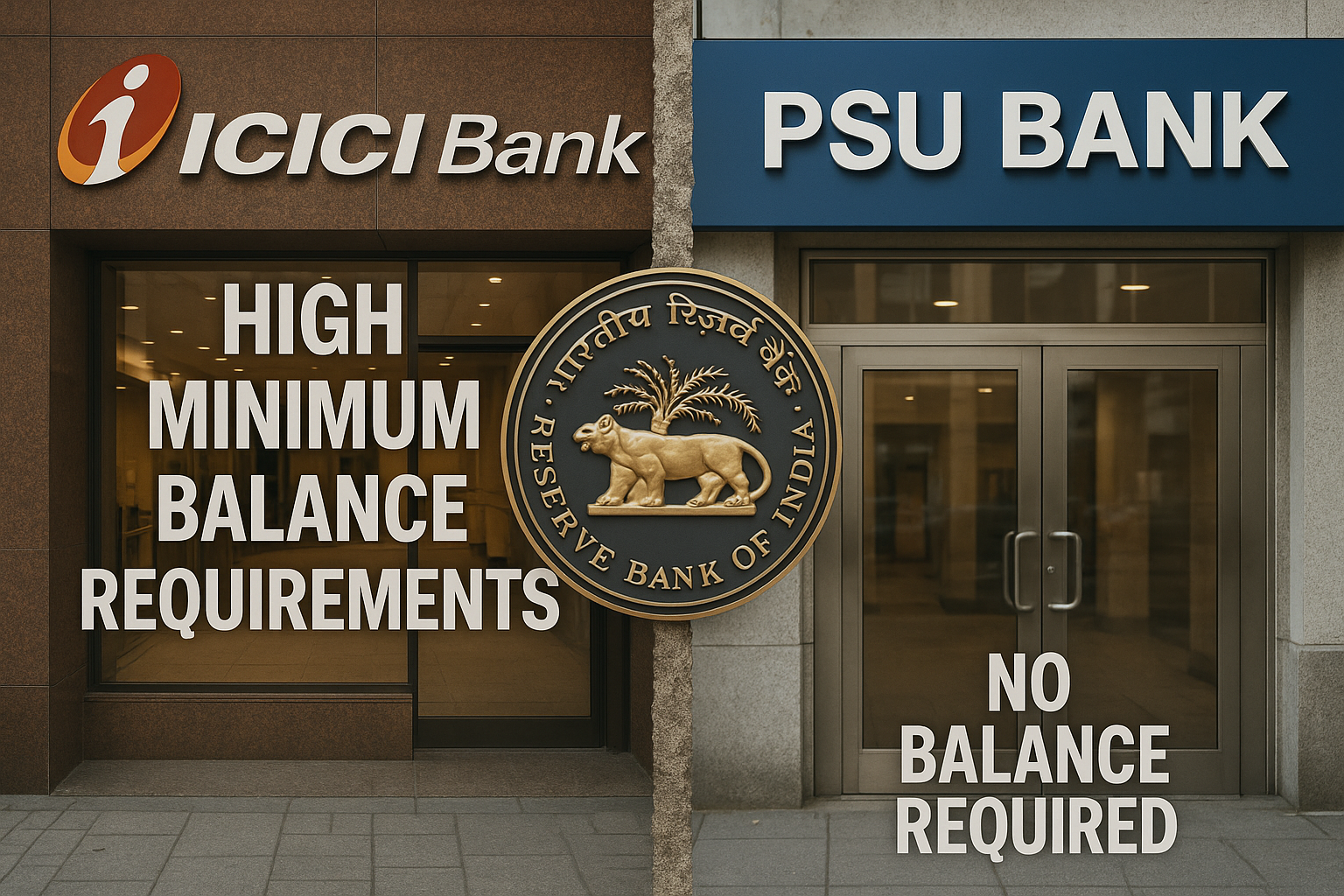

Reserve Bank of India Governor Sanjay Malhotra has clarified that minimum balance requirements for savings accounts are not regulated by the RBI. Instead, individual banks are empowered to determine their own thresholds based on business strategy and customer segments. This statement comes following ICICI Bank’s decision to drastically increase its minimum balance requirements.

Background and Context

Recently, ICICI Bank announced that as of August 1, 2025, new savings accounts will require significantly higher balances—a fivefold jump:

Metro/Urban: from ₹10,000 to ₹50,000 monthly

Semi-urban: from ₹5,000 to ₹25,000

Rural: from ₹2,500 to ₹10,000

These changes apply only to new accounts; existing customers continue under prior terms and may face penalties for non-compliance.

Following these changes, RBI Governor Malhotra was questioned at a financial inclusion event in Gujarat. He stated that the decision to set minimum balances lies entirely with individual banks and falls outside the regulatory domain of the RBI

Banking Sector Landscape

| Institution Type | Minimum Balance Policy |

|---|---|

| Private Banks | Varying thresholds; ICICI raised significantly |

| Public Sector Banks | Many have waived minimum balance requirements entirely |

Public sector banks such as SBI, PNB, Canara Bank, Indian Bank, and others have eliminated penalties for not maintaining minimum balances, aligning with financial inclusion goals

Market & Consumer Reactions

Jay Kotak, Chairman of Kotak Mahindra Group, voiced strong criticism of steep balance hikes, warning that such policies may exclude approximately 90% of the population, particularly the middle class Consumer advocacy groups express similar concerns, noting that higher thresholds may create banking access barriers, particularly in lower-income and rural segments.

What This Means for Stakeholders

Consumers: Must carefully evaluate account terms before opening new accounts—especially with banks like ICICI that enforce higher minimum balances.

Banks: While free to set thresholds, they must balance liquidity needs with financial inclusion mandates and public sentiment.

Regulators: The RBI’s non-interference stance allows for flexibility, but ongoing scrutiny from public and regulatory bodies could drive industry-wide policy recalibration.