India’s inflation trajectory could surprise on the downside this month, with Consumer Price Index (CPI) inflation for July potentially slipping below 3% — the lowest in recent history. As analysts weigh the implications...

India’s inflation trajectory could surprise on the downside this month, with Consumer Price Index (CPI) inflation for July potentially slipping below 3% — the lowest in recent history. As analysts weigh the implications...

India’s pension fund managers are urging the Pension Fund Regulatory and Development Authority (PFRDA) to relax bond investment guidelines for National Pension System (NPS) portfolios. They argue that easing restrictions on the maturity...

In a significant regulatory update on July 11, 2025, the Reserve Bank of India (RBI) clarified that borrowers can voluntarily pledge gold or silver as collateral for agricultural and MSME loans—without it being...

Jane Street, the U.S.-based quantitative trading powerhouse, recently deposited around ₹4,843.6 crore (approximately $567 million) into an escrow account—a critical move to meet SEBI’s interim order. The firm has now formally requested that SEBI lift...

The recent surge in fintech IPO activity in India—spurred by listings like HDB Financial Services raising ₹12,500 crore and upcoming filings by Pine Labs, Groww, and Kissht—reflects a shift. The public markets today...

In April 2025, the Reserve Bank of India (RBI) released draft guidelines introducing a new securitization framework for stressed assets. This marks a strategic shift, enabling banks and NBFCs to sell bad loans...

Public sector banks in India are rethinking their recruitment and training strategies by placing a stronger emphasis on regional language proficiency. This shift comes amid rising concerns about customer dissatisfaction due to language...

The upcoming Monsoon Session of Parliament, set to begin around 21 July 2025, will prominently feature the Insurance Laws (Amendment) Bill, which proposes sweeping reforms—including 100% foreign direct investment (FDI) and composite licences...

India’s financial regulatory architecture may be heading for significant change following a pivotal meeting of the Parliamentary Standing Committee on Finance at Parliament House Annexe on July 10, 2025. Representatives from key public...

RBI Governor Sanjay Malhotra informed the Parliamentary Standing Committee on Finance that 1.12 lakh fake ₹500 currency notes were detected during FY 2024–25, marking a 37% increase from the previous year. While overall...

As global momentum around cryptocurrencies surges—largely influenced by U.S. President Donald Trump’s recent support—the Reserve Bank of India (RBI) has confirmed it is closely observing international developments. RBI Governor Sanjay Malhotra briefed the...

RBI Governor Sanjay Malhotra has clarified that while ₹2,000 denomination notes are no longer in active circulation, they remain legal tender in India. This statement was made during a meeting with the Parliamentary...

As India’s fintech lenders scale their unsecured credit portfolios, many encounter a common roadblock: How do you approve more customers without triggering a spike in defaults? The answer may lie in an often-overlooked...

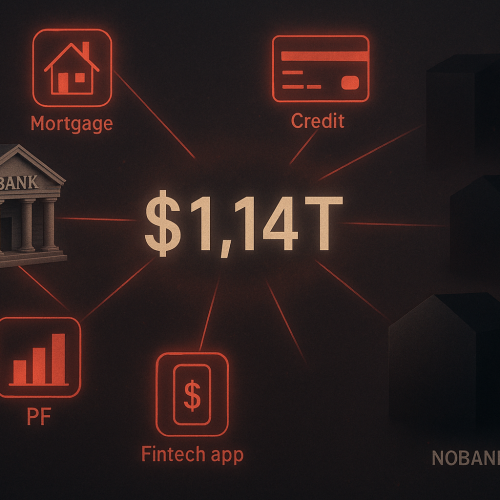

The financial system is entering a new phase of complexity and exposure as U.S. banks’ loans to nonbank financial institutions (NBFIs) surpass $1.14 trillion in Q1 2025, according to fresh data from the...

Following its unprecedented action against US-based trading firm Jane Street, SEBI Chairman Tuhin Kanta Pandey has reiterated the regulator’s zero-tolerance policy for market manipulation. Speaking at an industry event in Mumbai, Pandey emphasized...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.