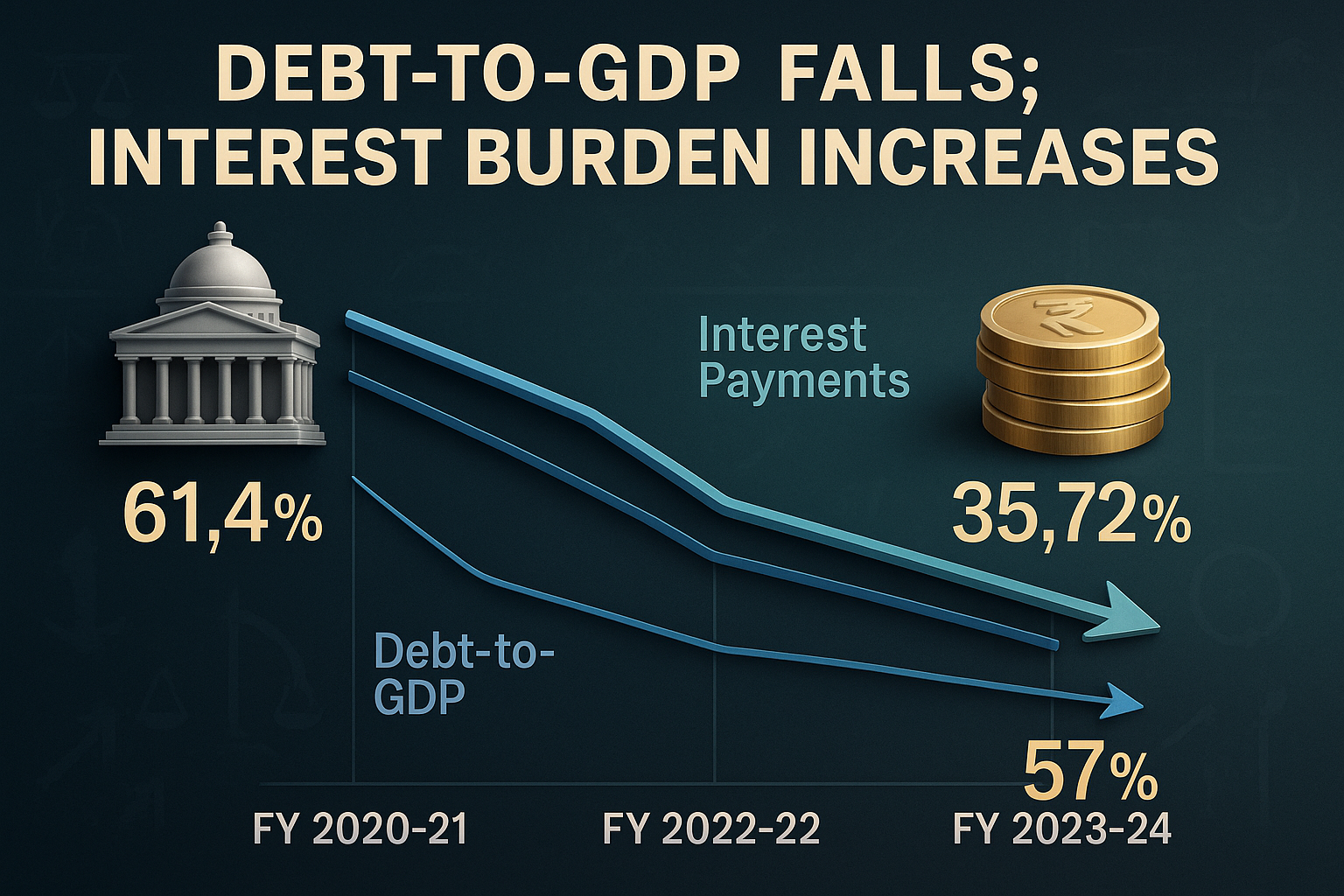

While India’s central government has successfully reduced its debt-to-GDP ratio from the pandemic peak of 61.4% in FY 2020–21 to 57% in FY 2023–24, its interest burden continues to climb. According to the latest Comptroller and Auditor General (CAG) report, interest payments now absorb 35.72% of the government’s revenue receipts—a level that strains fiscal flexibility despite the apparent improvement in debt sustainability.

Key Highlights

Debt-to-GDP Ratio Falls

The central government’s debt relative to GDP moderates steadily, easing to 57% by March 2024, down from a high of 61.38% in FY 2020–21. This reflects restrained borrowing amid robust GDP growth.Interest Payments Are Rising

Interest outgo, as a percentage of revenue receipts, rose to 35.72% in FY 2023–24, up from 35.35% in FY 2022–23 and 33.99% in FY 2021–22. These numbers underscore growing debt servicing costs even as debt growth slows.Improved Fiscal Balance

The CAG flagged that the debt stabilization indicator turned positive in FY 2023–24, signaling improved debt sustainability aligned with economic growth.

Underlying Dynamics

GDP Growth Outpacing Borrowing

The slowdown in debt accumulation compared to rapid GDP expansion has helped push debt-to-GDP lower—a positive sign of fiscal health.High Interest Costs

Even as borrowing moderates, servicing existing debt remains costly—likely due to earlier higher interest rates and elevated absolute debt levels.Revenue Pressure

With over a third of revenue receipts now directed toward interest payments, the government has less fiscal space for capital expenditure or social spending.

Broader Context & Comparative Insights

Globally, many advanced economies continue to grapple with rising debt and interest burdens. The OECD notes that elevated interest payments and primary deficits remain a concern for debt trajectories across member nations. Similarly, the IMF highlights how increased net interest expenses may offset improvements in fiscal margins.

Implications for India’s Fiscal Policy

Despite commendable progress in managing debt levels, rising interest servicing costs dampen the government’s ability to reallocate funds toward growth-enhancing programs.

Policy Trade-offs

Balancing between sustaining public investment and managing the interest burden will be critical, especially ahead of upcoming budget cycles.Need for Strategic Borrowing

The government may need to explore longer-dated, low-cost borrowing instruments or step up revenue growth to ease the interest pressure.