Despite bold campaign promises and sweeping tariffs, former U.S. President Donald Trump’s ambition to revitalize American manufacturing is faltering. Recent reports highlight that the U.S. manufacturing sector is facing a persistent downturn, marked by weak job growth, declining productivity, and structural limitations. The expectation that tariffs would trigger a reshoring wave and strengthen domestic factories has not materialized as envisioned.

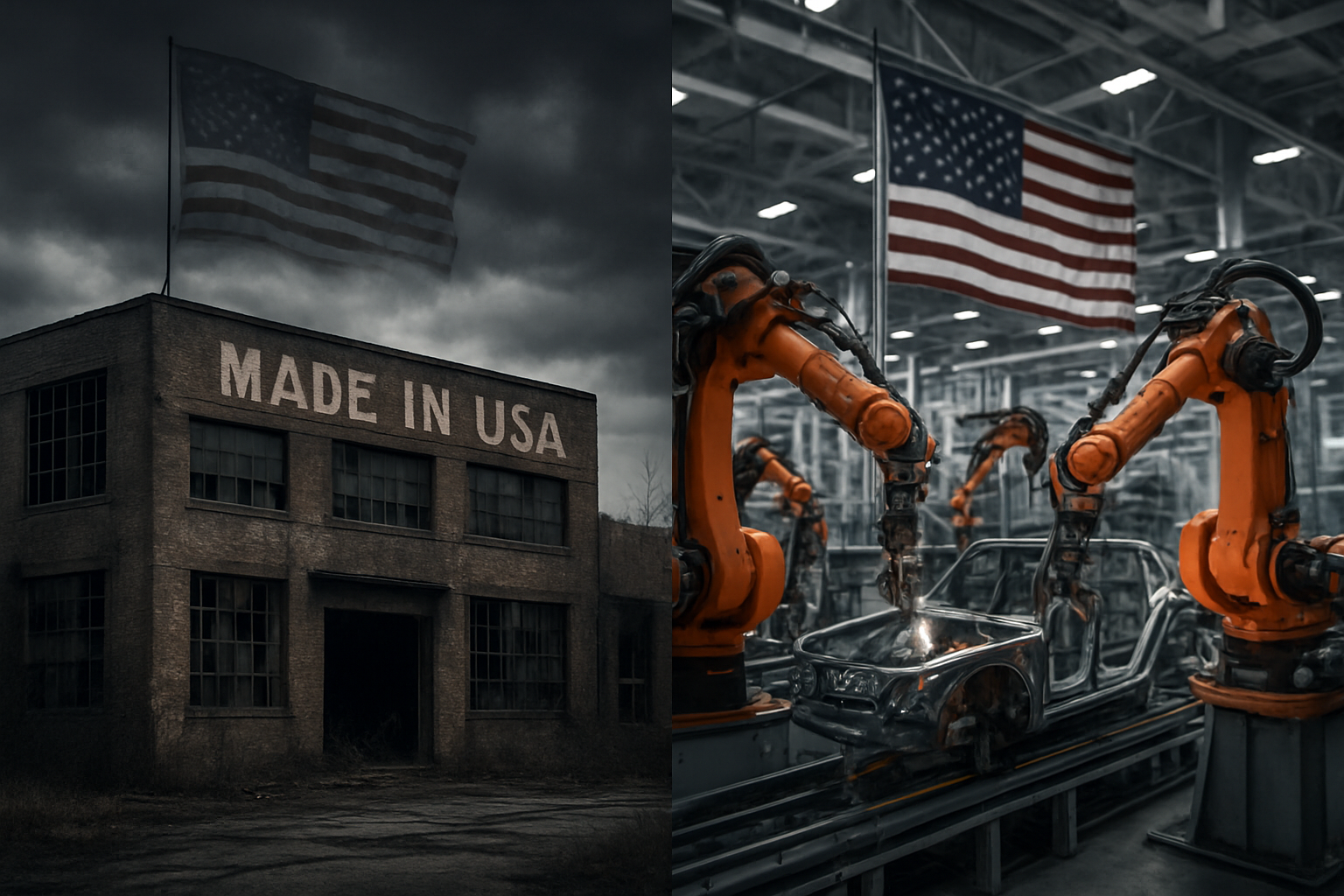

Background: Trump’s “Made in America” Promise

Donald Trump made manufacturing the cornerstone of his economic platform, vowing to bring back industrial jobs lost to globalization. His administration imposed tariffs on China, Mexico, the EU, and other trade partners, aiming to incentivize U.S.-based production. While these moves sparked debate and short-term shifts, long-term transformation remains elusive.

