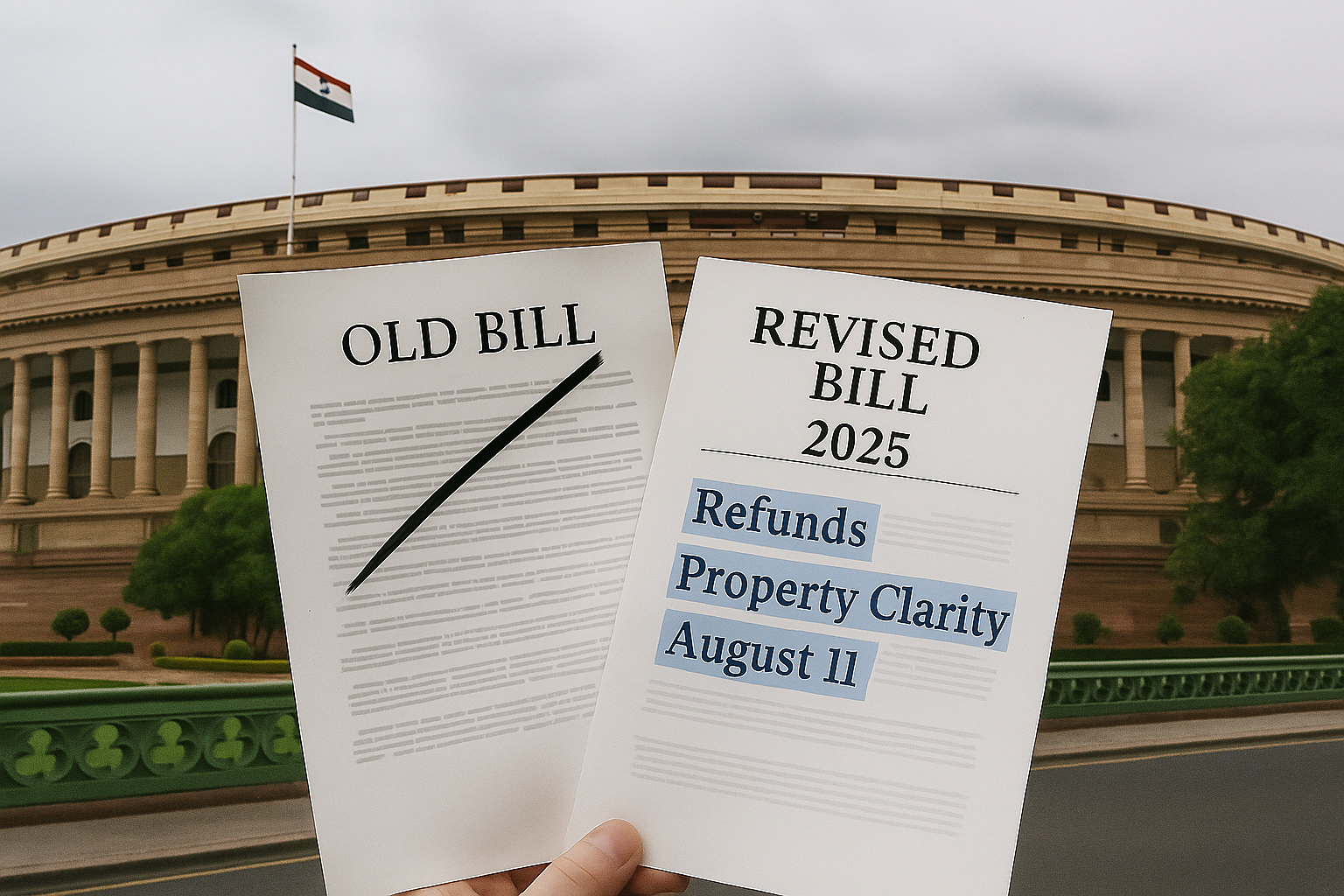

After withdrawing the original Income Tax Bill, 2025 amidst concerns over drafting errors and legal ambiguities, the government is set to reintroduce a revised, refined version to Parliament today (August 11, 2025). Key changes include improved clarity on house property valuation, refund eligibility for late ITR filers, and precise interpretation of business occupancy clauses. The move aims to simplify the direct tax framework and bolster taxpayer trust.

Background & Rollback of Original Bill

The Income Tax Bill, 2025, initially introduced in Parliament on February 13, sought to overhaul the six-decade-old tax law. However, due to drafting flaws—particularly in sections related to house property, salary deductions, and commercial property rules—the government withdrew it on August 8 and announced plans to table a revised version with corrections and stakeholder inputs.

Reasons for the Withdrawal

A Parliamentary Select Committee reviewed the draft bill and flagged major issues such as:

-

Ambiguities in Clause 21 (house property valuation),

-

Misaligned language in salaries and commercial property provisions,

-

Potential punitive implications for late ITR filers.

What’s New in the Revised Bill

1. Refund Flexibility Restored

The restrictive clause disallowing income tax refunds for late ITR filers has been removed, ensuring affected taxpayers can claim due refunds.

2. House Property Clause Clarification

The vague term “in normal course” used for calculating annual value has been clarified. The revised phrasing—“as he may occupy”—ensures occupied and temporarily unused commercial properties aren’t wrongly taxed.

3. Retains Core Intent

Parliamentary Affairs Minister Kiren Rijiju affirmed the new version preserves the original bill’s intent and incorporates all recommendations from the Select Committee.

Implications for Taxpayers

-

Moderate Relief for Common Taxpayers: The revised bill is expected to ease compliance challenges, particularly benefiting property owners and salaried individuals.

-

Transparency for Corporations and Trusts: Enhanced clarity in property and salary provisions will assist entities in better tax planning and compliance.

What to Expect Next

-

The revised Income Tax Bill will be introduced in Lok Sabha on August 11, following which it will be examined, debated, and sent to the Select Committee.

-

If passed, the updated version will replace the 1961 Act, ushering in clearer and more equitable tax regulations.