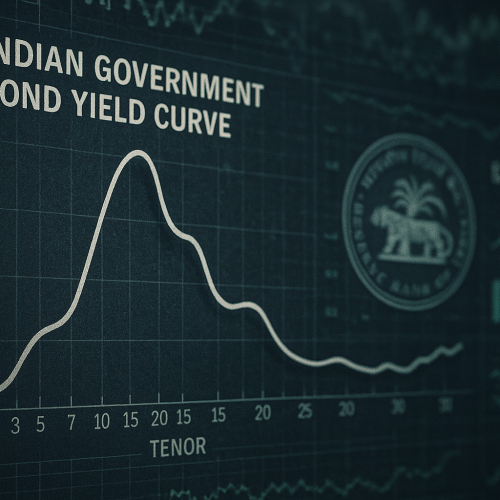

India’s risk-free yields — normally expected to follow a smooth, predictable curve — are showing unusual deviations across maturities. Analysts point to liquidity imbalances, supply-demand distortions in government securities and shifting expectations around...