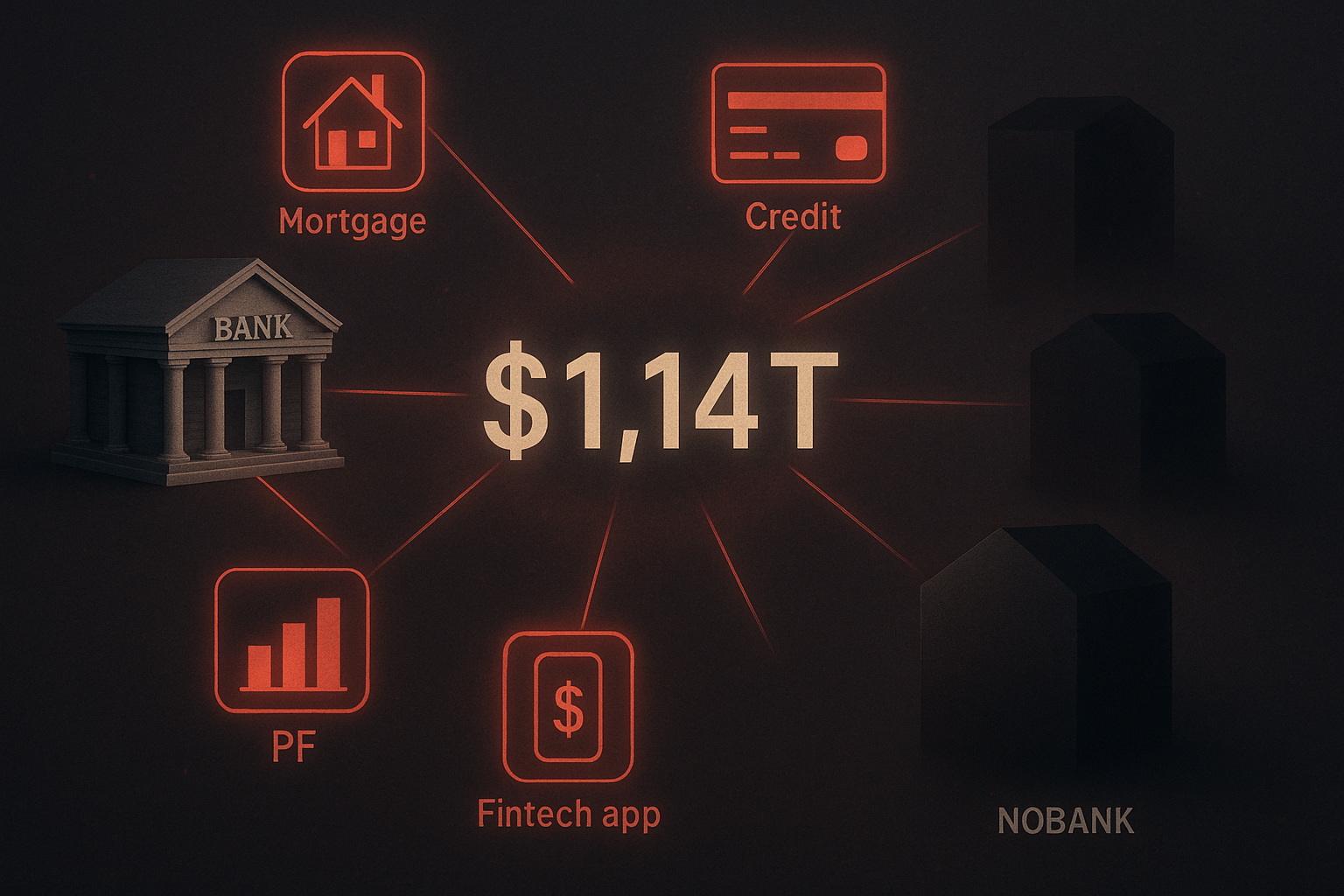

The financial system is entering a new phase of complexity and exposure as U.S. banks’ loans to nonbank financial institutions (NBFIs) surpass $1.14 trillion in Q1 2025, according to fresh data from the St. Louis Federal Reserve. Driven by a decade-long average annual growth rate of 26% in lending to non-depository financial entities, this development is fueling concerns about systemic risk, regulatory blind spots, and potential market instability—hallmarks of what many term the “shadow banking” system.

