Indian Non-Banking Financial Companies (NBFCs) have rapidly ramped up their external borrowing in 2025, raising a substantial $3.67 billion through syndicated loans—more than double the total amount borrowed in 2024. This surge reflects improving sentiment among global lenders, alongside more attractive borrowing conditions and regulatory incentives. A broader trend shows NBFCs dominating foreign funding through External Commercial Borrowings (ECBs), especially amid domestic credit constraints.

Growing Reliance on Offshore Markets

Syndicated Loan Surge

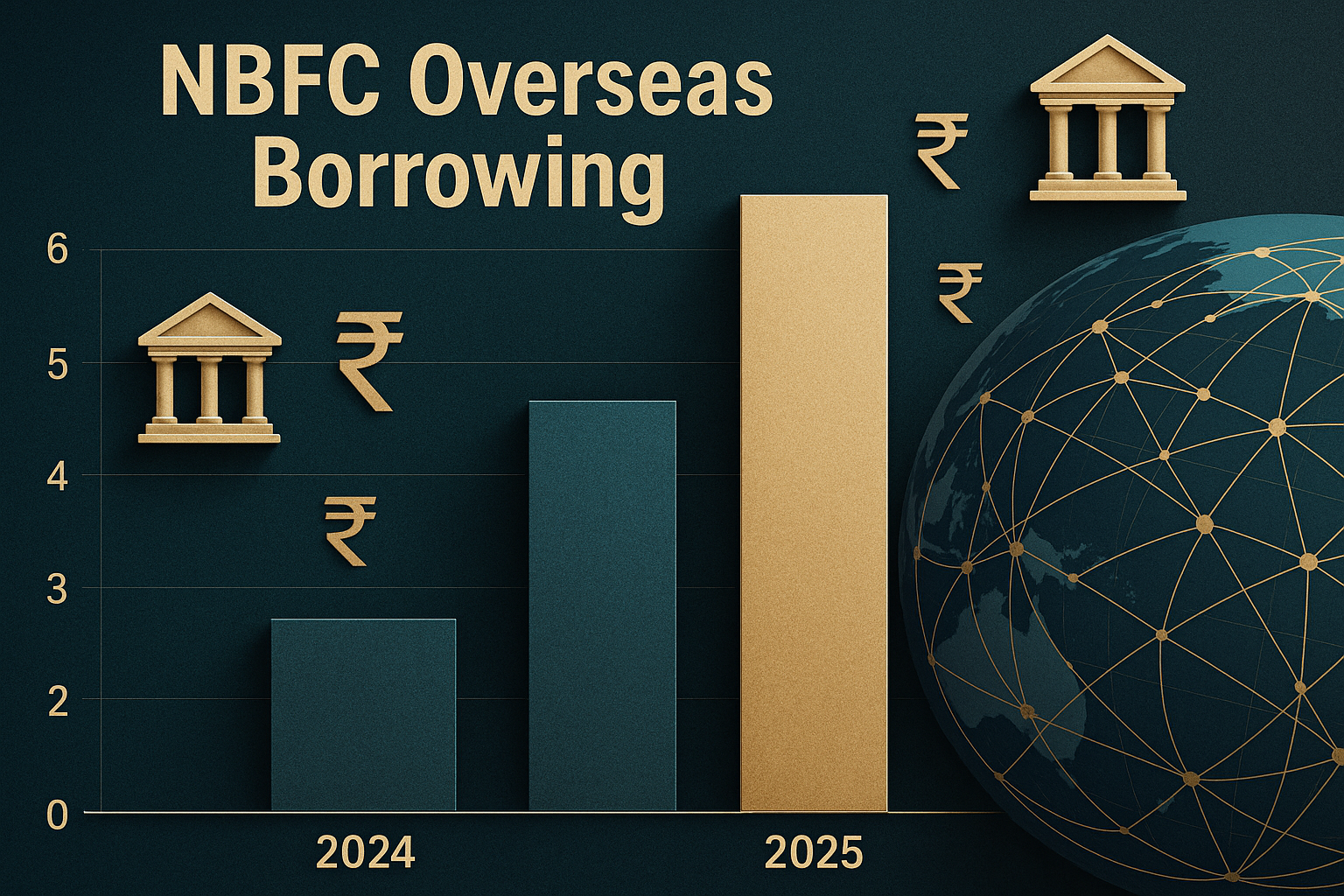

NBFCs have raised $3.67 billion overseas so far in 2025, surpassing the $1.64 billion total for all of 2024. The growth is fueled by cheaper pricing, improved access to international syndicates, and favourable tax treatment on offshore debt.Dominance in ECB Flows

Throughout FY25, Indian corporations mobilized a record $61 billion via ECBs, with NBFCs contributing nearly 44% or approximately $21 billion, up from 25% the previous year.Leaders in April Borrowing

In April alone, NBFCs raised around $1.53 billion, positioning them as the top borrowers among Indian firms via overseas loans.

Underlying Drivers for the Offshore Shift

| Driver | Insight |

|---|---|

| Domestic Funding Squeeze | Many banks, reacting to higher risk weights and limited credit flow to NBFCs, have offered only marginal MCLR cuts—pushing NBFCs toward cost-effective offshore options. |

| Better Liquidity Access | Global institutions are responding with large syndicates, providing a broader and deeper pool of funding instruments. |

| Regulatory & Tax Incentives | Favorable taxation on external borrowing has made overseas loans comparatively attractive for NBFCs. |

| Borrowing Diversification | Alongside managing liability costs, NBFCs are seeking international funding to hedge against domestic volatility and fund growth. |

Broader Implications

Viability of NBFC Funding

The strategic pivot to overseas borrowing underscores NBFCs’ adaptability and willingness to leverage global capital for operational resilience.Regulatory Oversight

Increased overseas borrowing brings exchange-rate and debt sustainability risks—areas where the RBI may need to recalibrate ECB guidelines.Macroeconomic Balance

While this offshore funding surge reinforces credit flow, it also increases exposure to currency risks—a delicate trade-off for systemic stability.