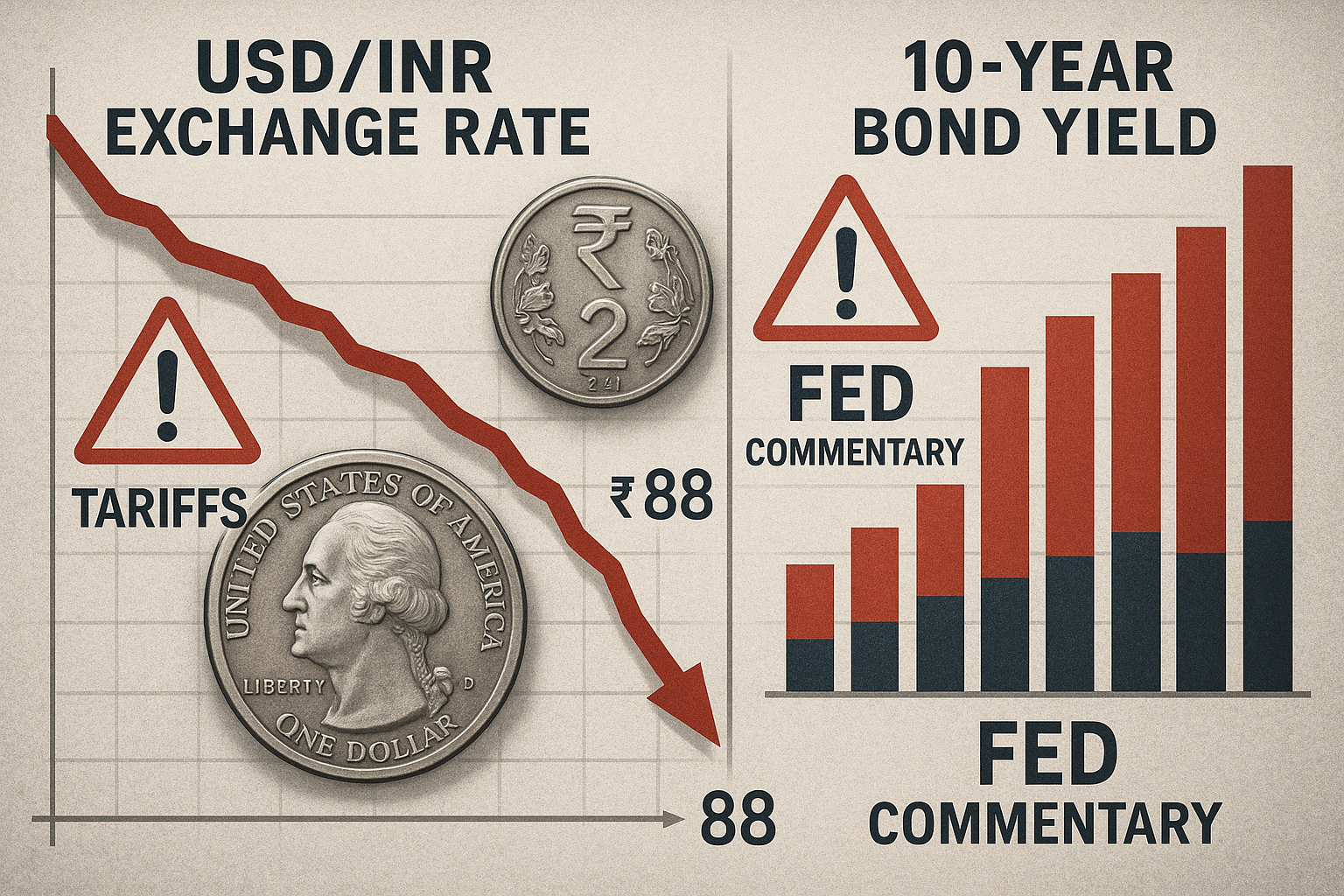

The Indian rupee and government bond yields are coming under sharp pressure following a 25% tariff threat from former U.S. President Donald Trump and hawkish commentary from the U.S. Federal Reserve. The dual headwinds are creating turbulence in currency and fixed income markets in India.

Trump Tariff Shock: 25% Duty on Indian Imports

Trump’s announcement that India would face a 25% import tariff starting August 1—and additional penalties for purchases of Russian energy and defence equipment—has triggered immediate market anxiety. The rupee is sliding toward its all-time low and opening weaker in one-month forwards around ₹87.66–87.69 per USD.

Rupee’s Decline & Volatility Path

-

The Indian rupee dipped to levels close to ₹87.95—a six-month low—and continues to trade near ₹87.8 per USD amid rising trade uncertainty and foreign capital outflows.

-

Accelerated foreign selling of Indian equities and bonds—approximately $2 billion in July alone—adds pressure to the currency.

Bond Market Ripples & Yield Surge

-

India’s benchmark 10-year government bond yield has climbed to around 6.37%–6.40% as markets anticipate higher inflation and Fed rate firmness. Technical resistance broke, amplifying downward pressure on bond prices.

-

Investors are repositioning away from bonds in anticipation of higher U.S. yields and wage inflation, reducing appetite for sovereign securities.

Fed’s Hawkish Commentary Raises Risk Bar

-

Fed Chair Powell signalled delay in rate cuts amid strong U.S. labor market data, reinforcing expectations of prolonged monetary restraint and supporting dollar strength.

-

Elevated U.S. Treasury yields have made emerging market debt less attractive, prompting capital outflows and weighing on the rupee and bond markets.

Market Sentiment & Technical Outlook

| Asset | Outlook & Impact |

|---|---|

| Rupee (USD/INR) | Sliding toward record lows; trades near 87.8 with limited relief expect. Technical momentum remains bearish. |

| 10-Year Bonds | Yields likely to breach 6.40% resistance. Bond prices down; traders eye RBI’s next intervention. |

| Equities & FIIs | Stock volatility rising; FIIs scaled back exposure to equities and debt in July. |

Implications for Stakeholders

-

Investors: Currency risk increases for unhedged positions. Bondholders face potential mark-to-market losses. May consider hedged strategies or duration reduction.

-

Importers & Consumers: Weaker rupee ups import costs—especially for oil—raising inflationary pressure.

-

Exporters: May gain margin relief from rupee depreciation, but trade deal uncertainty may dampen demand.

-

Policymakers & RBI: Likely to monitor intervention thresholds carefully—balancing currency defense with inflation and rate outlook.

Conclusion

Trump’s tariff threat combined with persistent U.S. economic strength and a hawkish Fed has shaken Indian markets. The rupee’s sharp decline and rising bond yields reflect growing macro stress. With diplomatic uncertainty and external rates elevated, market volatility is expected to persist until clarity returns on both trade negotiations and U.S. monetary outlook.