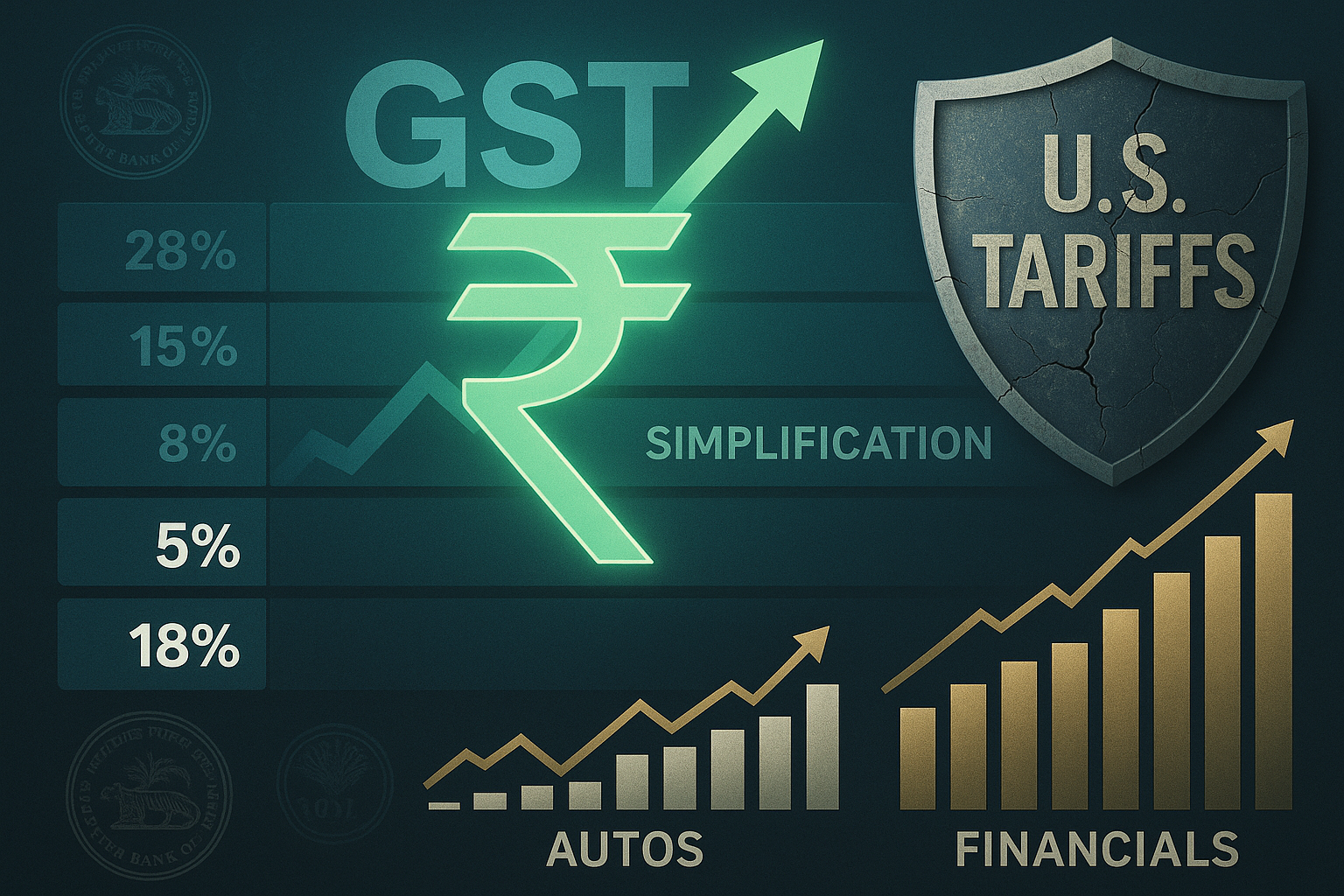

The Indian rupee recorded its sharpest single-day appreciation in more than a month, gaining 40 paise against the U.S. dollar to close near ₹86.95–86.99/USD. The surge was driven by two powerful triggers: growing optimism over the proposed Next Gen GST reforms and easing concerns about new U.S. tariffs on Indian exports. The rally underscores how policy clarity and global trade signals continue to influence currency sentiment, reinforcing India’s reform-led growth story.

Rupee’s Best Performance in Weeks

Currency traders and market watchers described the move as the rupee’s biggest daily gain since July 2025. The currency opened firm, sustained momentum throughout the day, and closed with notable strength, outperforming many Asian peers.

This gain marked a reversal from weeks of volatility, where the rupee had faced pressure from:

-

Global trade uncertainty,

-

Rising U.S. interest rate expectations, and

-

Imported inflation concerns.

Drivers Behind the Rally

1. GST Reform Hopes

The government’s signal to rationalize GST slabs—from four to two (5% and 18%) while keeping luxury items at 40%—sparked optimism in markets.

-

Auto and FMCG stocks rallied, with investors betting on higher consumer demand.

-

Insurance premiums could fall sharply under the proposed cuts, further fueling household spending.

-

For currency markets, this translated into confidence that domestic consumption growth will strengthen India’s external position.

2. Fading U.S. Tariff Fears

Global sentiment turned positive as negotiations signaled that Washington may delay or soften additional 25% tariffs on Indian goods.

-

This eased pressure on Indian exporters.

-

Investors interpreted the move as a reduction in external headwinds that had weighed on the rupee.

3. Domestic Credit Upgrade

A recent sovereign credit rating outlook upgrade has bolstered investor trust in India’s macroeconomic trajectory.

-

The upgrade signaled confidence in fiscal management.

-

Combined with GST-led consumption optimism, it created a virtuous cycle of investor inflows.

Broader Market Reactions

Equities Surge

-

The Sensex and Nifty both closed higher, with consumption and auto stocks leading the charge.

-

Maruti Suzuki, Tata Motors, and FMCG majors like Hindustan Unilever rallied as analysts factored in stronger demand.

Bonds Under Pressure

-

The bond market saw a mild sell-off amid concerns of fiscal costs associated with tax cuts.

-

Yields ticked upward, reflecting investor caution on government borrowing.

Commodities and Oil Impact

-

A stronger rupee reduces import costs, particularly for crude oil, which could ease inflationary pressure.

-

This provided further comfort to markets anticipating lower input costs for businesses.

Policy Context: Next Gen GST and Market Confidence

The government’s proposed GST rationalization is not only a tax exercise but also a signal of reform continuity.

-

Lowering indirect taxes on key consumption goods is aimed at stimulating demand.

-

Simplifying slabs reduces compliance burden and improves transparency.

-

By pairing reforms with investor-friendly communication, policymakers are reinforcing the stability narrative critical to currency confidence.

Global Comparisons

India’s rupee performance also stood out in the region:

-

While several Asian currencies weakened against a stronger dollar index, the rupee gained ground, highlighting domestic fundamentals at play.

-

The move underscored the importance of domestic policy actions in cushioning global shocks.

Why This Matters

-

Currency Stability: A stronger rupee cushions India’s import bill, especially crude oil and commodities.

-

Export Competitiveness: Tariff relief improves exporters’ outlook and tempers trade deficit fears.

-

Policy Validation: Shows markets are highly responsive to reform clarity and fiscal discipline.

-

Festive Boost: Strengthening consumer sentiment ahead of the festive season could sustain momentum across sectors.

-

Investor Signal: Reinforces India’s narrative as a resilient, reform-driven economy capable of absorbing global shocks.