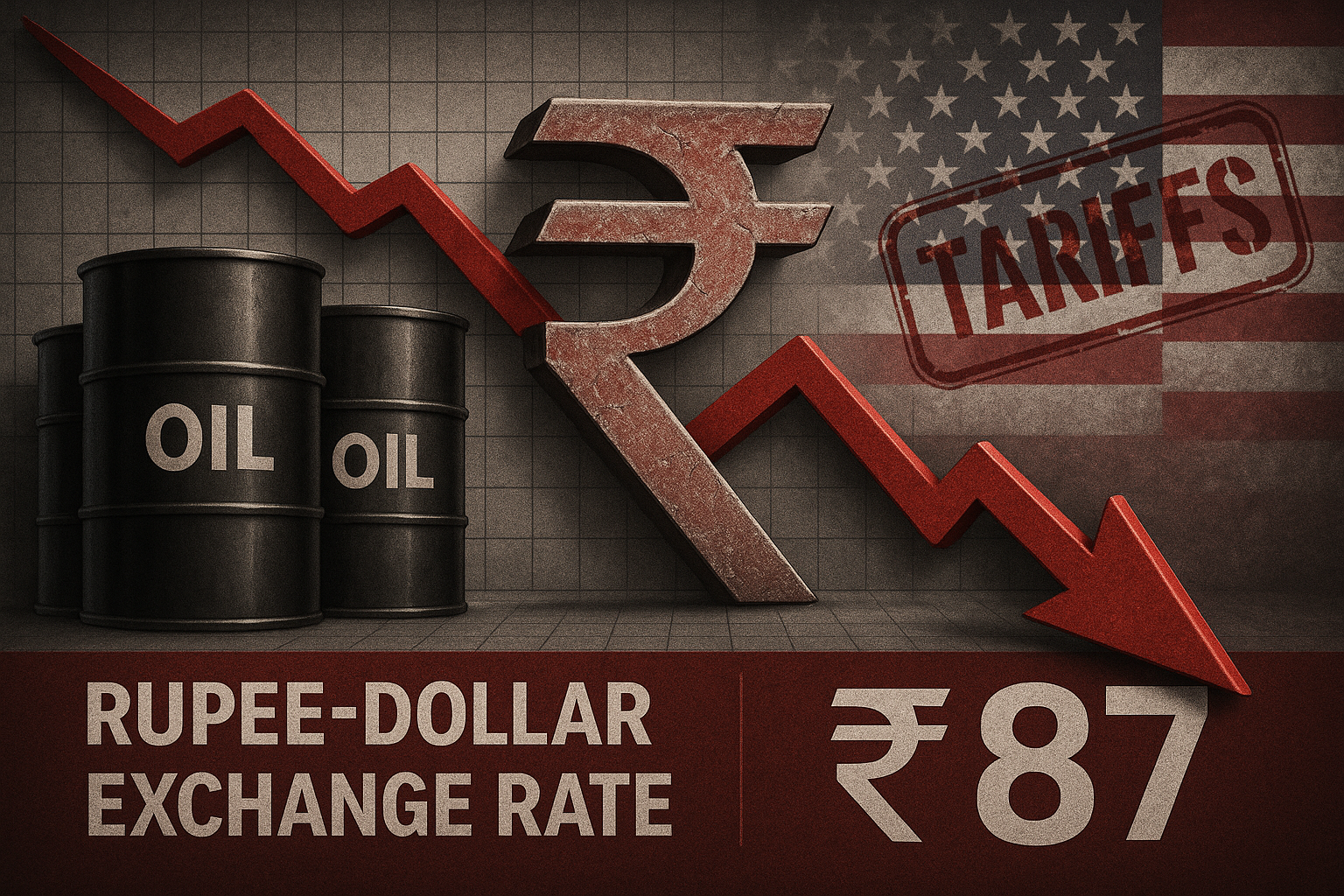

The Indian rupee plummeted to a four-month low on July 30, 2025, breaching the ₹87 mark against the U.S. dollar amid heightened uncertainty over a potential 20–25% U.S. tariff on Indian exports and rising crude oil prices. This marks the lowest valuation since mid-March.

Key Drivers Behind the Rupee Decline

1. U.S. Tariff Threat Intensifies Pressure

Comments from former President Donald Trump about imminent tariffs ranging from 20–25% on Indian goods rattled markets, fueling speculation and denting confidence ahead of a looming August 1 trade deadline. India is holding off on fresh concessions while negotiations continue, pushing the rupee into a sharp downturn.

2. Importers Dollar Demand & FII Outflows

Month-end dollar purchases by importers combined with persistent foreign capital outflows strained the rupee. Overseas investors divested roughly $689 million in equities and $66 million in debt on July 28 alone, exerting bearish sentiment.

3. Rising Crude Brent Oil Prices

A surge in Brent crude above $72 per barrel escalated inflation worries and elevated India’s import bill, further weakening the currency.

RBI Intervention & Market Response

Traders indicate that the Reserve Bank of India (RBI) intervened intermittently via dollar sales through state-run banks to cushion rupee depreciation—but interventions were measured rather than large-scale.Those operations prevented further slide even as the greenback rose.

Exchange Rates & Recent Trends

-

The rupee sank to intra-day low of ₹87.15 before slightly recovering.

-

It closed at ₹86.9150 on July 29, down 0.2%—the weakest since March.

-

Over the past 15 sessions, the rupee closed stronger only twice, signaling sustained losses.

Earlier in February, the currency touched a record low of ₹87.35, driven by rate-cut speculation and importer dollar demand.

Implications & Market Sentiment

| Area | Implication |

|---|---|

| Investors & Markets | Rising volatility and currency risk may spur equity market caution. |

| Importers | Higher import costs may squeeze margins, especially in commodities and oil-heavy sectors. |

| Exporters | A weaker rupee can support export margins, but uncertainties around trade deal and tariffs create ambiguity. |

| Policy & Central Bank | RBI may maintain a cautious stance, balancing intervention with monitoring of rate transmission ahead of its policy meeting. |

Outlook

With trade negotiations still unsettled and oil prices climbing, analysts anticipate further rupee weakness toward the ₹87–₹87.10 range, unless a breakthrough on bilateral talks arrives. The currency outlook remains sensitive to global risk perception, and RBI’s measured responses will be closely scrutinized.

Conclusion

The rupee’s breach past ₹87/USD underscores the compounded impact of tariff concerns, oil inflation, and foreign investor retreat. While mild RBI intervention helped arrest further slide, depreciation pressures persist. India’s upcoming trade talks with the U.S. and the next monetary policy stance could shape the near-term trajectory of the rupee.