The Indian Finance Ministry has warned of a growing “trade policy dislocation” globally amid escalating geopolitical conflicts, notably in West Asia. These developments have prompted the government to suspend its Medium-Term Expenditure Framework (MTEF) under the FRBM Act for FY 26 due to heightened uncertainty in fiscal forecasting.

Context & Implications

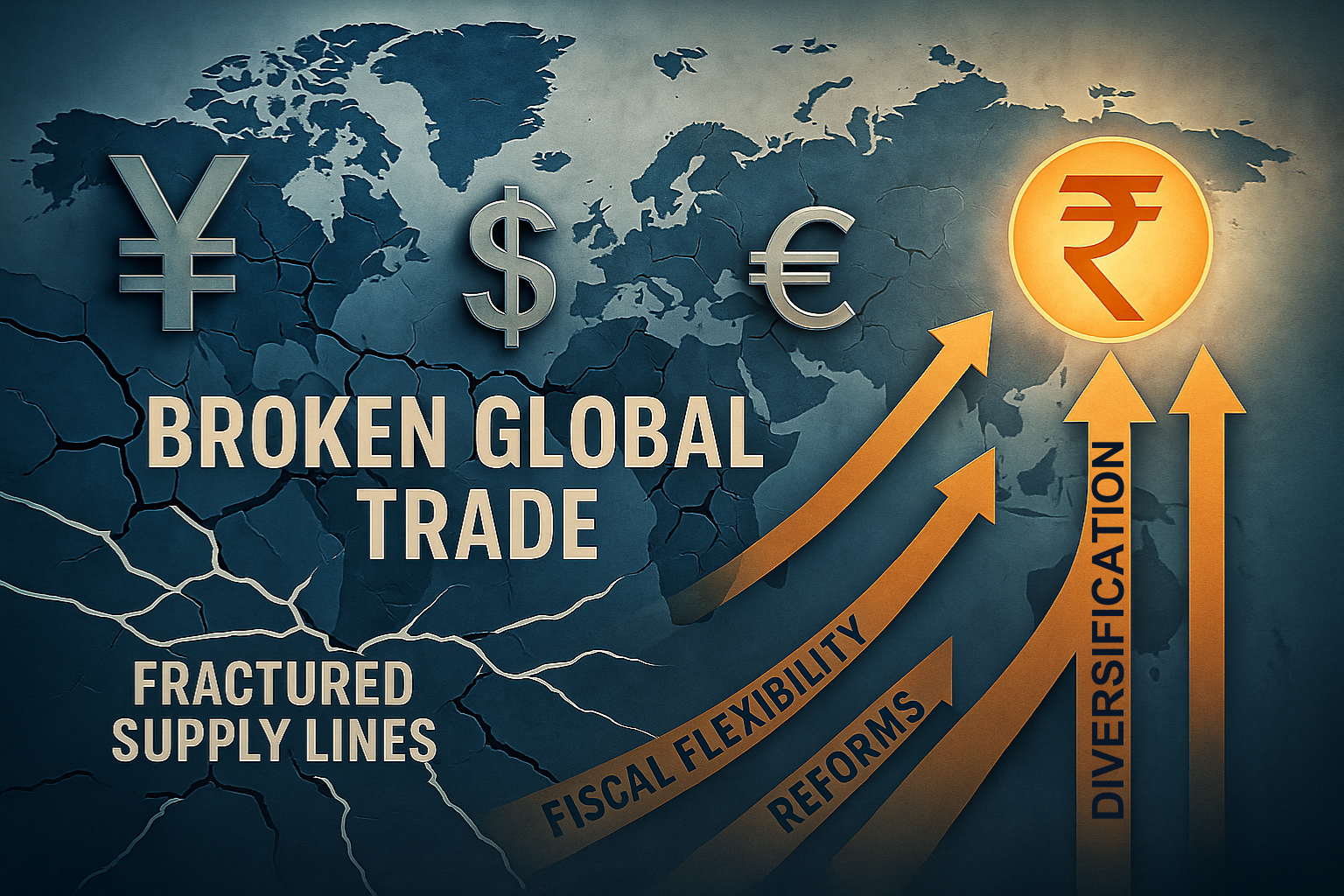

Trade & Fiscal Uncertainty

In its mid-year budget review, the Finance Ministry cited the unpredictable trajectory of global trade norms and surging geopolitical tensions as reasons it could not provide reliable medium‑term revenue and expenditure projections. As such, it has decided to forgo the standard MTEF process for the upcoming financial year.

Geopolitical Tensions

The West Asia crisis and fluctuating policy environments across major economies have disrupted global supply chains, elevated commodity price volatility, and complicated trade agreements. These stressors collectively hinder fiscal planning and economic stability.

India’s Multi‑Pronged Strategy

Trade Diversification & Reforms

To counteract these challenges, India is pursuing a multi‑faceted strategy involving:

Entering new export markets

Accelerating structural reforms

Boosting public capital expenditure (capex)

Enhancing foreign investment flows

This integrated approach aims to strengthen economic resilience.

WTO Engagement

India is actively pushing for reforms in the World Trade Organization (WTO)—calling for stricter mechanisms to address unfair trade practices, including non-market behavior and non-tariff barriers. The country also advocates for restoring a robust dispute resolution system.

Focus on Domestic Priorities

Prime Minister Modi reaffirmed that the welfare of farmers, small industries, and youth remains non-negotiable. The government’s “vocal for local” and Atmanirbhar Bharat policies are being leveraged to boost domestic production and shield vulnerable sectors from global disruptions.

Fiscal Strategy in Uncertain Times

By skipping the MTEF this year, the government underscores prudence in fiscal planning. The decision reflects that consistency in assumptions—especially concerning trade revenues and expenditure forecasts—is currently unattainable. As global volatility intensifies, maintaining flexibility in budgeting becomes paramount.

Conclusion

As global trade environments grow more unpredictable, India is responding pragmatically—abandoning rigid fiscal frameworks, doubling down on reforms, and safeguarding domestic economic interests. This policy pivot reflects a strategic shift toward adaptability over predictability in managing financial stability.