As India’s monetary policy enters a critical juncture, global ratings agency Fitch Ratings has noted that the Reserve Bank of India’s commitment to maintaining sufficient banking system liquidity could be a key enabler for effective transmission of future interest rate cuts.

While the RBI has yet to officially pivot to rate easing, Fitch’s assessment hints at how liquidity dynamics may play a quiet, yet powerful role in shaping borrowing costs across the economy.

Background

India’s benchmark interest rate—the repo rate—has remained steady at 6.5% since February 2023, as the central bank continues to balance inflation risks with growth imperatives.

However, with inflation moderating and policy focus subtly shifting toward supporting economic expansion, expectations are rising that the RBI could begin easing rates in the coming quarters.

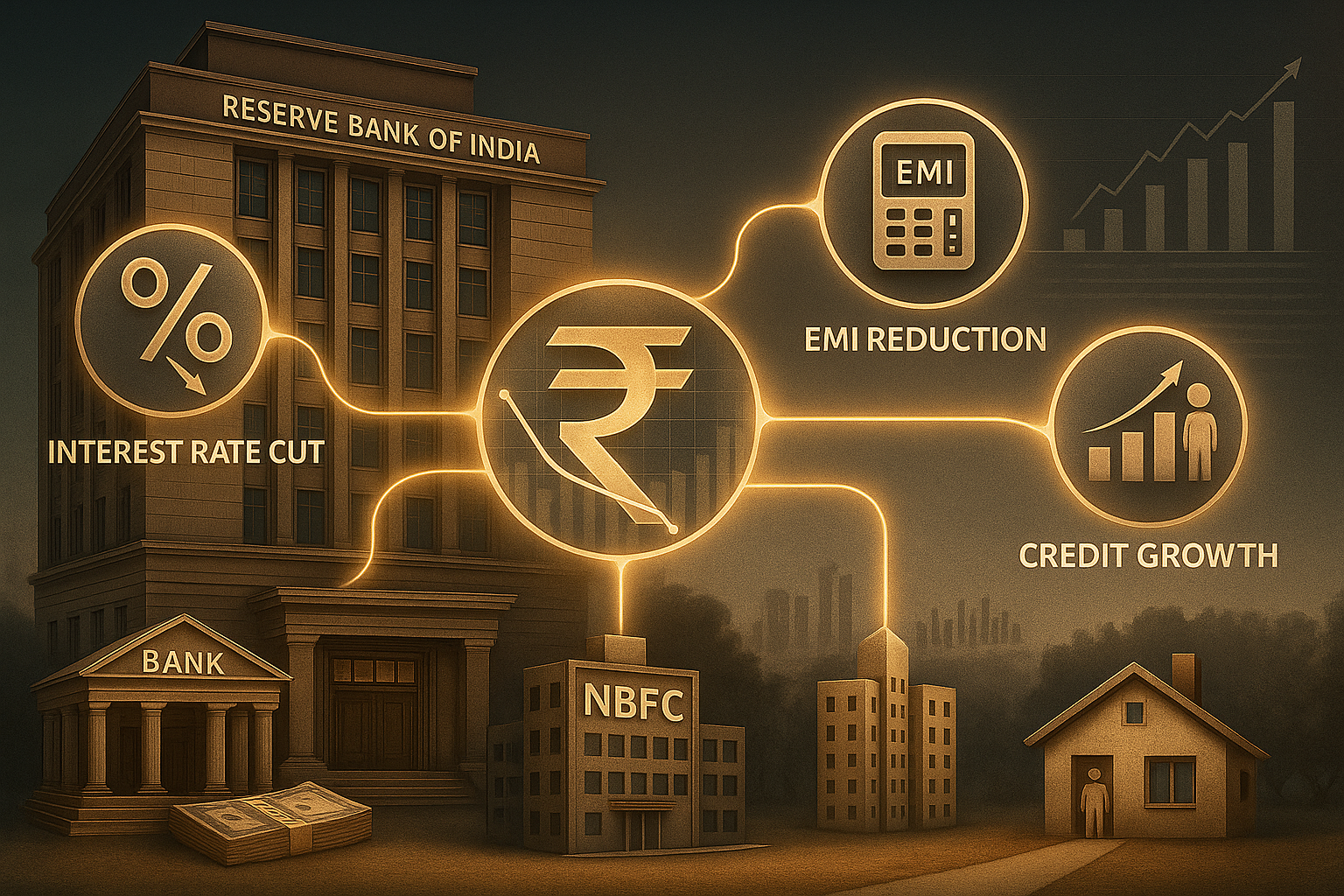

Amidst this backdrop, Fitch highlighted that a well-supported liquidity environment would allow banks and NBFCs to pass on future rate cuts to consumers and businesses more smoothly.

Fitch’s Key Observations

RBI’s liquidity management framework appears supportive of transmission.

A consistent liquidity surplus allows banks to lend at lower rates without margin pressure.

This becomes critical when policy rates are eased, as transmission to end-borrowers typically lags.

“The RBI has indicated its intent to maintain adequate liquidity in the banking system. This commitment will facilitate stronger rate transmission when the central bank begins cutting policy rates,” Fitch stated.

What’s at Stake?

In India, rate transmission has historically been sticky. While the RBI may lower repo rates, it doesn’t always immediately translate into lower EMIs, cheaper loans, or improved corporate borrowing conditions.

That’s often because banks face liquidity constraints or need to preserve interest margins. By ensuring liquidity stays comfortable, the RBI can shorten the lag between rate moves and real-world impact.

Expert View

CA Manish Mishra, macro-finance commentator:

“Liquidity is the silent engine behind monetary policy. Even a 25 bps cut won’t help much if banks are scrambling for funds. This is why RBI’s liquidity assurance matters.”

CA Manoj Kumar Singh, financial policy advisor:

“Fitch’s view is timely. India’s transmission pipeline has improved over the years, but sustained surplus liquidity—especially through government spending or OMOs—can accelerate the effect of future cuts.”

Broader Implications

Retail Borrowers: Cheaper credit lines and EMIs are more likely if banks don’t fear liquidity tightness.

NBFCs & Fintechs: Easier access to short-term funding improves cash flow and risk appetite.

Bond Market: May react positively to signals that rate easing will translate effectively.

Growth Outlook: Faster transmission could boost investment and consumption cycles.

Conclusion

Fitch’s commentary brings to light a crucial aspect of the RBI’s strategy — stability in system liquidity as a precondition to effective rate easing. As markets look for cues on when and how the RBI might cut rates, the groundwork being laid through liquidity management could be just as important as the actual policy move itself.