“We’re going to bring our jobs back,” Trump declared in 2016. Nearly a decade later, data shows those jobs didn’t return at the scale expected.

The Numbers Behind the Struggle

Manufacturing PMI

The Purchasing Managers’ Index (PMI) for manufacturing has remained below 50, indicating contraction for five consecutive months.

June 2025 PMI: 48.7, down from 49.2 in May.

Employment Metrics

U.S. factory employment saw a net loss of 37,000 jobs between March and July 2025.

While some sectors (e.g. defense, semiconductors) show resilience, broader segments like automobiles, steel, and textiles are either stagnant or in decline.

Output & Investment

Capital investments in domestic manufacturing have slowed, with foreign direct investment (FDI) in the sector down 12% YoY.

Over $20 billion in proposed factory projects are delayed due to regulatory uncertainty and rising costs.

Why the Revival Isn’t Working

1. Tariffs Alone Are Not Enough

Tariffs increased costs for U.S. manufacturers who rely on global supply chains. Input prices rose, diminishing competitive advantage and squeezing margins.

2. Automation Continues to Replace Jobs

Technological advances have led to jobless growth. Even where production increases, headcounts don’t. U.S. factories are more likely to install robotic arms than hire new workers.

3. Workforce Challenges

Younger generations show low interest in blue-collar factory jobs. Aging skilled labor, lack of vocational training, and a service-focused workforce limit the sector’s growth.

4. Policy Volatility

Manufacturers cite regulatory uncertainty, especially around trade, tax, and environmental policies, as a key deterrent to investment.

“Companies can handle tariffs if predictable, but constant change in policy kills long-term planning,” said an executive at a Michigan-based auto-parts maker.

Global Supply Chains Aren’t Reversing

Despite some reshoring rhetoric, the global supply chain remains intact. Critical inputs — from electronics to rare earths — continue to be imported. Many firms are “China plus one” sourcing rather than fully relocating production.

Even U.S.-led semiconductor factories still rely heavily on overseas assembly, testing, and materials.

Economic & Political Implications

Economic Fallout

Rising consumer prices due to higher production costs.

U.S. export competitiveness falls, especially in markets facing retaliatory tariffs.

Political Ramifications

Trump’s 2024 campaign promise of a “manufacturing renaissance” is now under scrutiny.

Voter trust in protectionist trade policies is eroding, especially in Rust Belt states.

Expert Opinions

Crisil U.S. Analyst – Michael Thompson:

“Tariffs without a holistic industrial strategy are like pouring water into a bucket with holes. Without labor reforms, supply chain investment, and consistent regulation, revival remains a myth.”

Brookings Institution:

“America’s economic future lies in advanced tech, green energy, and services — not steel mills. Nostalgia is not policy.”

What the Future Holds

While the manufacturing revival faces strong headwinds, there is still potential in niche sectors:

Defense, aerospace, and chipmaking may expand due to geopolitical shifts and incentives like the CHIPS Act.

Green manufacturing (EVs, solar, wind equipment) has federal support but struggles with local zoning and high setup costs.

Still, experts agree that without a workforce transformation, long-term infrastructure investment, and reduced policy volatility, broad-scale manufacturing growth is unlikely.

Conclusion

Trump’s bid to restore American manufacturing through tariffs and protectionism has yielded limited success. Structural challenges — not foreign competition alone — are the real obstacles. As the U.S. economy transitions, it must decide whether to invest in the future or continue chasing an industrial past.