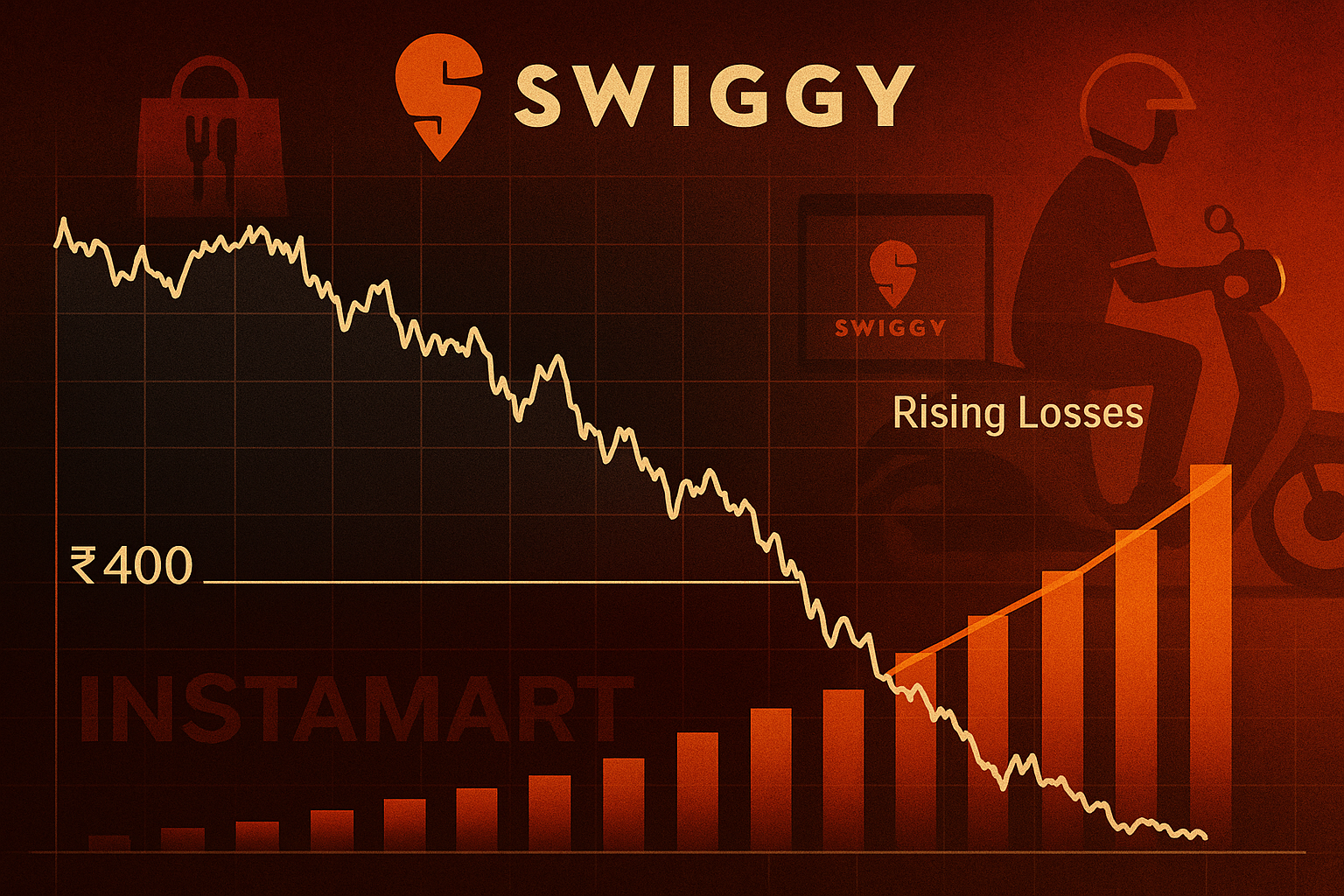

On August 1, 2025, Swiggy shares fell over 4% intraday, slipping below its IPO listing price of ₹412, as the company reported its Q1 FY26 net loss nearly doubling to ₹1,197 crore, compared to ₹611 crore a year ago.

Financial Highlights

-

Revenue Surge: Swiggy posted a 54% YoY increase in operating revenue to ₹4,961 crore, up from ₹3,222 crore in Q1 FY25.

-

Loss Escalation: Consolidated net loss jumped to ₹1,197 crore, a nearly 96% increase year-on-year, and higher sequentially from ₹1,081 crore in Q4 FY25. Total operating expenses rose 60% to ₹6,244 crore.

-

Profit Margins: Adjusted EBITDA loss widened to ₹813 crore from ₹465 crore a year earlier; the food delivery segment saw EBIT at ₹202 crore, while Quick Commerce (Instamart) reported a sharp loss. GOV in B2C rose 45% to ₹14,797 crore, led by food delivery at ₹8,086 crore (+18.8% YoY) and Instamart at ₹5,655 crore (+108% YoY) .

Stock & Market Reaction

-

Price Movement: Swiggy shares dropped to as low as ₹386.25 per share after the result—down ~4% on BSE—and are now trading below their ₹412 IPO price, a level breached since February 2025.

-

YTD Fall: The stock has declined over 25% in 2025 and is down ~41% from its listing peak in December 2024 (₹617).

Business Strategy & Segment Performance

Instamart (Quick Commerce):

-

Generated ₹5,655 crore in GOV but reported a ₹896 crore segment loss with negative 15.8% margin .

-

Swiggy added 41 dark stores, totaling 1,062 across 127 cities, focusing on deeper market penetration rather than expansion to new locations.

-

Contribution margins improved ~100 bps QoQ to −4.6% despite increasing cash burn in this vertical.

Food Delivery:

-

GOV hit ₹8,086 crore with EBIT at ₹202 crore; adjusted EBITDA margin contracted to 2.4% vs 2.9% last quarter, attributed to delivery partner incentives and wage cost escalations.

Analyst Outlook

-

Jefferies upgraded the stock to “Buy” with a ₹500 target, citing improving unit economics and a pause in dark store expansion. However, it flagged Swiggy as a high-risk, high-reward investment due to low margins.

-

Motilal Oswal highlighted potential strengths in margin resilience and revenue growth, though flagged continued loss pressure tied to Instamart scaling.

Implications for Investors

| Aspect | Current Situation |

|---|---|

| Valuation | Trading below listing price; sharp YTD correction |

| Cash Burn | Over ₹1,050 crore in Q1; growing Instamart losses |

| Growth Potential | Food and quick commerce continue to scale fast |

| Risk Profile | Low-margin business requiring execution discipline |

What to Watch Going Forward

-

Dark Store Investment Pace: Jefferies expects slower capex ahead, which may narrow losses and stabilize margins.

-

Instamart Profitability Path: Contribution margin recovery and scaled logistics efficiencies will be key.

-

Competitive Intensity: Performance relative to rivals like Blinkit, Zepto, BigBasket, and Tata-backed platforms will matter.

-

Stake Sale Strategy: Swiggy is evaluating exit from its 12% Rapido stake to simplify operations amid strategic clashes with Rapido entering food delivery

Conclusion

Swiggy’s Q1 FY26 results present a mixed scenario: impressive topline growth, but worsening losses—primarily driven by rapid scale-up in Instamart. With shares trading below the IPO price and elevated volatility, the stock remains a high risk–high reward play. Investors may wait for clearer evidence of margin recovery before redeploying capital, while longer-term bulls remain optimistic about Swiggy’s scale and market coverage.