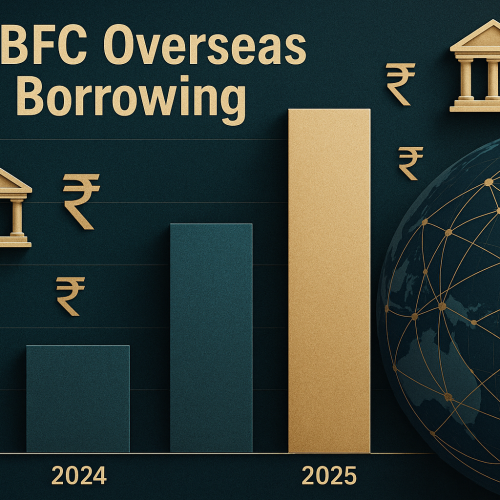

Indian Non-Banking Financial Companies (NBFCs) have rapidly ramped up their external borrowing in 2025, raising a substantial $3.67 billion through...

India’s foreign exchange (forex) reserves increased by $4.74 billion, climbing to $693.62 billion for the week ending August 8, as...

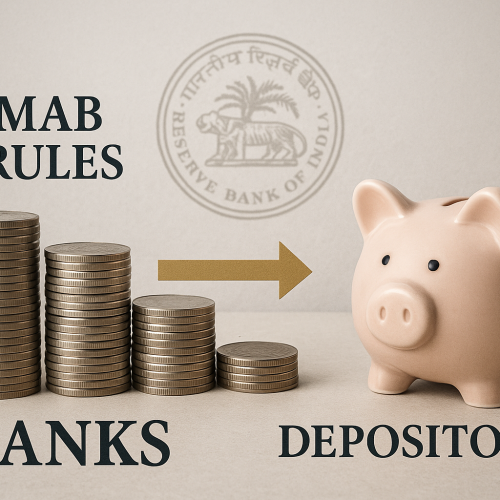

A recent policy shake-up brought the minimum average balance (MAB) practice to the spotlight after ICICI Bank raised its MAB...

The government’s newly launched FASTag Annual Pass saw spectacular adoption on its very first day—approximately 139,000 passes were sold across...

India is poised to become a global benchmark in data quality, trailblazing standards that even developed nations could adopt, according...

In a much-anticipated “Diwali gift” to the nation, the Indian government is poised to overhaul the Goods and Services Tax...

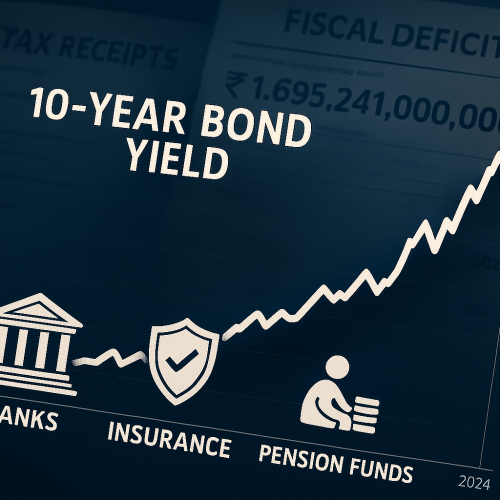

India’s multi-month bull run in long-duration government bonds has hit a roadblock. Rally momentum is fading as demand from key...

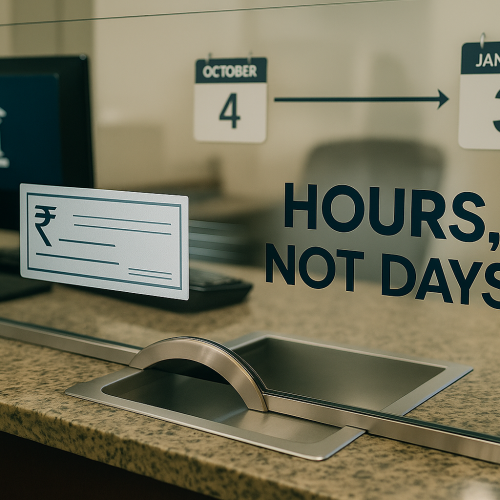

The Reserve Bank of India (RBI) is set to drastically shorten cheque clearance times under a new efficiency-driven reform called...

Economists expect the Reserve Bank of India (RBI) to keep interest rates unchanged in the near term, signalling that its...

India is bracing for the economic turbulence triggered by the U.S. doubling tariffs on Indian exports—a retaliatory measure over India’s...

As India enters a new phase of digital expansion with over a billion additional users joining the economic mainstream in...

Kerala State Financial Enterprises (KSFE), a state-run miscellaneous non-banking financial company (MNBC), has become the first MNBC in India to...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.