As the Goods and Services Tax (GST) Council gears up for its much-anticipated meeting in late July, hopes are rising across industries for a long-awaited rationalisation of GST rates. Several leading brokerages and...

As the Goods and Services Tax (GST) Council gears up for its much-anticipated meeting in late July, hopes are rising across industries for a long-awaited rationalisation of GST rates. Several leading brokerages and...

In a significant move aimed at reducing taxpayer grievances and ensuring faster refunds, the draft Income Tax Bill 2025 proposes a simplified process for claiming TDS (Tax Deducted at Source) refunds. The move...

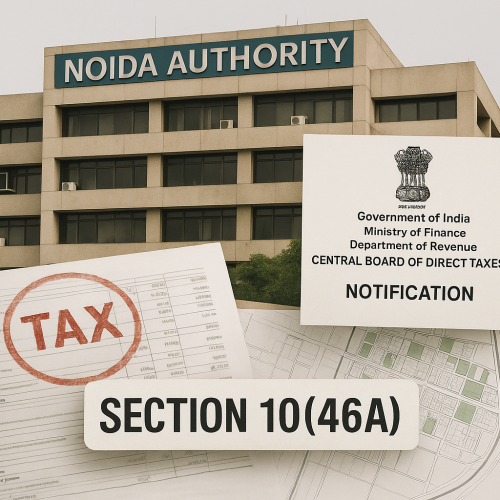

The Central Board of Direct Taxes (CBDT) has formally notified the New Okhla Industrial Development Authority (NOIDA) as an exempt entity under Section 10(46A) of the Income Tax Act, 1961. This tax relief...

On July 18, 2025, the Income Tax Department officially enabled online filing of ITR-2 for Assessment Year 2025–26 (FY 2024–25), offering taxpayers the ease of filing returns with pre-filled information. This update allows...

Indian households burdened by rising insurance costs may soon catch a break. The government is reportedly considering a Goods and Services Tax (GST) reduction on life and health insurance premiums, a move that...

India’s microfinance sector, a critical source of credit for low-income households and self-employed borrowers, is expected to face continued asset quality pressure in the first half of FY26, according to a recent report...

In a key milestone for India’s fintech landscape, EximPe, a cross-border B2B payments startup, has received final approval from the Reserve Bank of India (RBI) to operate as a Payment Aggregator (PA) for...

In a move that underlines how deeply technology is reshaping Indian banking, HDFC Bank has quietly taken a significant step forward: the launch of its own Generative AI platform, internally dubbed Project Indra....

Japan’s Sumitomo Mitsui Financial Group (SMFG) is reportedly considering a $1.1 billion follow-on investment in Yes Bank, targeting a roughly 5% equity stake alongside potential convertible bond purchases worth $680 million. This could boost SMFG’s...

Gold surged this week after President Trump reaffirmed plans to impose 30% tariffs on imports from the EU and Mexico, effective August 1. As geopolitical tensions heightened, bullion rallied to a three‑week high of...

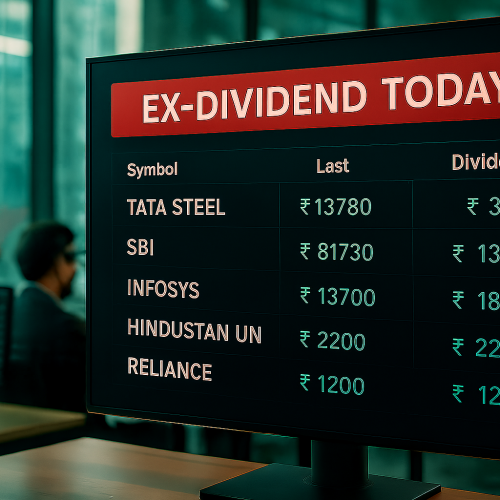

On 15 July 2025, five prominent Indian stocks—IDBI Bank, Mahindra & Mahindra Financial Services (Mahindra Finance), Aditya Birla Real Estate (ABREL), Grindwell Norton, and Kirloskar Pneumatic—will trade ex-dividend. Investors who held these stocks...

HDFC Bank is scaling up its artificial intelligence transformation with a centralized generative AI (GenAI) platform, transitioning from pilot initiatives to enterprise-grade deployment. With over 15 “lighthouse” programmes in motion, the bank aims...

India’s pension fund managers are urging the Pension Fund Regulatory and Development Authority (PFRDA) to relax bond investment guidelines for National Pension System (NPS) portfolios. They argue that easing restrictions on the maturity...

In April 2025, the Reserve Bank of India (RBI) released draft guidelines introducing a new securitization framework for stressed assets. This marks a strategic shift, enabling banks and NBFCs to sell bad loans...

The upcoming Monsoon Session of Parliament, set to begin around 21 July 2025, will prominently feature the Insurance Laws (Amendment) Bill, which proposes sweeping reforms—including 100% foreign direct investment (FDI) and composite licences...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.