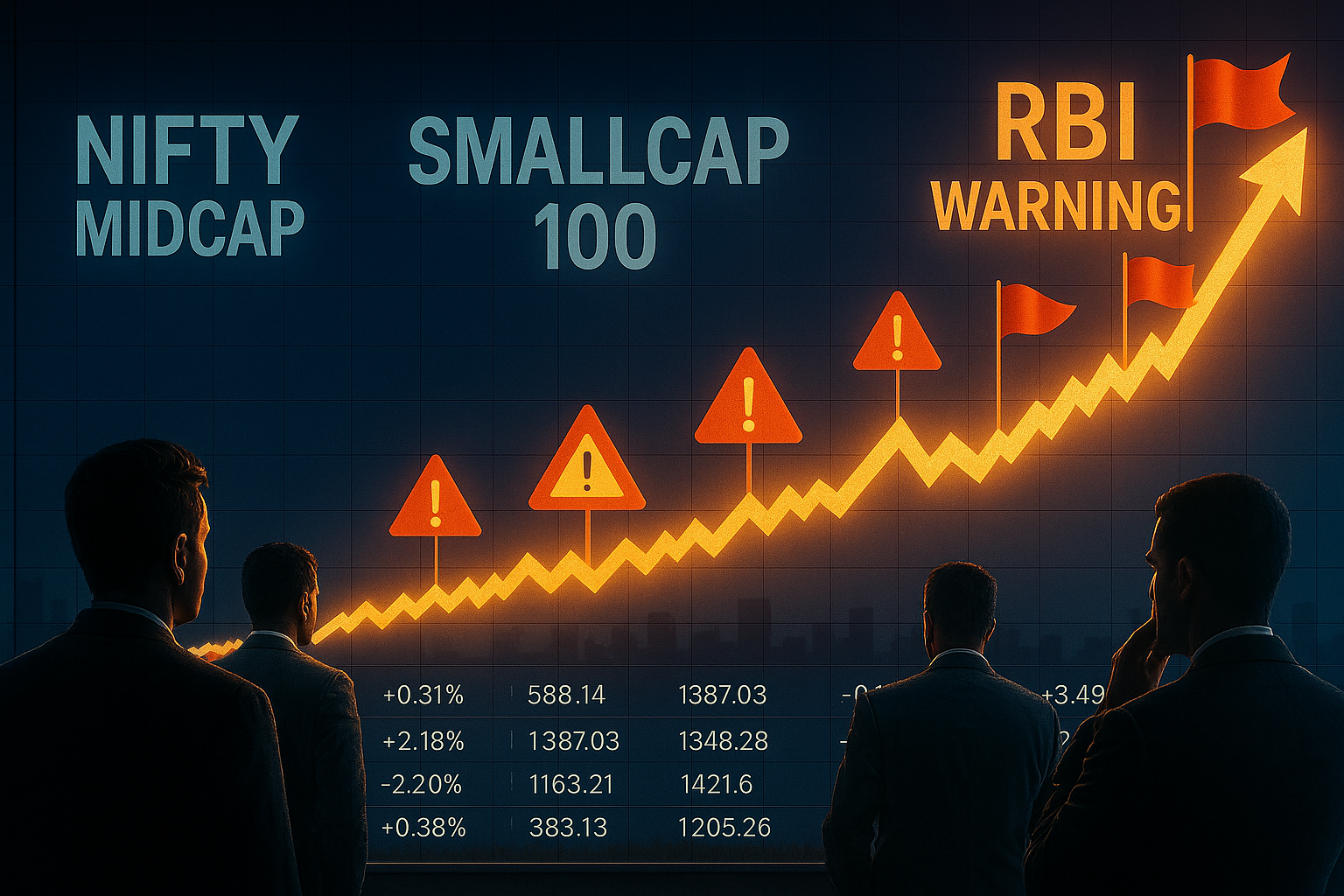

The Reserve Bank of India (RBI) has raised red flags over potential overvaluation in Indian equity markets, particularly in the small- and mid-cap segments, according to its latest Financial Stability Report (FSR) released in June 2025. The central bank cautioned that current market valuations are diverging from economic fundamentals, and a slowdown in corporate earnings could trigger volatility, especially amid global macroeconomic uncertainty.

