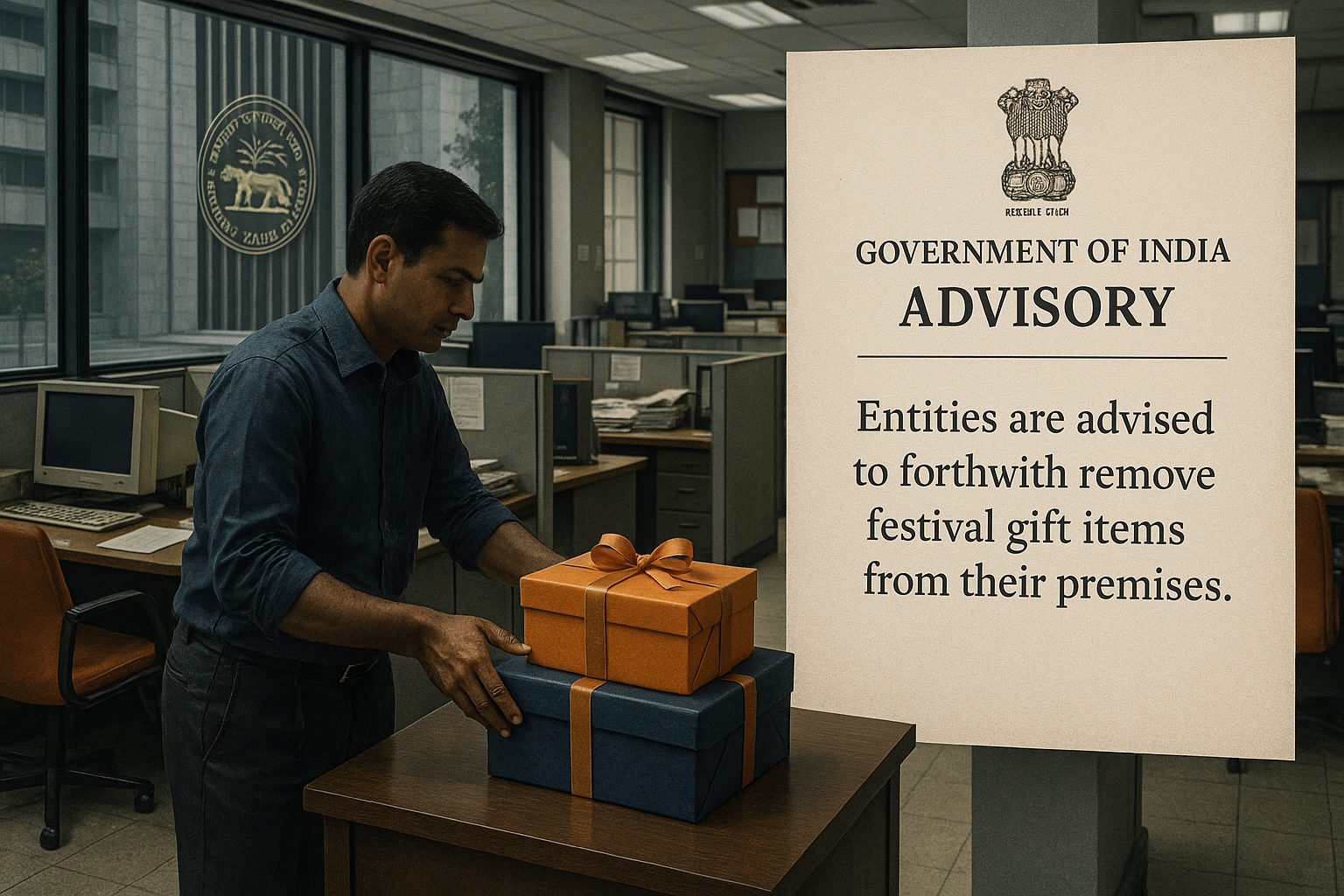

The Finance Ministry (FinMin) has instructed banks, financial institutions, and CPSEs—including the RBI—to discontinue spending on festival gifts like Diwali hampers. The advisory, based on a Department of Public Enterprises (DPE) directive, is aimed at curbing non-essential expenditure and reinforcing fiscal prudence. The move comes even as the government pushes tax cuts and GST 2.0 reforms to boost household consumption.

Core Development

The Department of Financial Services (DFS) circulated the advisory, stressing that no funds should be spent on gifts or related items during festivals.

The DPE’s September 19 circular highlighted widespread practices of CPSEs incurring such expenses.

Ministries, departments, and other government organs have been directed to comply.

The measure aligns with the government’s broader fiscal responsibility agenda, even as it promotes consumption through tax relief and GST cuts.

Key Drivers / Issues

Curbing wasteful expenditure amid fiscal consolidation.

Promoting judicious use of public resources.

Balancing state-driven consumption support with institutional austerity.

Stakeholder Impact

For banks and FIs, the order curtails discretionary spends during festivals. Employees and stakeholders may see reduced gifting perks, while the government reinforces its fiscal discipline stance. Taxpayers indirectly benefit from more responsible resource allocation.

Industry & Policy Reactions

Economists note the timing is significant: while the government reduces GST on 375 items and celebrates GST Bachat Utsav to spur demand, it expects public institutions to set an example in prudent spending. Policy experts view it as a signal of fiscal seriousness to both domestic and international observers.

Challenges Ahead

Balancing austerity with employee morale in government-linked entities.

Monitoring compliance across the vast network of CPSEs and financial institutions.

Avoiding public perception of mixed signals—tax relief for consumers versus austerity for state entities.

Strategic Outlook

The directive underscores a dual-track strategy: encourage private consumption while ensuring public sector prudence. Such measures may help India strengthen its fiscal credibility even as it navigates global economic challenges.

Why This Matters

This move reflects India’s commitment to fiscal responsibility, showing that the government is leading by example. Cutting festival gift expenditure may be symbolic, but it reinforces discipline, transparency, and responsible governance.