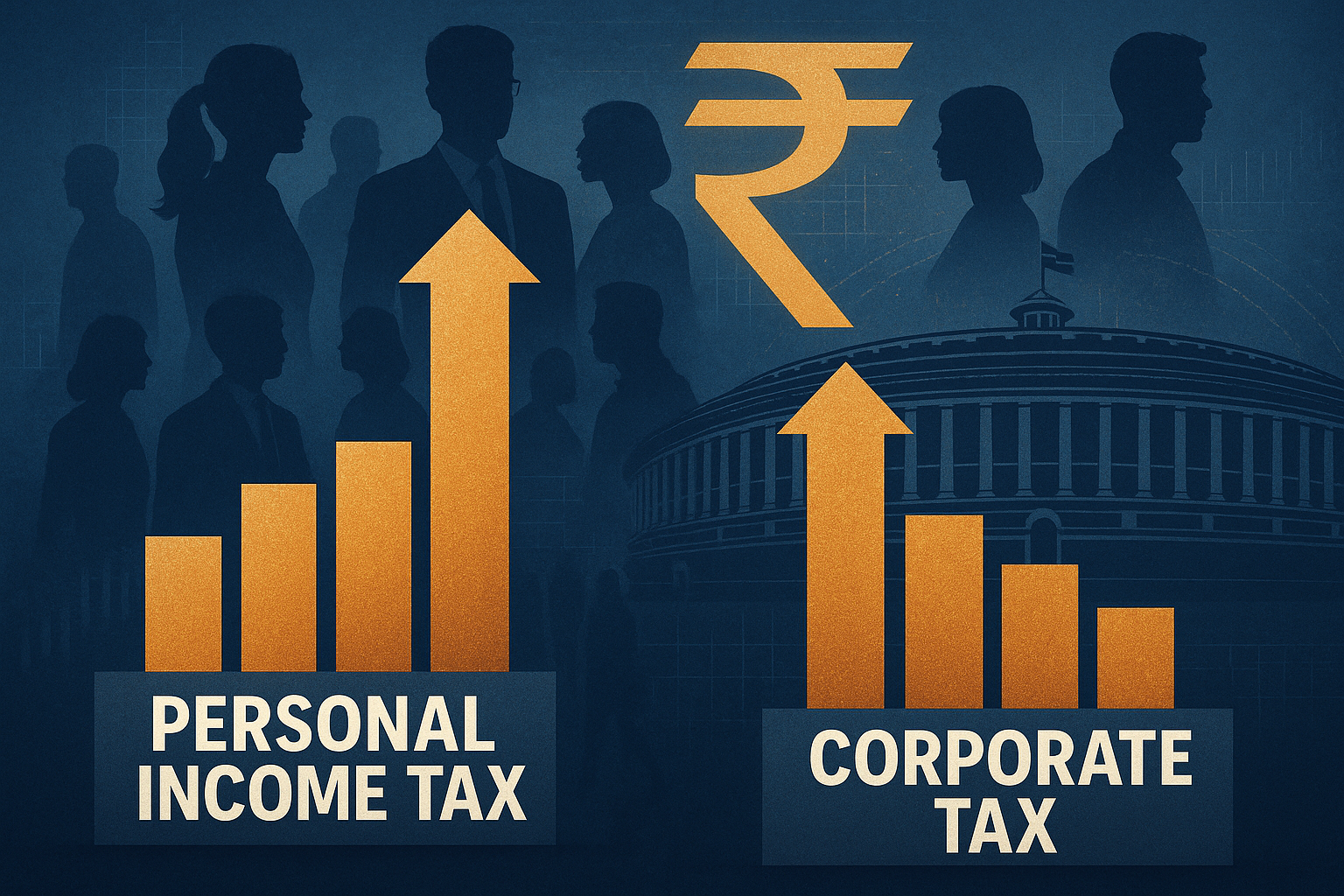

In a landmark shift, personal income tax collections have overtaken corporate tax revenues in India for the first time, according to official reports. The development highlights a significant change in the country’s tax landscape, with individuals contributing more to government revenues than corporates.

This reflects both the government’s success in widening the tax base and the growing role of salaried professionals, entrepreneurs, and high-net-worth individuals in driving fiscal resources.

Why Personal Taxes Are Rising

Several structural reforms have boosted personal income tax collections in recent years. The increased use of technology, e-filing systems, and data analytics has reduced evasion while expanding the taxpayer base. Rising formalization of the economy, higher salaries, and stronger compliance culture have also contributed to the trend.

At the same time, corporate tax rates were cut in 2019 to enhance competitiveness and attract investment, which partly explains why corporate tax collections have grown more modestly.

Implications for the Tax System

The overtaking of corporate tax by personal income tax underscores a shift in India’s revenue reliance. For policymakers, this trend raises questions about balancing the tax burden while ensuring fairness between individuals and businesses.

Personal taxpayers now form the backbone of India’s fiscal system.

Corporate incentives remain vital for investment, but individual contributions are filling a bigger gap.

Policy Perspective

The government is expected to continue refining tax administration to sustain personal income tax growth while also ensuring corporate competitiveness. Experts argue that strengthening direct taxes while reducing reliance on indirect taxes like GST can improve equity in the system.

This milestone also reflects India’s gradual move toward a more broad-based and transparent tax regime.

Why This Matters

For Government: A more stable and predictable revenue stream through individual taxpayers.

For Individuals: Greater responsibility in shaping fiscal outcomes.

For Policymakers: Need to maintain balance between incentivizing businesses and ensuring tax equity.

The shift underscores how India’s economic growth story is increasingly powered by a widening pool of individual contributors.