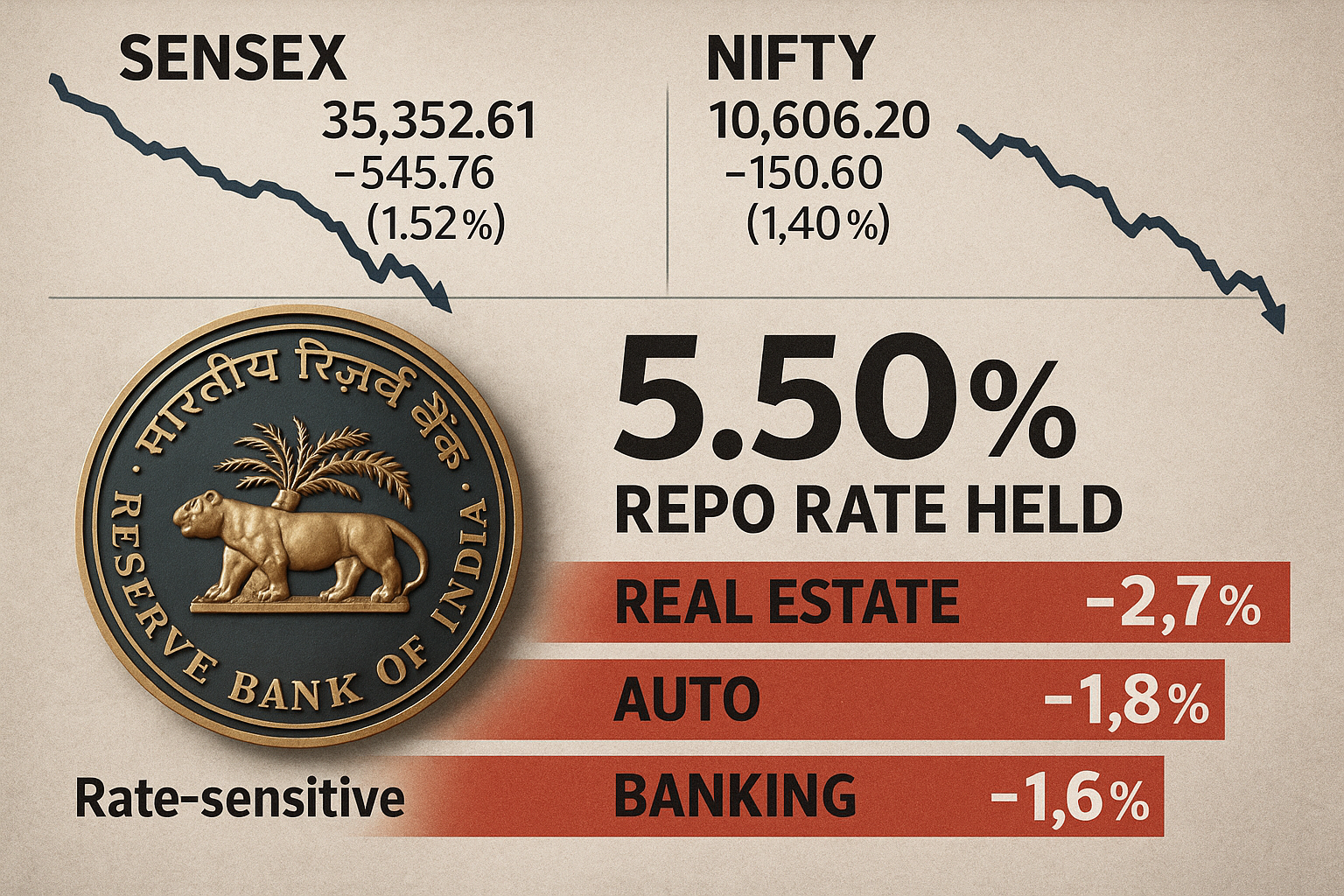

The Reserve Bank of India (RBI), in its bi-monthly monetary policy review held on August 6, 2025, kept the repo rate unchanged at 5.5%, aligning with market expectations. The central bank retained a neutral stance, emphasizing its data-dependent approach amid continued domestic disinflation, global trade volatility, and geopolitical risks.

