Following a challenging FY25 marked by accounting irregularities and a leadership reshuffle, IndusInd Bank is recalibrating for growth with a renewed focus on retail deposits, secured retail lending, MSME portfolios, and rural outreach....

Following a challenging FY25 marked by accounting irregularities and a leadership reshuffle, IndusInd Bank is recalibrating for growth with a renewed focus on retail deposits, secured retail lending, MSME portfolios, and rural outreach....

After withdrawing the original Income Tax Bill, 2025 due to drafting errors and ambiguities, the Government of India will reintroduce a revised version in the Lok Sabha today. The updated Bill addresses key...

the Securities and Exchange Board of India (SEBI) mandated financial intermediaries—including mutual funds, stockbrokers, PMS, AIFs, RIAs, depositories, and exchanges—to make their digital platforms fully accessible to persons with disabilities (PwDs), aligning with...

After withdrawing the original Income Tax Bill, 2025 amidst concerns over drafting errors and legal ambiguities, the government is set to reintroduce a revised, refined version to Parliament today (August 11, 2025). Key...

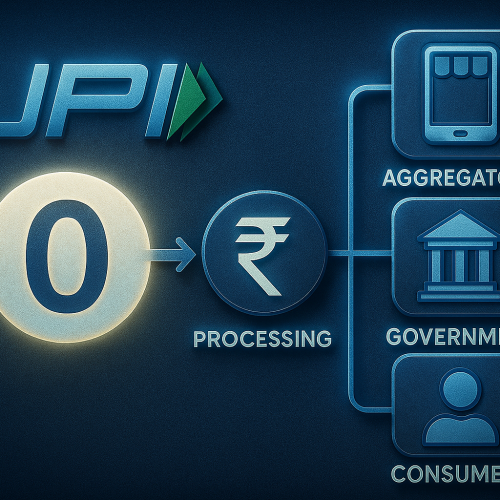

Reserve Bank of India Governor Sanjay Malhotra emphasized that while the Unified Payments Interface (UPI) has delivered transformative results, the cost of sustaining it can’t be ignored. He clarified that, although UPI transactions...

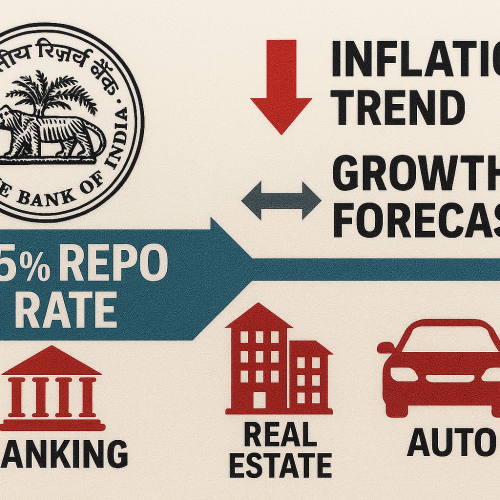

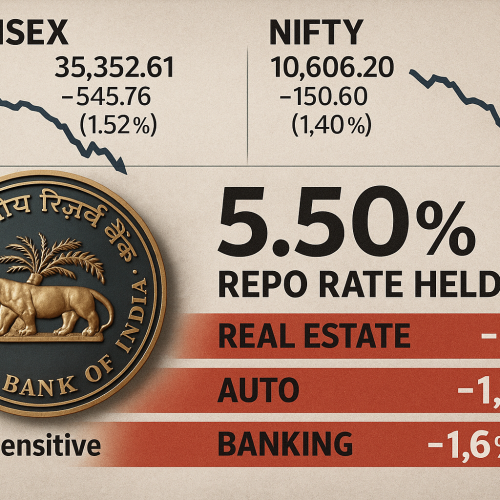

The State Bank of India (SBI) characterizes the RBI’s decision to hold the repo rate at 5.5% as a “technical pause.” With inflation projected to stay below 3% through Q3 FY26 and likely...

Securities and Exchange Board of India (SEBI) Chairman Tuhin Kanta Pandey has dismissed recent media speculation that SEBI plans to curb weekly index options expiry contracts, calling such claims “false and speculative.” He...

The Indian Finance Ministry has warned of a growing “trade policy dislocation” globally amid escalating geopolitical conflicts, notably in West Asia. These developments have prompted the government to suspend its Medium-Term Expenditure Framework...

Former U.S. President Donald Trump’s threat to impose a 25% tariff on Indian exports is raising alarms across global markets. Experts now recommend Indian investors reassess their portfolio allocations and seek strategic sector...

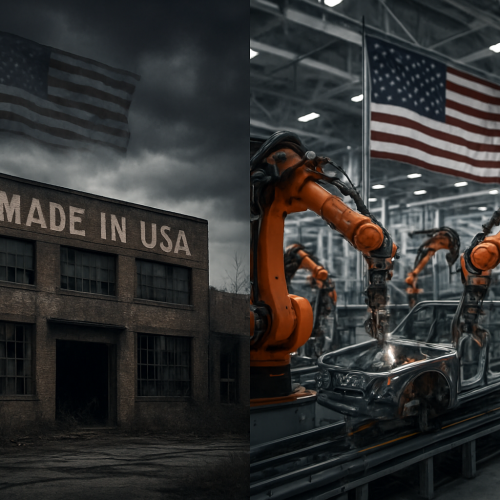

Despite bold campaign promises and sweeping tariffs, former U.S. President Donald Trump’s ambition to revitalize American manufacturing is faltering. Recent reports highlight that the U.S. manufacturing sector is facing a persistent downturn, marked...

At its August 6 meeting, the Reserve Bank of India’s Monetary Policy Committee (MPC) unanimously maintained the repo rate at 5.5% and retained a neutral stance. This marks the first pause after three...

Former U.S. President Donald Trump has doubled down on aggressive tariff policies under his “Liberation Deal” strategy—imposing steep duties on major trading partners. In exchange, he touts massive pledges from nations like Saudi...

The Reserve Bank of India (RBI), in its bi-monthly monetary policy review held on August 6, 2025, kept the repo rate unchanged at 5.5%, aligning with market expectations. The central bank retained a...

Following the launch of a 25% U.S. tariff on Indian goods, bilateral trade negotiations between India and the United States have hit major snags. While India remains open to dialogue, key disagreements over...

India has officially ruled out any immediate retaliatory measures in response to U.S. President Donald Trump’s surprise decision to impose a 25% tariff on Indian goods, effective August 1. Instead, New Delhi is exploring...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.