India’s market regulator, the Securities and Exchange Board of India (SEBI), has rejected the settlement requests filed by industrialist Anil Ambani, his family members, and former Yes Bank CEO Rana Kapoor. The pleas...

India’s market regulator, the Securities and Exchange Board of India (SEBI), has rejected the settlement requests filed by industrialist Anil Ambani, his family members, and former Yes Bank CEO Rana Kapoor. The pleas...

Jane Street, the U.S.-based quantitative trading powerhouse, recently deposited around ₹4,843.6 crore (approximately $567 million) into an escrow account—a critical move to meet SEBI’s interim order. The firm has now formally requested that SEBI lift...

In one of the largest enforcement drives in recent years, the Securities and Exchange Board of India (SEBI) has launched a wide-ranging investigation into pump-and-dump schemes allegedly executed by over 200 privately listed...

Following its unprecedented action against US-based trading firm Jane Street, SEBI Chairman Tuhin Kanta Pandey has reiterated the regulator’s zero-tolerance policy for market manipulation. Speaking at an industry event in Mumbai, Pandey emphasized...

In a move aimed at streamlining digital onboarding processes in the financial sector, Registered Intermediaries (RIs) such as brokers, mutual fund houses, and portfolio managers can now use the ‘e-KYC Setu System’ developed...

In a landmark enforcement move, the Securities and Exchange Board of India (SEBI) has barred US-based trading firm Jane Street from the Indian securities market and impounded ₹4,840 crore—marking one of the largest...

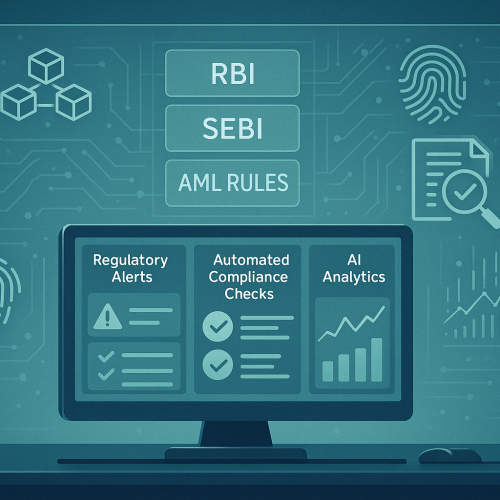

As compliance becomes more complex and regulatory scrutiny intensifies, Regulatory Technology (RegTech) is emerging as a transformative force in India’s BFSI sector. Leveraging AI, machine learning, and blockchain, RegTech enables financial institutions to...

As climate change, social equity, and corporate accountability take center stage, BFSI institutions in India are increasingly aligning with Environmental, Social, and Governance (ESG) frameworks. From issuing green bonds to integrating ESG metrics...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.