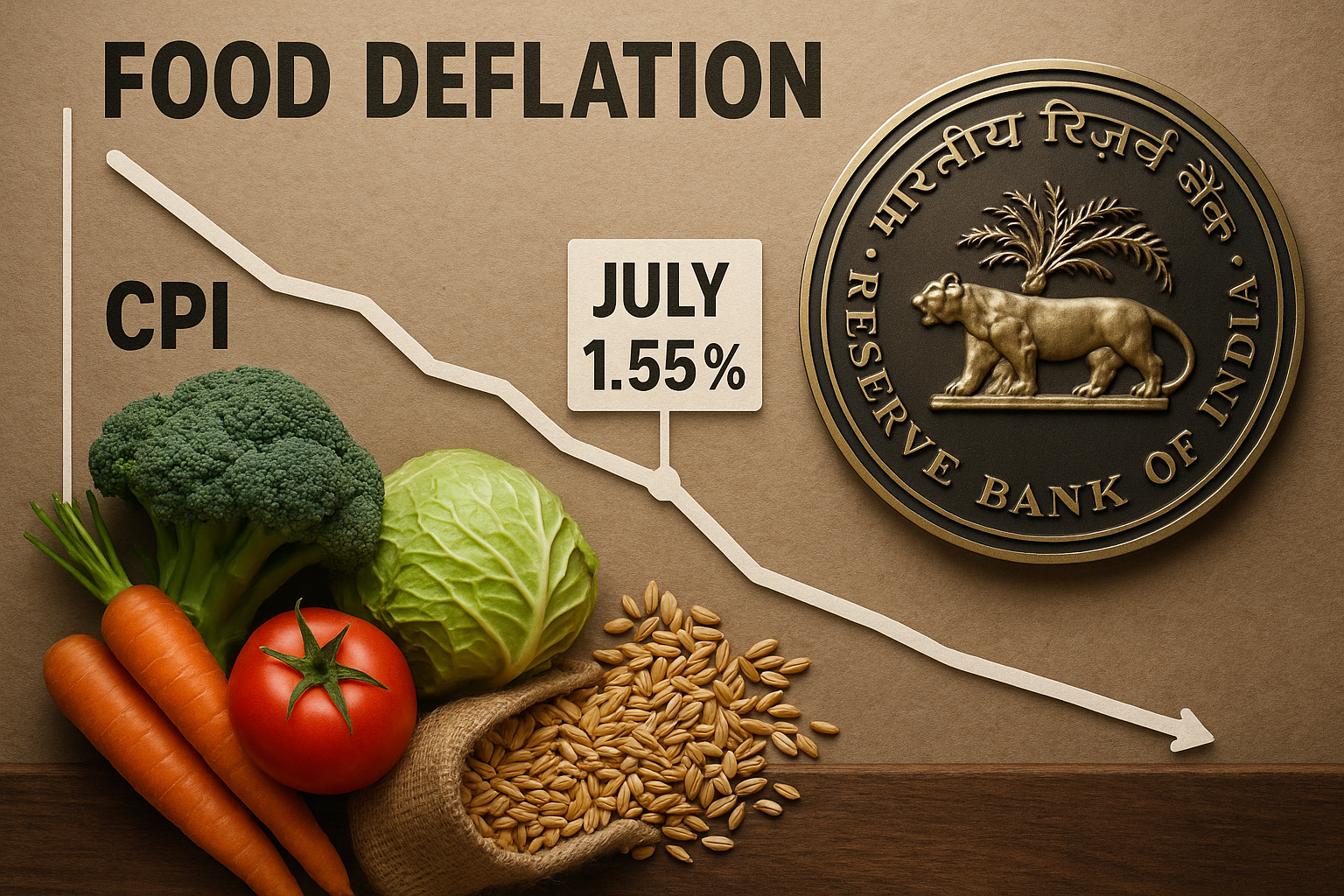

India’s annual retail inflation (CPI) dropped to 1.55% in July, marking its lowest level since June 2017. According to government data, this figure came in below the 2.10% recorded in June and well below economists’ expectations of 1.76%.

Drivers of the Disinflation

Food Price Deflation: Food inflation continued its downward spiral into negative territory, hitting −1.76% in July—mainly driven by sharp falls in prices of vegetables, pulses, cereals, and other staples.

Base Effect and Monsoon Trends: The sharp decline is also attributed to favorable base-year comparisons and improved supply conditions following a strong spring harvest, despite uneven monsoons.

Urban-Rural Divergence: Rural inflation eased to 1.2%, and urban inflation slid to 2.05%, indicating a broad-based slowdown across both demographics.

What It Means for Policy and the Markets

RBI’s Policy Room: With inflation below the 2% lower bound of its 2–6% target band, the RBI has more space to be accommodating—though it maintained a neutral stance at its latest policy meeting.

Anticipated Rebound in Inflation: Economists expect consumer prices to gradually trend upward again—possibly exceeding 4% by early 2026—as base effects fade and food prices normalize.

Potential Rate Cuts: Soft inflation, coupled with muted domestic demand indicators, could pave the way for further interest rate reductions, possibly by September or October, depending on evolving economic conditions.

Key Insights for Stakeholders

| Stakeholder | Implications |

|---|---|

| Consumers | Lower food prices offer temporary relief and support purchasing power. |

| RBI & Policymakers | Greater flexibility to maintain supportive monetary policy, with close watch on upward inflation momentum. |

| Investors & Markets | Lower inflation may provide a tailwind for equities and bonds by easing cost pressures. |

| Agricultural Sector | Continued food deflation signals stress for producers, especially small-scale farmers. |