India’s foreign exchange reserves rose for the second consecutive week, climbing by $1.48 billion to $695.10 billion, according to data from the Reserve Bank of India (RBI). The increase reflects stronger inflows from...

India’s foreign exchange reserves rose for the second consecutive week, climbing by $1.48 billion to $695.10 billion, according to data from the Reserve Bank of India (RBI). The increase reflects stronger inflows from...

A subtle but important divergence has emerged between the Reserve Bank of India (RBI) and the government over India’s medium-term growth outlook. While the government maintains optimism about sustained high growth driven by...

The Securities and Exchange Board of India (SEBI) is reviewing its block deal framework, with proposals to raise the minimum order size from the current ₹10 crore to ₹25 crore. The move aims...

South Indian Bank has rolled out a new product, SIB Gold Xpress, designed to provide borrowers with quick access to funds against their gold holdings. The scheme offers loans of up to 90%...

In today’s volatile markets, where momentum-driven rallies often dominate investor sentiment, contrarian investing is emerging as a powerful strategy. Instead of following the herd, contrarian investors deliberately take positions that go against prevailing...

The Securities and Exchange Board of India (SEBI) is preparing to extend the maturity period of equity derivatives, a step that could significantly deepen liquidity and modernize India’s capital markets. At present, contracts...

India’s long-debated GST reforms have taken a major step forward with the Group of Ministers (GoM) approving a simplified two-slab structure. The move is expected to ease compliance for businesses, reduce classification disputes,...

Finance Minister Nirmala Sitharaman has assured a group of ministers that the proposed GST rate rationalization will be designed to benefit the common man, farmers, and the middle class. Amid growing expectations of...

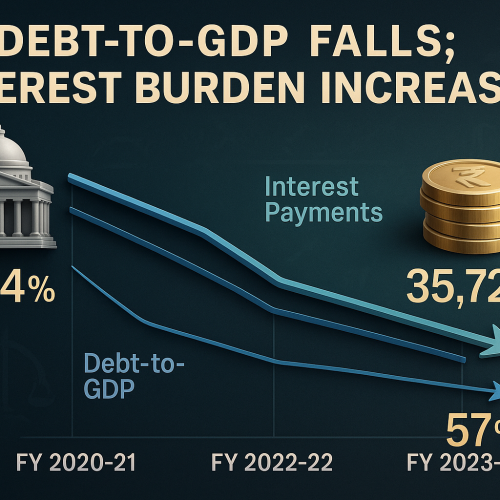

While India’s central government has successfully reduced its debt-to-GDP ratio from the pandemic peak of 61.4% in FY 2020–21 to 57% in FY 2023–24, its interest burden continues to climb. According to the...

Indian banks are riding the momentum of a record-breaking IPO year, extending more credit to investors eager to participate in public offerings. In FY 2024–25, IPO-linked lending grew by 53% over the previous...

India’s Central Board of Direct Taxes (CBDT) has opened consultations with crypto industry players to explore the need for a dedicated legal framework for Virtual Digital Assets (VDAs). Key issues under scrutiny include...

The latest ET Editorial — “GST 2.0: Great Sense (of) Timing” by MS Mani — applauds the government’s decision to launch comprehensive GST reforms right against the backdrop of tariff pressures and faltering...

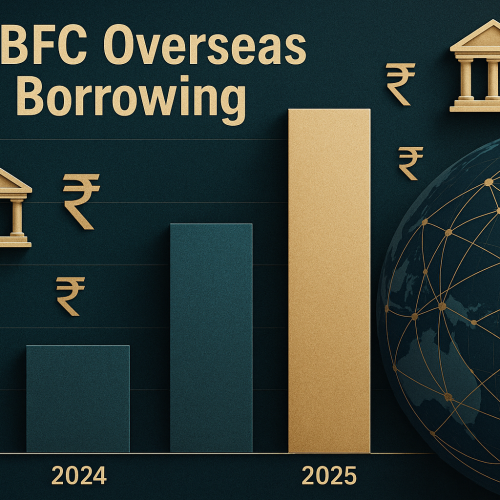

Indian Non-Banking Financial Companies (NBFCs) have rapidly ramped up their external borrowing in 2025, raising a substantial $3.67 billion through syndicated loans—more than double the total amount borrowed in 2024. This surge reflects...

India is bracing for the economic turbulence triggered by the U.S. doubling tariffs on Indian exports—a retaliatory measure over India’s stance on Russian oil imports. According to Fitch’s CreditSights, while the direct impact...

Kerala State Financial Enterprises (KSFE), a state-run miscellaneous non-banking financial company (MNBC), has become the first MNBC in India to surpass a business turnover of ₹1 lakh crore. The remarkable feat was achieved...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.