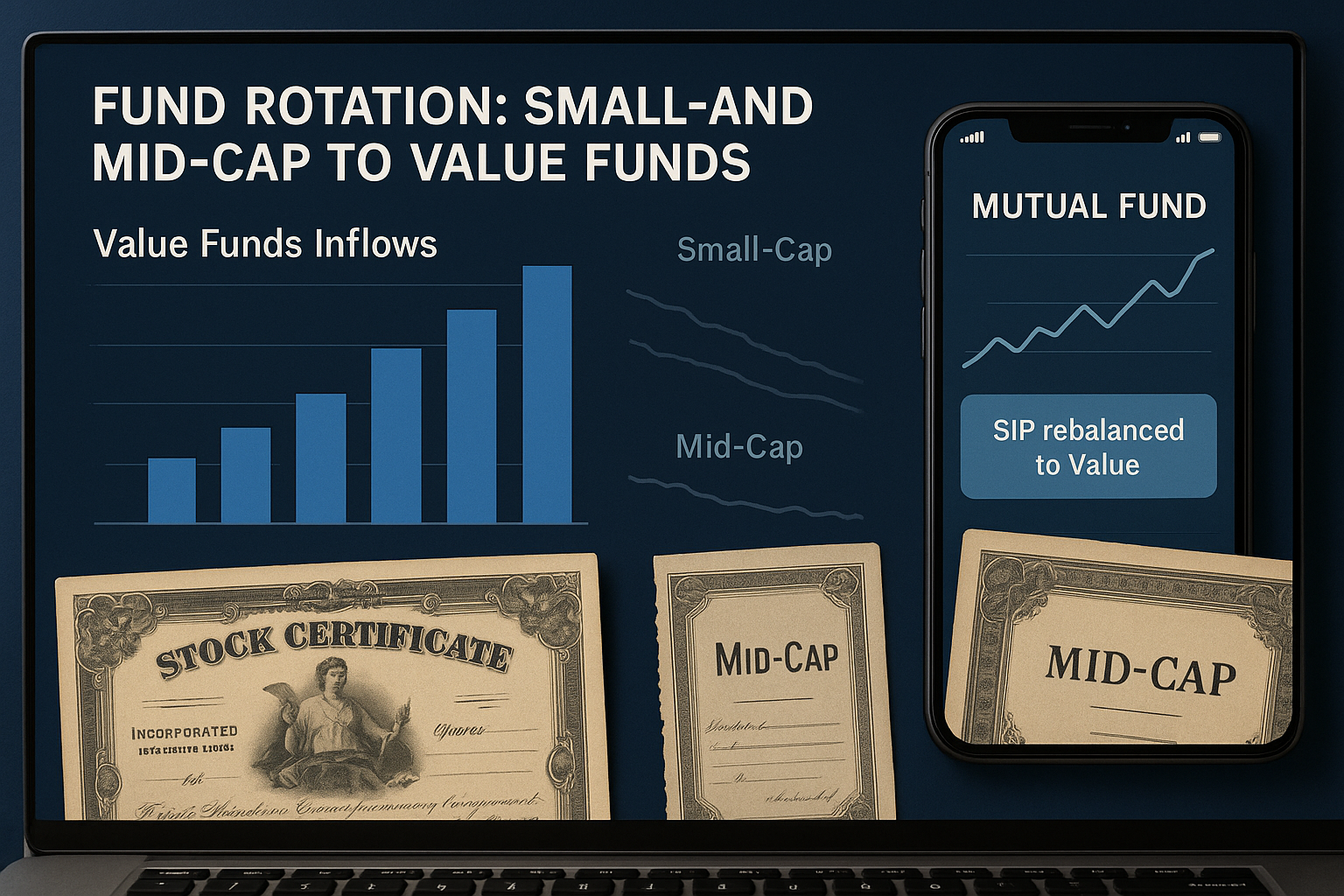

As India’s equity markets show signs of valuation fatigue in the small-cap and mid-cap segments, investors are increasingly reallocating capital toward value funds—a category long overshadowed by high-growth peers. According to recent industry data, value-oriented equity schemes have seen a notable rise in inflows in H1 FY25, reflecting a shift in investor sentiment towards undervalued large-cap opportunities and margin-of-safety investing.

With benchmark indices hovering near all-time highs and pockets of froth visible in broader markets, seasoned investors and advisors are once again championing value investing as a counter-cyclical hedge in a potentially overheated cycle.

Background and Context

Value funds, a subset of equity mutual funds, focus on undervalued stocks that trade below their intrinsic worth based on metrics like price-to-earnings (P/E), price-to-book (P/B), and dividend yield. These funds often carry a contrarian stance, investing in sectors or companies temporarily out of favor but with strong long-term fundamentals.

In recent years, growth and thematic funds—especially small-cap, mid-cap, and sectoral schemes—attracted significant investor attention due to their outsized short-term returns. However, in 2025, amid growing concerns over valuation bubbles, value funds have emerged as a relatively stable and overlooked alternative.

Fund Flow Trends

| Fund Category | Net Inflows (H1 FY25) | YoY Change |

|---|---|---|

| Value Funds | ₹3,820 crore | +44% |

| Small-Cap Funds | ₹2,980 crore | -23% |

| Mid-Cap Funds | ₹3,120 crore | -17% |

| Large-Cap Funds | ₹2,610 crore | +12% |

The 44% increase in net inflows into value funds in just six months underscores a sentiment rotation from riskier growth assets to stable value-driven allocations.

Fund managers attribute the surge to mean reversion strategies, capitalizing on underperforming sectors like utilities, IT, and select manufacturing.

Performance and Risk Metrics

While value funds underperformed during the 2020–2022 bull market, their three-year Sharpe ratios and drawdown resilience have improved:

5-Year CAGR (category average): ~12.8%

3-Year Sharpe Ratio: 0.86 (vs. 0.74 in small-cap)

Max Drawdown (2023): –9.2% (lower than mid/small-cap peers)

According to Morningstar India, funds like ICICI Prudential Value Discovery, Nippon India Value Fund, and HDFC Capital Builder Value Fund are seeing renewed SIP traction from conservative investors.

Expert Views

CA Manish Mishra, Certified Wealth Strategist:

“Value funds are finally getting the respect they deserve. In overheated markets, they serve as a natural ballast—especially for risk-averse investors aiming for capital preservation with modest alpha.”

CA Manoj Kumar Singh, Investment Consultant, MF Certified:

“The rotation we’re seeing is tactical and data-driven. Institutional and retail investors alike are rebalancing into large-cap-heavy value portfolios that offer stronger downside protection.”

Market Implications

Smart Money Rotation: The surge in value fund inflows suggests that institutional money is actively repositioning portfolios in anticipation of macro volatility or policy tightening.

SIP Rebalancing: Wealth managers are advising clients to increase allocations to value funds, especially through Systematic Transfer Plans (STPs) from mid- and small-cap schemes.

Low Beta Advantage: Value funds are expected to outperform during corrections, making them a strategic component in 2025 H2 asset allocations.

Conclusion

The comeback of value investing in India marks a return to fundamentals amidst a market driven by sentiment and speculative momentum. As investors grow cautious of elevated valuations in small- and mid-cap stocks, value funds offer a rational, data-backed alternative that blends growth potential with risk mitigation. With domestic and global uncertainties ahead, their appeal as a defensive yet rewarding strategy is likely to grow through FY25 and beyond.