A recent report by Motilal Oswal emphasizes how India’s calibrated approach to capital liberalisation, combined with the Reserve Bank of India’s strategic foreign exchange (FX) management, has buffered the economy from global uncertainties—such as geopolitical tensions, diverging monetary policies, and tariff volatility.

A Pragmatic Capital Liberalisation Roadmap

Unlike a full-scale capital account opening, India has pursued selective liberalisation—opening segments like FDI and controlled portfolio inflows while maintaining checks on outbound debt and speculative short-term borrowings. This framework offers flexibility while limiting external volatility exposure.

Key outcomes:

-

A resilient current account deficit (CAD)

-

Balanced capital inflows with minimal “hot money” risks

-

Shift toward high-value services exports, enhancing macro stability

RBI’s FX Playbook: Managed Flexibility over Full Floats

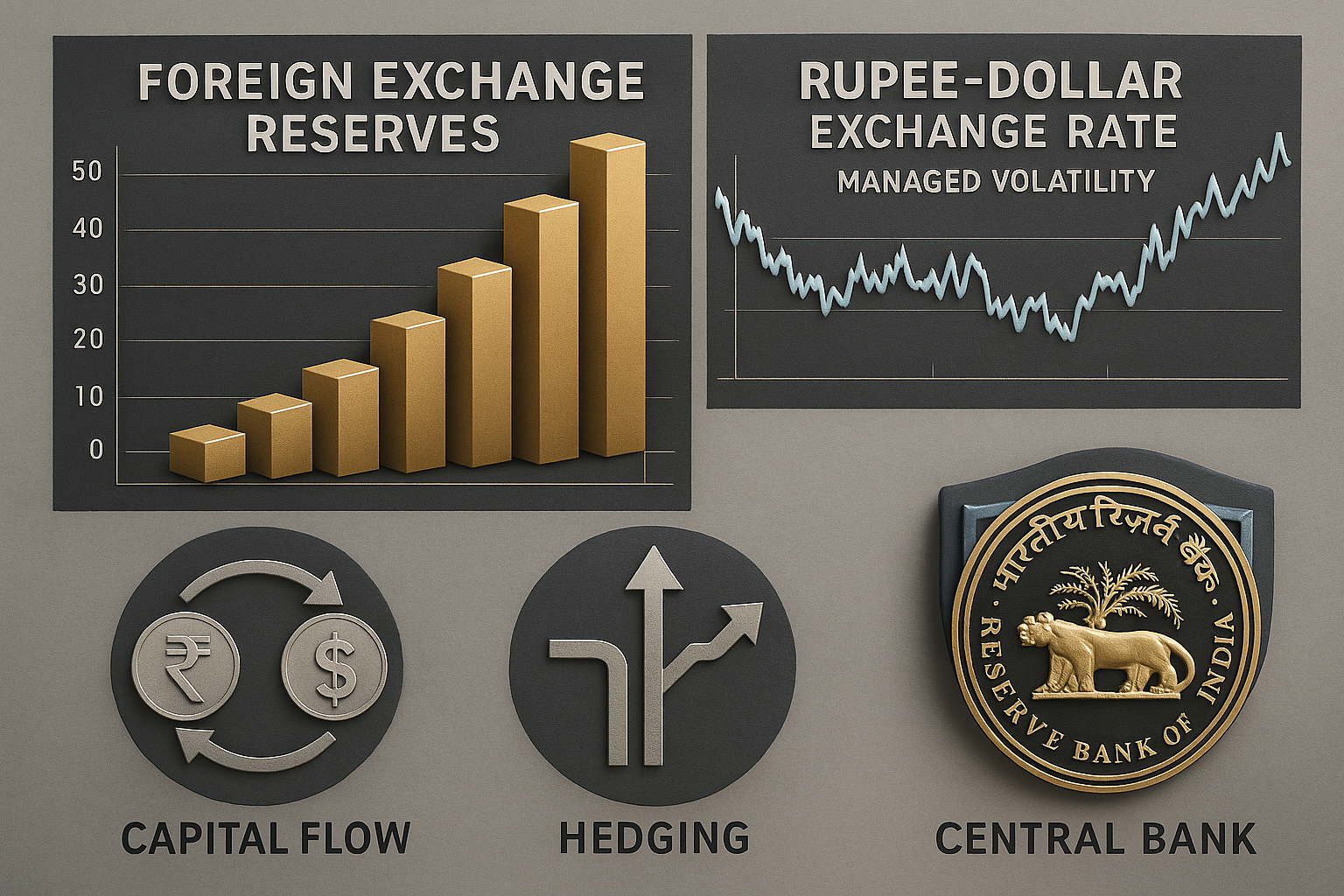

The RBI’s FX strategy is built on flexibility—not necessarily targeting absolute exchange levels, but rather mitigating excessive volatility through timely interventions.

Key measures include:

-

Spot and forwards-based interventions when intra-day swings exceed thresholds

-

Forex swaps and bond purchases to replenish reserves and inject rupee liquidity as needed.

In FY25, the RBI conducted a record gross dollar sale of $398 billion, resulting in a net outflow of roughly $34.5 billion, balancing FX intervention needs with liquidity safeguards.

Market Signals & Corporate Behaviour Shift

Reduced Reliance on FX Intervention

Since Governor Sanjay Malhotra took office in December 2024, the RBI has adopted a more tolerant stance on currency movements—allowing daily ranges to widen and volatility metrics to double, with the rupee floating within a band of ₹83–88 per USD.

Corporate Hedging Momentum

Faced with sharper rupee swings, companies—from exporters to SMEs—have significantly raised their hedging ratios, with some hedging up to 90% of their FX exposure using straightforward forwards instead of complex derivatives.

This shift strengthens corporate risk management and reduces systemic dependence on central bank intervention.

Macroeconomic Resilience Indicators

-

Foreign Exchange Reserves: Bolstered to record highs, now over $640 billion and constituting over 74% of the RBI’s balance sheet.

-

Growth vs. Inflation: Despite global shocks, inflation has remained within RBI’s comfort zone, thanks to controlled deficit levels and stronger capital buffering.

Balancing the ‘Impossible Trinity’

India’s policy choices reflect a nuanced navigation of the “impossible trinity”: managing growth via monetary easing, preserving exchange-rate stability, and regulating capital flows. By allowing judicious rupee depreciation while selectively intervening, the RBI has avoided structural trade-offs.

Key Implications

| Stakeholder | Takeaway |

|---|---|

| Policymakers & Regulators | Gradual capital use and FX buffers help absorb shocks without market disruption |

| Businesses & Exporters | Increased responsibility on corporates to actively hedge FX risk |

| Investors | Stable external balance and credible FX policy support confidence in India’s capital markets |

| Economy at large | Enhanced resilience helps navigate trade uncertainties, commodity price spikes, and monetary divergence effects |

Conclusion

India’s selective capital liberalisation—anchored by prudent foreign exchange operations—has created a buffer against global shocks without compromising growth ambitions. The RBI’s shift toward tolerance for exchange fluctuations, paired with deep FX reserves and proactive corporate hedging, reinforces India’s position as a resilient emerging-market economy.