The Finance Ministry has highlighted the transformative potential of the Account Aggregator (AA) ecosystem in expanding access to formal credit across India. By enabling secure and consent-based sharing of financial data, the AA...

The Finance Ministry has highlighted the transformative potential of the Account Aggregator (AA) ecosystem in expanding access to formal credit across India. By enabling secure and consent-based sharing of financial data, the AA...

India’s financial ecosystem is on the brink of a digital revolution, with discussions intensifying around the rupee’s possible transition into crypto and blockchain-based formats. The government and regulators are examining frameworks for a...

The Open Network for Digital Commerce (ONDC) is set to introduce insurance products on its platform within the next 12 months, marking a major milestone in India’s push for digital financial inclusion. The...

India’s midcap IT players—Coforge, Persistent Systems, LTIMindtree, and Mphasis—are recalibrating their strategies as global macro uncertainties weigh on tech spending. Instead of relying solely on traditional outsourcing, these firms are increasingly leveraging generative...

The Reserve Bank of India (RBI) is set to drastically shorten cheque clearance times under a new efficiency-driven reform called Continuous Clearing and Settlement on Realisation. Starting October 4, 2025, cheques will clear...

As India enters a new phase of digital expansion with over a billion additional users joining the economic mainstream in the coming years, businesses must fundamentally transform. Mohamed Kande and Sanjeev Krishan argue...

In a landmark move to strengthen financial literacy and promote digital inclusion, the Reserve Bank of India (RBI) has launched its official, verified WhatsApp channel. This initiative forms part of the ongoing #RBIKehtaHai...

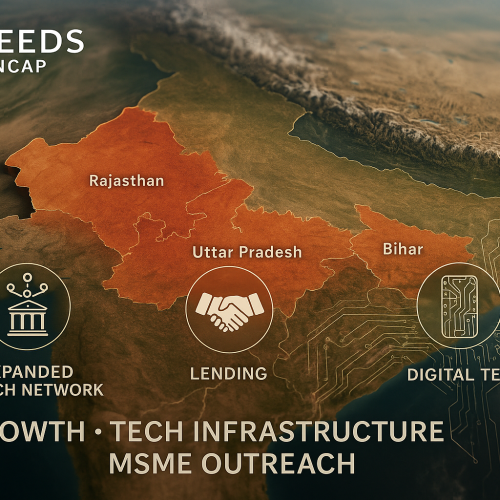

Gurugram-based fintech NBFC Seeds Fincap has raised ₹50 crore in a Pre-Series B funding round led by existing investors Z47 and Lok Capital, with fresh participation from Norinchukin Capital and Alteria Capital. The...

The Reserve Bank of India (RBI) has granted in-principle approval to Paytm Payments Services Ltd (PPSL)—a wholly owned arm of One 97 Communications—to operate as an Online Payment Aggregator (PA). This milestone paves...

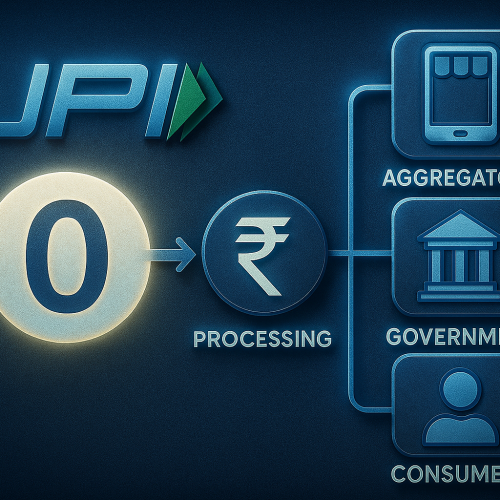

In July, UPI (Unified Payments Interface) recorded a staggering 19.5 billion transactions amounting to ₹25 lakh crore. While groceries and supermarkets dominated by volume, debt collection agencies emerged as the highest-value recipients—highlighting UPI’s...

Following a challenging FY25 marked by accounting irregularities and a leadership reshuffle, IndusInd Bank is recalibrating for growth with a renewed focus on retail deposits, secured retail lending, MSME portfolios, and rural outreach....

the Securities and Exchange Board of India (SEBI) mandated financial intermediaries—including mutual funds, stockbrokers, PMS, AIFs, RIAs, depositories, and exchanges—to make their digital platforms fully accessible to persons with disabilities (PwDs), aligning with...

Reserve Bank of India Governor Sanjay Malhotra emphasized that while the Unified Payments Interface (UPI) has delivered transformative results, the cost of sustaining it can’t be ignored. He clarified that, although UPI transactions...

Mumbai-based fintech platform Fibe (formerly EarlySalary), backed by TPG Rise Fund, is planning an IPO to raise ₹1,000–1,500 crore, targeting a valuation of over US $1 billion by mid-to-late 2026. The move places Fibe...

India’s retail credit market reached ₹82 trillion in FY 2025, growing at a 15.1% CAGR since FY 2019, and is projected to expand further at 14–16% per annum through FY 2028. Strong demand across housing, auto,...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.