While the policy stance was broadly in line with expectations, Indian equity markets reacted with mild negativity, particularly among rate-sensitive sectors like real estate, auto, and banking. This underscores the growing caution among investors around earnings growth, interest rate sensitivity, and evolving international developments—particularly the emerging tariff standoff between the U.S. and India.

Market Reaction: Indices Slip as Optimism Fades

Shortly after the RBI announcement:

BSE Sensex lost over 260 points, closing around 80,448, down 0.32%.

Nifty50 declined by 0.43%, ending at 24,544.

Broader markets underperformed, with midcap and small-cap indices falling 1.2–1.4%.

The muted sentiment reflects both a disappointment over the lack of a dovish tilt and concerns over escalating trade tensions with the U.S. following former President Donald Trump’s tariff statements.

Sectoral Performance: Pressure on Rate-Sensitive Sectors

| Sector | Movement | Key Stocks Hit |

|---|---|---|

| Real Estate | -2.0% to -2.5% | DLF, Lodha, Godrej Properties |

| Automobiles | -1.0% to -1.2% | Maruti, Tata Motors, M&M |

| Financials | -0.5% to -0.8% | SBI, HDFC Bank, ICICI Bank |

| PSU Banks | Marginally up | Recovery on selective buying |

The real estate sector saw the steepest decline, as the RBI’s rate-hold dims hopes for faster transmission of previous cuts, impacting housing demand. Auto stocks also declined due to concerns over financing costs, while banking and NBFCs remained mixed, reflecting balance sheet strength versus rate headwinds.

RBI’s Justification and Commentary

RBI Governor Shaktikanta Das stressed that the central bank’s decision to maintain the status quo is rooted in:

Subdued inflation outlook: June CPI fell to a 77-month low of 2.1%, leading the RBI to revise FY26 inflation estimates down to 3.1% from 3.7%.

Steady growth expectations: GDP growth for FY26 is projected at 6.5%, while FY27 is expected to grow at 6.6%, buoyed by manufacturing recovery and strong rural demand.

Global headwinds: The RBI flagged emerging global risks, including new U.S. tariff threats, tensions in the Red Sea, and volatile oil prices as critical factors.

“We are vigilant of external shocks and continue to maintain monetary and financial stability as our core focus,” said Das in his address.

Trade Tensions Loom: The Trump Tariff Factor

One of the most discussed topics during the RBI presser was the potential imposition of a 25% U.S. tariff on select Indian exports, proposed under a renewed protectionist push by Donald Trump.

While the RBI did not explicitly factor this into its rate decision, it emphasized the potential negative impact on India’s export-driven manufacturing, especially in textiles, chemicals, and auto components. Analysts now believe any future rate cuts will be contingent on how this geopolitical friction unfolds.

Analyst Views: Cautious but Not Bearish

Most brokerage firms interpret this policy as a ‘dovish pause’, where the RBI prefers to monitor past transmission of ~100 bps rate cuts delivered between December 2024 and April 2025.

Kotak Institutional Equities stated:

“Given falling inflation and stable GDP, there is room for one more rate cut later this year if global headwinds do not worsen.”

Motilal Oswal noted that “markets are adjusting to a new normal of moderate policy support and high geopolitical risk”, hence the sideways movement.

What to Watch Ahead

| Key Metric | Why It Matters |

|---|---|

| Credit growth data | Determines impact of current rates |

| Global tariff developments | Can influence currency & exports |

| Monsoon and agri output | Influences rural demand, food prices |

| Core CPI trajectory | Will guide future rate decisions |

Conclusion: RBI Balancing Act Continues

While the RBI refrained from easing policy further, it has sent a clear signal: the door remains open to action if inflation remains benign and external risks persist. Investors should stay cautious but not overly defensive. Sectors like infrastructure, export-oriented manufacturing, and IT may offer relatively safer bets until the policy direction gains clarity.