A report by Goldman Sachs highlights a fundamental shift in Indian households’ investment preferences: more citizens are moving from traditional physical assets like gold and real estate toward financial assets such as mutual...

A report by Goldman Sachs highlights a fundamental shift in Indian households’ investment preferences: more citizens are moving from traditional physical assets like gold and real estate toward financial assets such as mutual...

the Securities and Exchange Board of India (SEBI) mandated financial intermediaries—including mutual funds, stockbrokers, PMS, AIFs, RIAs, depositories, and exchanges—to make their digital platforms fully accessible to persons with disabilities (PwDs), aligning with...

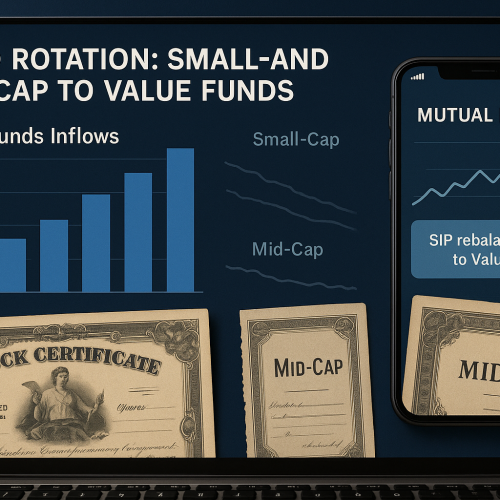

As India’s equity markets show signs of valuation fatigue in the small-cap and mid-cap segments, investors are increasingly reallocating capital toward value funds—a category long overshadowed by high-growth peers. According to recent industry...

Nestled in the Eastern Himalayas, the Kingdom of Bhutan is best known for its Gross National Happiness philosophy, stunning landscapes, and guarded cultural heritage. But now, this tiny landlocked nation is making waves...

Gold surged this week after President Trump reaffirmed plans to impose 30% tariffs on imports from the EU and Mexico, effective August 1. As geopolitical tensions heightened, bullion rallied to a three‑week high of...

India’s traditional banking fee models—minimum balance penalties, transaction charges, and bundled service pricing—are undergoing a quiet revolution. Enter subscription-based banking, where banks and fintechs now offer flat monthly or annual fees for premium...

With smartphones in hand and financial influencers in their feed, India’s Gen Z and millennial population is transforming the way investments happen. A wave of WealthTech platforms like Groww, Zerodha, INDMoney, and Smallcase...

India is witnessing a silent revolution in how financial data is shared, accessed, and monetized—driven by the Account Aggregator (AA) Framework, a consent-based system that enables individuals to control their personal financial data...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.