As traditional banks deepen ties with private equity, hedge funds, mortgage originators, and fintech lenders, the interconnectedness between banks and nonbanks is reaching unprecedented levels, prompting analysts and regulators to warn of counterparty risk, liquidity mismatches, and potential runs in the event of financial stress.

Background and Context

Nonbank financial intermediation (NBFI), often referred to as shadow banking, involves entities that engage in credit intermediation outside the regulatory perimeter of traditional banks. These include mortgage lenders, asset managers, pension funds, insurance companies, private credit funds, broker-dealers, and fintech platforms.

According to the Fed, the current structure results in an “extra layer of intermediation”, where banks no longer lend directly to households or businesses but rather to NBFIs, which channel capital to the real economy through indirect means. This layered structure can amplify both risk and opacity, particularly in a crisis.

Recent headlines underscore this evolution:

Meta is seeking $29 billion from private equity players to fund AI data centers, bypassing traditional corporate lending channels.

Apollo Global Management is collaborating with major banks to tokenize and trade private credit, creating synthetic liquidity in an inherently illiquid market.

Breakdown of Bank Exposure to NBFIs

According to the St. Louis Fed and Financial Stability Board (FSB):

| NBFI Type | Share of Bank Loans |

|---|---|

| Mortgage Intermediaries | 23% |

| Private Credit Funds | 23% |

| Business Lending Platforms | 21% |

| Consumer Lending Platforms | 9% |

| Other (hedge funds, securitization vehicles, etc.) | 24% |

The growth of fintech lending—valued at $38.5 billion across seven jurisdictions—has also added momentum to the NBFI sector, especially as marketplace platforms and balance-sheet-based digital lenders scale aggressively.

Risks Emerging from Interconnected Lending

A Congressional Research Service (CRS) report last week highlighted several vulnerabilities arising from these trends:

Counterparty Credit Risk: Banks are increasingly exposed to NBFIs, which are less regulated and may lack robust risk buffers. A failure at one large NBFI could cascade into the banking system.

Liquidity Mismatch and Runs: Many NBFIs fund long-term loans using short-term instruments, making them susceptible to investor runs, particularly in volatile environments (e.g., open-ended funds or repo markets).

Data and Transparency Gaps: Unlike banks, many NBFIs are not required to disclose detailed operational or balance sheet data, making regulatory oversight limited and lagged.

Concentration Risks: A few dominant intermediaries—especially in private equity, asset management, and mortgage origination—hold disproportionate influence, potentially posing systemic risks if they fail.

Erosion of Traditional Banking: Banks, in competing with NBFIs, have shifted portfolios away from core deposits and toward securities, compressing net interest margins and elevating balance sheet risk.

Expert Viewpoints

Dr. Jeremy Stein, former Federal Reserve Board Governor:

“Shadow banking isn’t inherently problematic—but when traditional banks become heavily entangled with opaque, less-regulated credit intermediaries, the entire financial system is exposed to unseen risks.”

Karen Petrou, co-founder of Federal Financial Analytics:

“The blurring lines between banks and nonbanks mean that regulators can’t afford to operate in silos. A systemic risk in the shadow banking world is a systemic risk to everyone.”

Global Policy Perspective:

The Financial Stability Board (FSB) has called for enhanced data collection, stress testing, and cross-border regulatory coordination to monitor systemic risks from NBFIs. The Bank for International Settlements (BIS) has recommended introducing macroprudential buffers specifically for banks exposed to NBFIs.

Market Implications

The increase in nonbank lending has broader implications:

Monetary Policy Transmission: Central bank rate changes may less directly impact lending activity, as NBFIs operate outside the traditional reserve-based banking model.

Securitization Risks: Many NBFIs package and sell risk through complex instruments, reminiscent of pre-2008 practices.

Moral Hazard: The implicit “too interconnected to fail” perception may embolden risk-taking across both sectors.

Conclusion

As banks and nonbanks intertwine, the potential for hidden fragilities within global financial markets grows. While the rise of NBFIs has expanded credit access and innovation, the lack of regulatory parity, data transparency, and systemic stress testing creates the risk of financial instability. With $1.14 trillion already at stake and growing, the need for coordinated global supervision and forward-looking risk containment has never been more urgent.