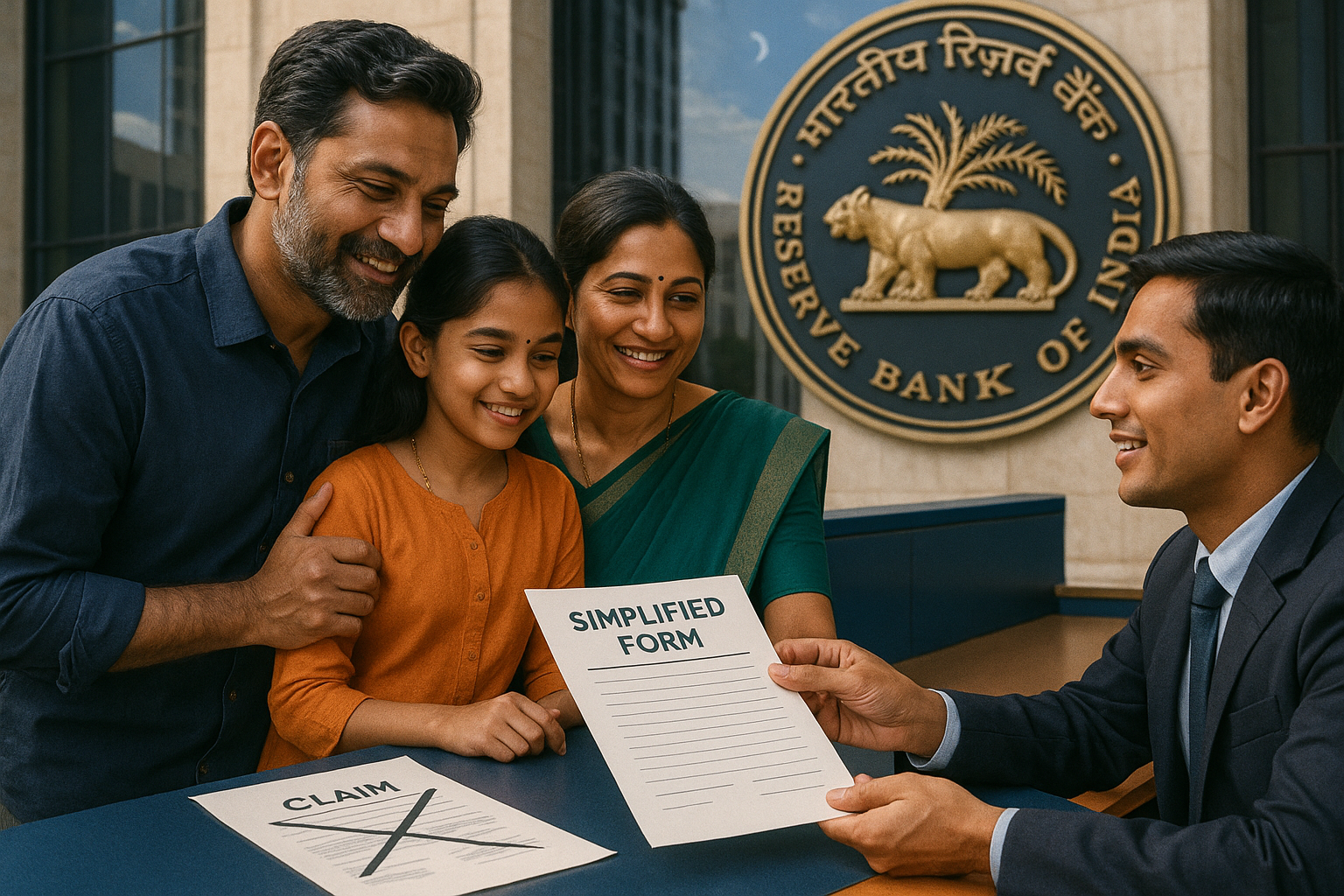

The Reserve Bank of India (RBI) has introduced standardised procedures for banks to settle claims of deceased customers, eliminating divergent practices across lenders. From now, nominees and survivors will not be required to furnish succession certificates or legal documents, irrespective of account size. For non-nominee accounts, simplified processes with monetary thresholds have been prescribed. The guidelines must be fully implemented by March 31, 2026

Core Development

Payments to nominees/survivors: No legal documents or indemnity bonds required.

Non-nominee accounts:

Up to ₹5 lakh (co-op banks) and ₹15 lakh (other banks): settlement allowed with RBI-specified forms, death certificate, claimant’s identity proof, indemnity bond, and no-objection certificates.

Above thresholds: succession certificate, death certificate, indemnity bond, and other legal documents required.

Affidavit option: In absence of succession certificate, affidavit by an independent person known to the family is acceptable.

Court disputes: Claims settled only after court decree or withdrawal of restraining orders.

Premature FD closure: Allowed without penalty even within lock-in periods.

Key Drivers / Issues

Eliminating delays caused by excessive paperwork.

Providing relief to survivors in times of distress.

Aligning banking practices with consumer protection and ease-of-access goals.

Stakeholder Impact

For families of deceased customers, the process becomes faster and less burdensome. Banks gain clarity with uniform procedures, reducing operational disputes. Regulators strengthen trust in the financial system through consumer-friendly reforms.

Industry & Policy Reactions

Policy experts praised RBI’s move, calling it a landmark step in improving the ease of claim settlement. Consumer rights advocates highlighted its role in reducing hardships for nominees, especially in rural areas where legal documentation is harder to obtain.

Challenges Ahead

Ensuring consistent adoption across all banks, especially co-operative lenders.

Preventing misuse through fraudulent claims under simplified processes.

Educating customers and bank staff on the new norms.

Strategic Outlook

The new framework is expected to streamline claims settlement and reduce litigation, setting a uniform national standard. It also underscores RBI’s continued emphasis on consumer-centric regulation in banking.

Why This Matters

The reform brings relief to millions of families, ensuring faster access to funds after the death of a depositor. By standardising processes, RBI reduces red tape, builds trust, and strengthens India’s financial inclusion agenda.