India’s microfinance sector is showing strong signs of revival, with improved credit quality and stable loan performance, according to the latest report by Microfinance Institutions Network (MFIN). After years of stress caused by...

India’s microfinance sector is showing strong signs of revival, with improved credit quality and stable loan performance, according to the latest report by Microfinance Institutions Network (MFIN). After years of stress caused by...

A new study has revealed a clear correlation between fintech adoption and stronger credit ratings for financial institutions. Banks, NBFCs, and cooperative lenders that integrate digital tools, AI-driven risk models, and data analytics...

India’s banking sector is witnessing stability in non-performing assets (NPAs), with gross and net NPA levels showing improvement across major public and private lenders. Backed by RBI’s strict regulations, provisioning norms, and asset...

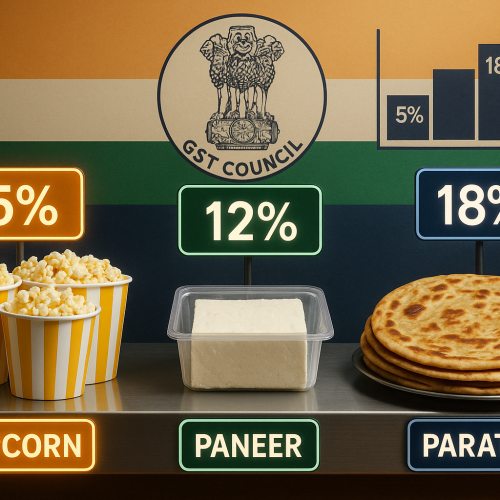

The GST Council’s latest round of tax reforms is expected to act as a powerful stimulus for India’s economy by driving consumption and spurring growth. With rationalized slabs and targeted relief on essential...

SK Finance Ltd, a leading non-banking financial company (NBFC), has reported a 30% year-on-year increase in net profit for Q1 FY26, reaching ₹87.59 crore. The growth was fueled by strong loan disbursements, improved...

Fintechs and lenders are projecting a sharp surge in consumer demand this festive season, driven by the government’s recent GST rate cuts on food, textiles, and daily-use items. By reducing tax burdens, the...

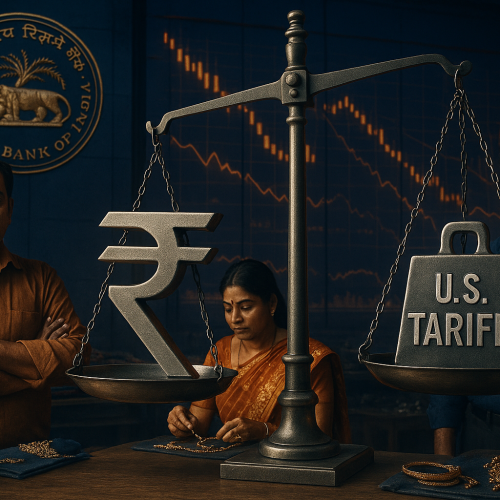

The Reserve Bank of India (RBI) is conducting a comprehensive review of the impact of steep U.S. tariffs on Indian exports while simultaneously assessing strategies to strengthen financial inclusion across the country. The...

The Reserve Bank of India (RBI) has announced that money markets, foreign exchange (forex) markets, and government securities (G-Sec) transactions will remain closed on September 8, 2025. The closure is due to a...

With the rollout of GST 2.0, businesses and consumers alike are seeking clarity on how new rates affect everyday expenses and big-ticket items. From large cars and insurance premiums to cigarettes and essentials,...

The government’s decision to cut freight tax rates is expected to provide a major boost to India’s logistics sector, reducing transportation costs, improving supply chain efficiency, and supporting exporters battling global tariff shocks....

The Indian government is planning a fresh crackdown to bring shell companies “out of their shell”, signaling a renewed push for transparency, accountability, and compliance in corporate governance. Shell entities, often used to...

The government’s latest GST rate reforms seek to resolve long-standing classification disputes over everyday food items such as popcorn, parathas, and paneer. These items have frequently been caught in tax litigation over whether...

Indian exporters are lobbying the Reserve Bank of India (RBI) to allow a gradual weakening of the rupee as a buffer against the steep 50% tariffs imposed by the U.S. on Indian goods....

The Reserve Bank of India (RBI) has rejected TBO Tek’s request for post-facto approval of a $712.25 million investment transaction, citing non-compliance with existing regulatory norms. The decision underscores RBI’s firm stance on...

The GST Council will convene on Wednesday to deliberate on tax cuts for daily-use consumer items, a move aimed at boosting festive demand and easing household budgets. If approved, the decision could provide...

CA Manish Mishra is the visionary driving force behind BFSI Diary. With a distinguished background in financial services and an unwavering commitment to disseminating knowledge, he established this platform to create a trusted space for insightful BFSI reporting and analysis. His strategic foresight and leadership continue to steer the portal’s growth, reinforcing its reputation and amplifying its impact across the industry.

A highly esteemed Chartered Accountant and distinguished finance professional, CA Manoj Kumar Singh leads BFSI Diary with unwavering dedication and expertise. Under his thoughtful editorial guidance, the platform upholds the highest standards of accuracy, relevance, and integrity in financial journalism, serving as a trusted resource for the entire BFSI community.

With extensive experience across digital innovation, platform architecture, and product engineering, Yash serves as a driving force behind our technology vision. His deep expertise in building scalable systems, combined with a strong understanding of modern development frameworks, ensures that our platform remains robust, future-ready, and user-centric. As the Lead Developer – Platform Engineering, he plays a crucial role in defining technical direction, elevating code quality, and enabling seamless collaboration across teams to deliver impactful digital solutions.

Visit the personal website of CA Manish Mishra to learn about his journey, professional achievements, and thought leadership in the fields of finance and strategy. Discover his insights beyond BFSI Diary.

BFSI Diary delivers cutting-edge news and insights in Banking, Financial Services, and Insurance. Guided by Chief Editor CA Manish Mishra, we provide professionals and enthusiasts with precise, reliable updates to master the fast-paced BFSI world. Stay ahead with BFSI Diary.

© 2025 BFSI Diary. All rights reserved.