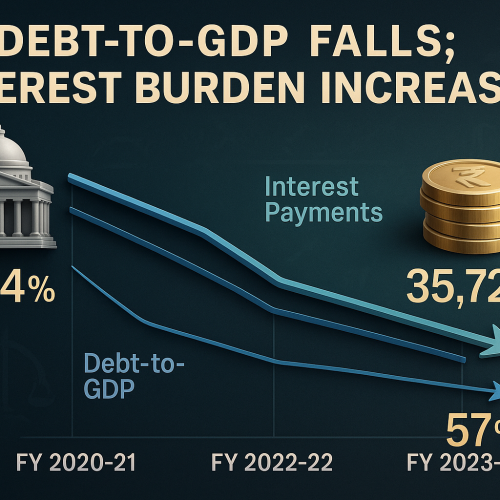

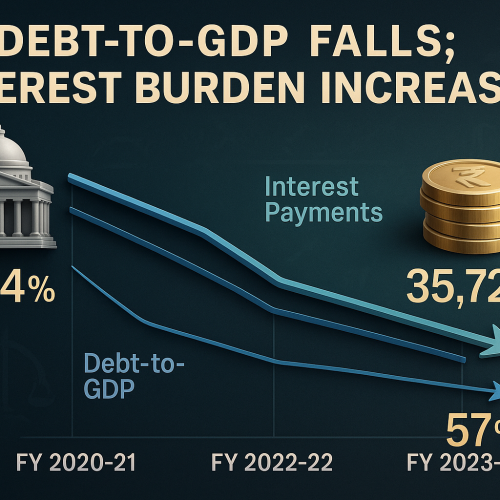

While India’s central government has successfully reduced its debt-to-GDP ratio from the pandemic peak of 61.4% in FY 2020–21 to 57% in FY 2023–24, its interest burden continues to climb. According to the...

While India’s central government has successfully reduced its debt-to-GDP ratio from the pandemic peak of 61.4% in FY 2020–21 to 57% in FY 2023–24, its interest burden continues to climb. According to the...

India remains assured it will achieve its fiscal deficit goal of 4.4% of GDP for FY26, even amid plans to implement sweeping consumption tax cuts. A government source confirmed that both the central...

India’s Central Board of Direct Taxes (CBDT) has opened consultations with crypto industry players to explore the need for a dedicated legal framework for Virtual Digital Assets (VDAs). Key issues under scrutiny include...

India remains confident it will meet its fiscal deficit target of 4.4% of GDP for FY26 despite introducing major consumption tax cuts. The GST overhaul announced by Prime Minister Modi—including slashed rates on...

The latest ET Editorial — “GST 2.0: Great Sense (of) Timing” by MS Mani — applauds the government’s decision to launch comprehensive GST reforms right against the backdrop of tariff pressures and faltering...

India’s foreign exchange (forex) reserves increased by $4.74 billion, climbing to $693.62 billion for the week ending August 8, as reported by the Reserve Bank of India (RBI). This rebound comes shortly after...

India is poised to become a global benchmark in data quality, trailblazing standards that even developed nations could adopt, according to Chief Economic Adviser (CEA) V. Anantha Nageswaran. Emphasizing the importance of robust,...

In a much-anticipated “Diwali gift” to the nation, the Indian government is poised to overhaul the Goods and Services Tax (GST) framework, reducing the current multi-slab structure to just two primary tax rates—5%...

Economists expect the Reserve Bank of India (RBI) to keep interest rates unchanged in the near term, signalling that its primary focus will be on sustaining economic growth rather than aggressively tackling inflation....

India is bracing for the economic turbulence triggered by the U.S. doubling tariffs on Indian exports—a retaliatory measure over India’s stance on Russian oil imports. According to Fitch’s CreditSights, while the direct impact...

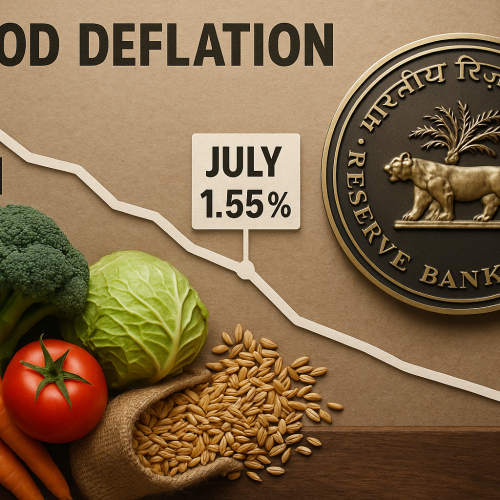

India’s annual retail inflation (CPI) dropped to 1.55% in July, marking its lowest level since June 2017. According to government data, this figure came in below the 2.10% recorded in June and well...

India’s market regulator, the Securities and Exchange Board of India (SEBI), has rejected the settlement requests filed by industrialist Anil Ambani, his family members, and former Yes Bank CEO Rana Kapoor. The pleas...

The Insolvency and Bankruptcy Board of India (IBBI) has proposed a significant amendment to the Corporate Insolvency Resolution Process (CIRP) under the Insolvency and Bankruptcy Code (IBC). The proposal mandates that the Committee...

Reserve Bank of India Governor Sanjay Malhotra has clarified that minimum balance requirements for savings accounts are not regulated by the RBI. Instead, individual banks are empowered to determine their own thresholds based...

The government unveiled the updated Income Tax Bill 2025 in Parliament, introducing several reforms aimed at simplifying tax compliance and extending targeted relief to taxpayers. Notable highlights include full deduction for commuted pension...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.