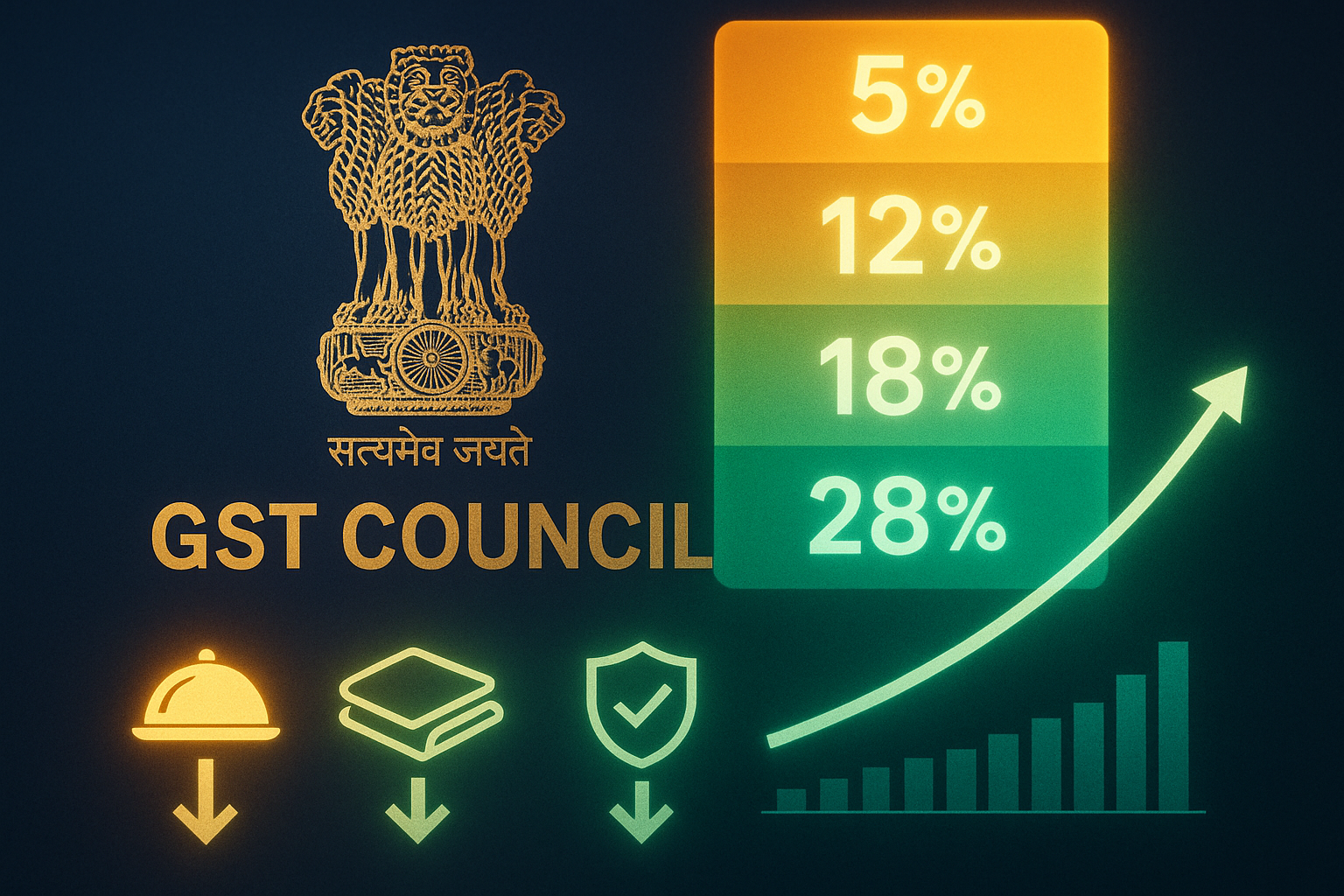

India’s long-awaited tax reform under GST 2.0 has arrived in the form of a new GST rate card, marking one of the most significant overhauls since the tax’s inception in 2017. The reform simplifies the structure into fewer slabs, reduces classification disputes, and is expected to boost consumption, improve compliance, and strengthen investor confidence.

This shift underscores India’s intent to build a transparent, predictable, and growth-oriented tax regime while addressing concerns of affordability and ease of doing business.

Core Development

The new GST framework introduces:

Fewer Slabs: Rationalization into two core rates for most goods and services.

Relief for Consumers: Lower tax rates on essentials like food, textiles, and insurance.

Clarity for Businesses: Simplified compliance and fewer disputes over classification.

The GST Council, after extensive consultations with states, approved the overhaul as a way to make GST more equitable, efficient, and aligned with India’s economic ambitions.

Key Drivers Behind the Reform

Affordability Push: Relief for households on essential items to stimulate demand.

Business Confidence: Transparent tax regime reduces uncertainty for investors.

Fiscal Balance: Reform structured to support growth without derailing revenue targets.

Stakeholder Impact

Consumers: Direct benefits from lower tax rates on essentials, improving disposable incomes.

Businesses: Reduced compliance costs and improved ease of operations.

Government: Gains credibility as a reform-driven administration committed to transparency.

Industry & Policy Reactions

Industry experts welcomed the new GST rate card as a historic milestone in tax reform. Economists argue it could provide a short-term consumption boost while also improving long-term competitiveness. Some cautioned, however, that effective implementation and state cooperation will be critical.

Challenges Ahead

Revenue Pressures: Lower rates may temporarily reduce collections.

Implementation Risks: GSTN must handle the transition without technical glitches.

State Concerns: Ensuring revenue-sharing stability remains a priority.

Strategic Outlook

The new GST rate card signals India’s commitment to rational, predictable, and pro-growth taxation. If executed smoothly, the reform could become a defining feature of India’s economic transformation and strengthen the country’s position as a stable, investor-friendly economy.

Why This Matters

Tax reform is a cornerstone of economic credibility. By streamlining GST, India is sending a strong message of policy stability, affordability, and competitiveness, crucial for its journey toward sustained growth.