Background and Context

India’s stock markets have been on a sharp upward trajectory, with benchmark indices hovering near record highs. However, the FSR warns that investor exuberance, especially in mid- and small-cap stocks, may be disconnected from ground realities.

According to the RBI:

The Nifty Midcap 100 index, expected to grow at 17.4%, would require 28% growth to support current valuations.

The Nifty Smallcap 100 index, with a forecasted 16.9% growth, would need 30.6% earnings expansion to be fairly priced.

“Optimism seems to be outpacing earnings realities,” the FSR noted, citing both domestic and global mismatches between asset prices and economic output.

Expert Perspectives

Nilesh Shetty, Portfolio Manager, Quantum Advisors

“There has already been a correction in mid- and small-caps earlier in the year due to valuation concerns. But a sharp rebound has pushed them close to all-time highs again—even as Q1 earnings may disappoint.”

Siddarth Bhamre, Head of Institutional Research, Asit C Mehta

“Midcaps are priced at a premium because of their perceived high growth potential. But the key question is: can that growth be sustained beyond 1–2 years?”

He also flagged the limited supply of high-quality stocks in the midcap space:

“Investors are willing to pay higher multiples for quality. But finding fundamentally sound names at fair prices is becoming increasingly difficult.”

Broader Market Implications

📉 Valuation Disconnect

The FSR highlights that stock prices are racing ahead of earnings growth, a risky divergence that could lead to sharp corrections if company performance fails to meet expectations.

🌍 Global Spillover Risk

The RBI emphasized that overvaluation isn’t just an Indian issue:

In the US, the Nasdaq needs 26% earnings growth to justify current prices, but is projected to grow only at 19.9%.

The report warns that any price correction or volatility in US markets could spill over into emerging markets like India, increasing systemic financial risk.

🔍 Retail Investor Exposure

With rising participation from retail investors—many heavily invested in small- and mid-cap stocks—a sudden reversal could result in widespread losses and sentiment-driven selloffs.

Market Reactions and Social Media Commentary

@MarketWatchIndia

“RBI warning on midcap overvaluation is a wake-up call. Are we ignoring fundamentals in the FOMO rush? #StockMarket #Midcaps”

@GlobalEquityTrends

“If US equities correct, the RBI rightly flags risk spillovers to EMs. India’s markets look resilient, but fundamentals must catch up. #FSR #RBI”

@EarningsRadar

“30% growth needed in Nifty Smallcap earnings to justify valuations? Big ask in a slowing macro. #Overvaluation #IndianEquities”

Challenges Ahead

Q1 FY26 earnings season will be closely watched to see if companies can justify elevated valuations.

Investors may need to reassess risk in small- and mid-cap exposure, with greater focus on profitability and cash flow.

Institutional investors could turn cautious, reallocating toward large caps or defensive sectors if earnings disappoint.

Future Outlook

Valuation Compression Likely: If earnings growth slows or interest rates remain elevated, multiples may contract in the coming quarters.

Flight to Quality: High-quality, large-cap companies may see increased institutional inflows.

Increased Volatility: Both domestic and global events could trigger short-term corrections or sectoral rotation.

The RBI has urged investors and institutions to remain vigilant and risk-aware, highlighting the importance of macro-financial alignment in capital markets.

Conclusion

The RBI’s assessment serves as a critical reminder that market rallies not backed by fundamentals carry inherent risks. While India’s economic prospects remain robust, earnings will need to deliver at a much higher pace to justify current equity valuations—particularly in the mid- and small-cap segments. Investors and fund managers may need to rebalance portfolios, focus on quality over hype, and prepare for volatility as global and domestic growth narratives evolve.