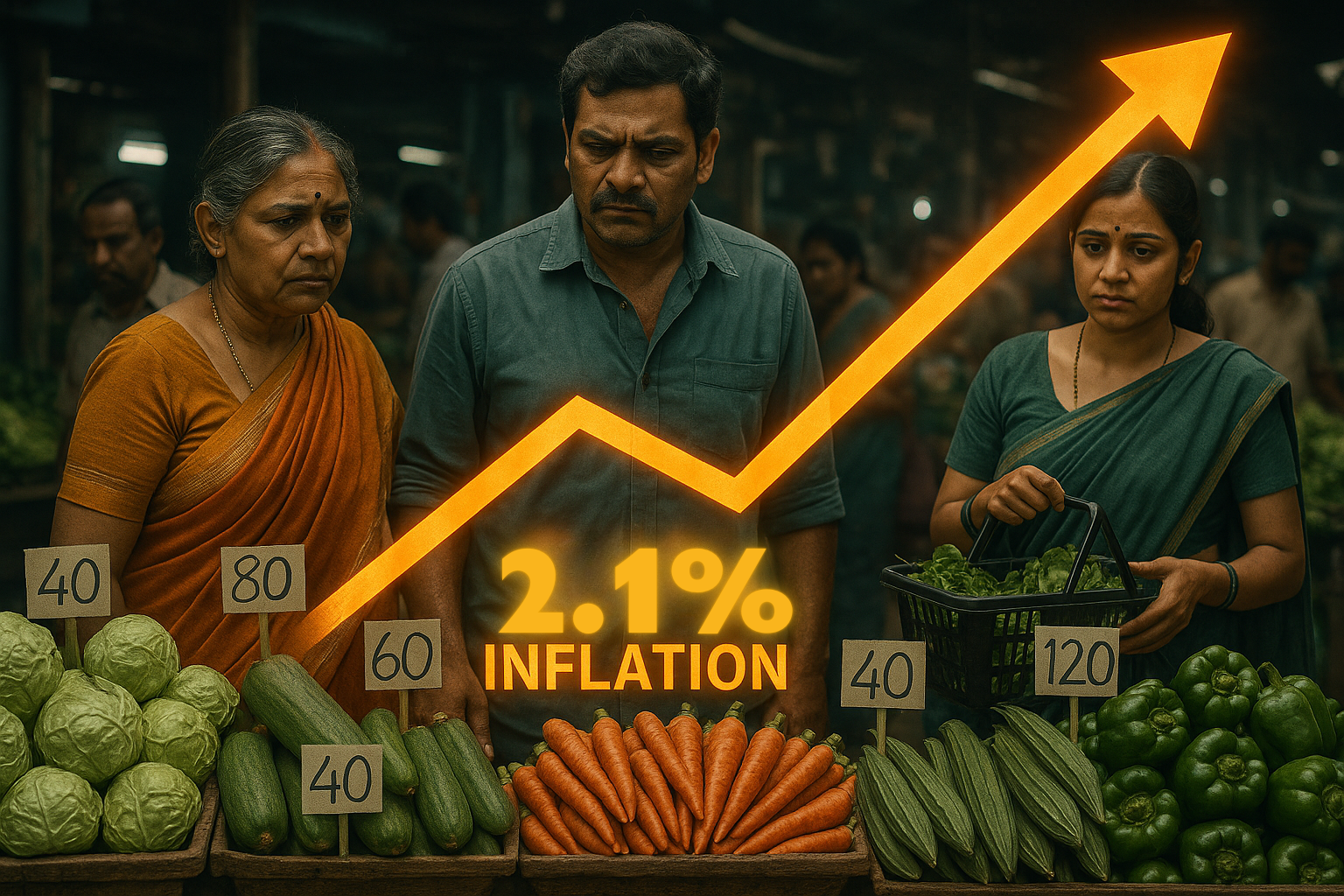

India’s retail inflation climbed to 2.1% in August 2025, primarily driven by rising food prices, according to official data. The increase, though still below the Reserve Bank of India’s (RBI) 4% target, reflects emerging pressures on household budgets and signals that food price volatility remains a key risk to India’s inflation trajectory.

The data comes at a time when recent GST rate cuts are expected to soften prices, raising questions on how effectively the benefits will offset the surge in food costs.

Core Development

The August retail inflation print revealed:

Headline CPI Inflation: Rose to 2.1%, up from the previous month’s levels.

Food Inflation: The largest contributor, led by vegetables, cereals, and pulses.

Core Inflation: Remained stable, indicating broader price stability outside food categories.

While the overall rate remains manageable, analysts caution that sustained food price spikes could undermine household spending power and impact consumption-led growth.

Key Drivers Behind the Spike

Seasonal Volatility: Poor rainfall and supply disruptions lifting prices of vegetables and pulses.

Festive Season Demand: Early demand buildup adding temporary pressures.

Global Trends: Rising import costs in select commodities.

Stakeholder Impact

Consumers: Face higher food bills, straining rural and urban household budgets.

Businesses: FMCG and retail firms may see short-term demand moderation.

Government & RBI: Must monitor closely to ensure inflation remains within target.

Industry & Policy Reactions

Economists emphasized that while the spike is notable, inflation is still well below RBI’s 4% target, giving policymakers room for caution rather than panic. However, they noted that supply-side measures will be necessary to stabilize food prices and prevent a prolonged impact.

Challenges Ahead

Food Price Risks: Monsoon variability remains a major driver of volatility.

Global Shocks: Any surge in crude oil or commodity prices could amplify inflation.

Policy Balancing: Managing consumer relief without derailing fiscal stability.

Strategic Outlook

Retail inflation at 2.1% reflects a mixed picture — headline stability with underlying food-driven pressures. The trajectory in the coming months will hinge on supply-side management, GST reforms’ effectiveness, and seasonal trends.

Why This Matters

Inflation trends directly affect consumer confidence, monetary policy decisions, and investment flows. Even small shifts, like the rise to 2.1%, highlight the importance of proactive measures in food supply management to safeguard India’s growth story.