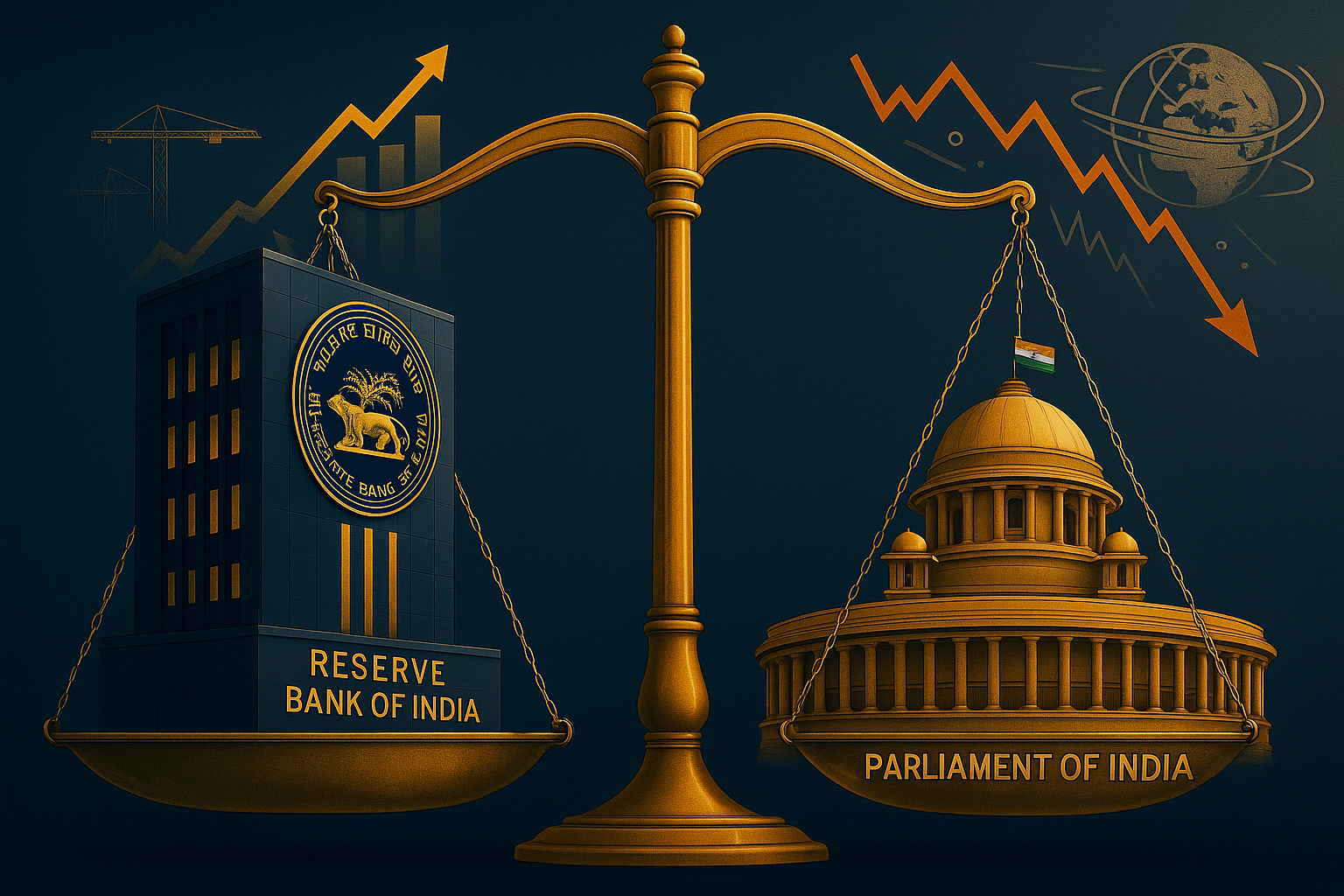

A subtle but important divergence has emerged between the Reserve Bank of India (RBI) and the government over India’s medium-term growth outlook. While the government maintains optimism about sustained high growth driven by investment and reforms, the RBI has struck a more cautious note, citing risks from inflation, global headwinds, and uneven domestic demand.

This difference in tone underscores the challenges of balancing policy credibility with growth ambition at a time when India seeks to position itself as the world’s fastest-growing large economy.

Government’s Optimistic Stance

The government has repeatedly emphasized that India’s growth trajectory remains intact, supported by strong infrastructure spending, resilient consumption, and structural reforms. Officials highlight buoyant tax revenues, strong FDI flows, and manufacturing push under Make in India as signs that the economy is well-positioned for a decade of expansion.

From New Delhi’s perspective, short-term fluctuations in inflation or trade balances are secondary to the bigger picture of long-term opportunity. This confidence is also crucial for attracting foreign investors and sustaining momentum in capital markets.

RBI’s More Guarded Outlook

In contrast, the RBI has cautioned against over-optimism. While acknowledging growth momentum, it points to challenges such as sticky food inflation, global interest rate volatility, and external trade imbalances.

For the central bank, anchoring inflation expectations and ensuring macroeconomic stability are as important as achieving high growth. The RBI’s cautious commentary suggests that policy rates and liquidity management will continue to be guided by prudence rather than political pressure.

What the Divergence Means

The differing perspectives do not necessarily indicate conflict but reflect the distinct roles of the two institutions.

The government prioritizes projecting confidence to sustain investment and sentiment.

The RBI emphasizes discipline, warning against risks that could derail growth if left unchecked.

Together, these views create a balance—optimism tempered by caution—ensuring that India’s growth narrative remains credible both domestically and internationally.

Why This Matters

This divergence highlights the dynamics between fiscal and monetary policy in shaping India’s economic path.

For Investors: Confidence in growth backed by caution improves market credibility.

For Policymakers: Healthy debate ensures checks and balances in decision-making.

For Citizens: A balanced approach supports both opportunity and stability.

Ultimately, India’s growth story depends on maintaining this equilibrium—encouraging ambition without underestimating risks.