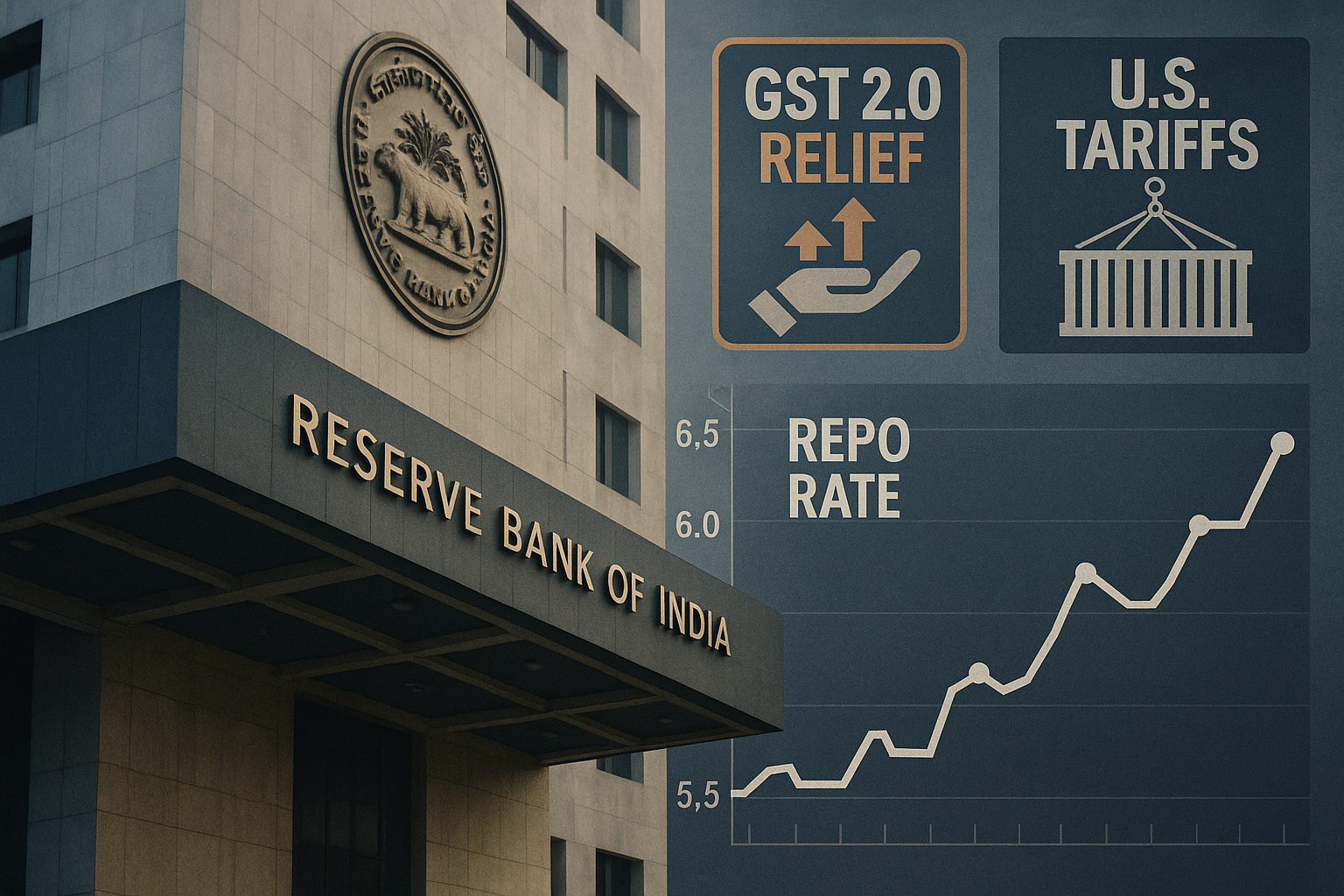

A majority of economists in an ET poll expect the Reserve Bank of India (RBI) to keep the repo rate steady at 5.50% during its October 1 policy meeting, despite inflation being below target. With recent GST 2.0 tax cuts boosting consumption and uncertainties from higher US tariffs clouding the outlook, policymakers are seen preferring to retain policy space rather than cut rates prematurely. Some economists, however, argue the RBI should act proactively, pointing to easing inflation and slower global growth.

Core Development

Of the 22 economists surveyed, 14 predict a status quo, while others see a potential 25 bps cut later in December if growth slows.

Key highlights:

Retail inflation fell to 2.7% in August, the seventh consecutive month below RBI’s 4% target.

GDP expanded 7.8% in Q1 FY26, faster than expected.

Recent GST rate cuts may temporarily reduce inflation, masking real demand trends.

US tariffs risk dampening exports and overall growth momentum.

Key Drivers / Issues

GST 2.0 effect: Lower tax rates have reduced prices, temporarily pushing inflation down.

Global risks: Higher US tariffs could drag trade and growth.

Inflation outlook: RBI expects CPI to rise above 4% in H1 2026.

Policy space: Holding rates now allows for backloaded cuts if slowdown worsens.

Stakeholder Impact

For borrowers, steady rates keep EMIs unchanged in the near term. Banks maintain lending margins amid stable rates. Businesses benefit from consumption support through GST cuts, though exports face headwinds. For investors, bond yields may stay range-bound until policy clarity emerges.

Industry & Policy Reactions

Dhiraj Nim (ANZ Bank): RBI may wait to see GST impact before using its “rate cut bullet.”

Pranjul Bhandari (HSBC): Expects a “dovish hold,” with a 25 bps cut possible in December if tariffs persist.

Barclays economists: See FY26 CPI averaging 2.4%, creating scope for easing.

Challenges Ahead

Balancing consumption boost from GST cuts with external trade risks.

Timing rate cuts without stoking inflationary pressures.

Navigating global headwinds while sustaining domestic growth momentum.

Strategic Outlook

The October policy is expected to be a cautious pause, with the RBI balancing strong domestic growth and subdued inflation against uncertain global conditions. Future cuts may come if US tariffs deepen the slowdown and GST-led demand fades post-festive season.

Why This Matters

RBI’s rate stance shapes borrowing costs, investment flows, and growth momentum. A steady hand now reflects caution amid global uncertainty while leaving room for targeted policy easing later.