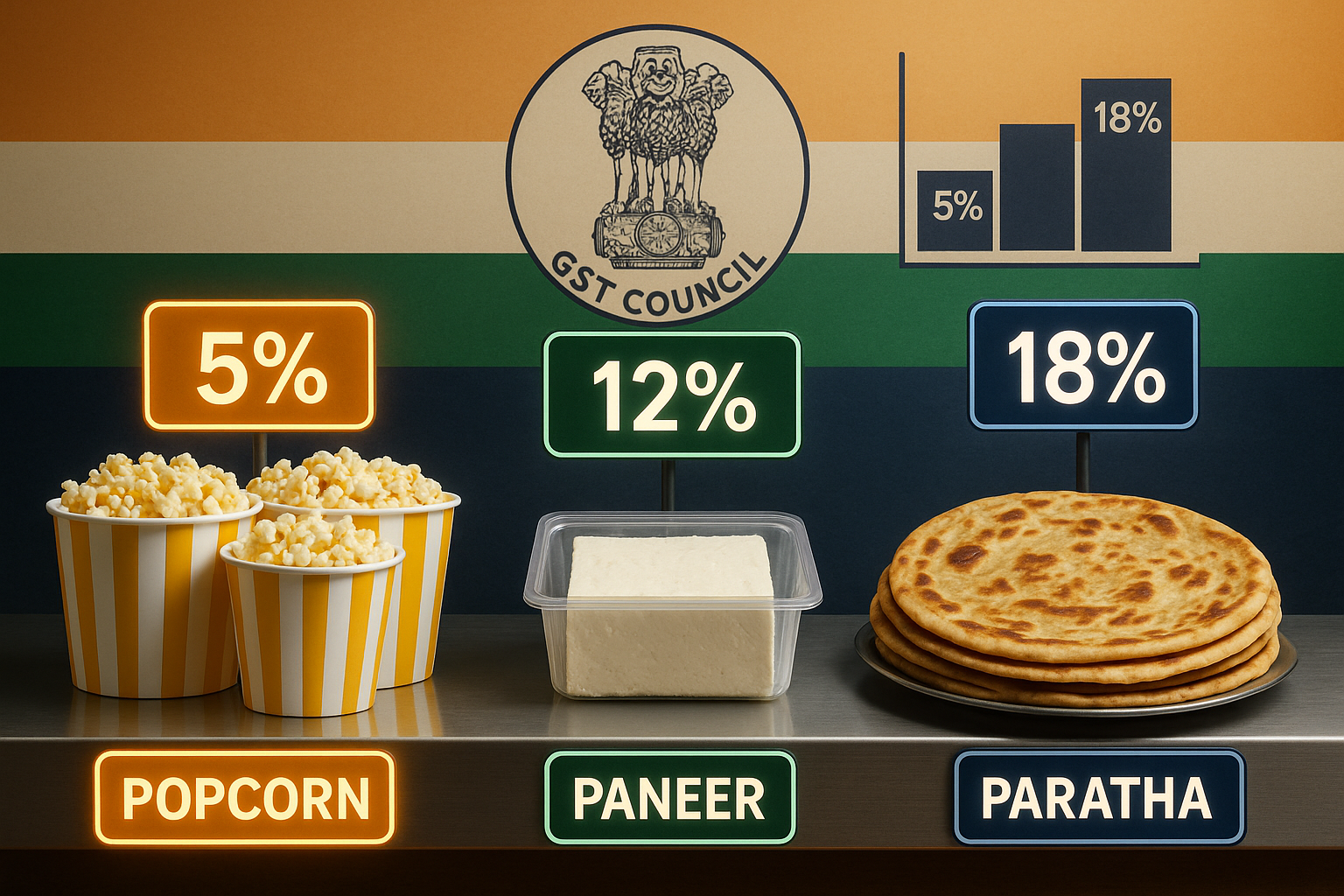

The government’s latest GST rate reforms seek to resolve long-standing classification disputes over everyday food items such as popcorn, parathas, and paneer. These items have frequently been caught in tax litigation over whether they fall under processed foods, ready-to-eat meals, or essential goods — each attracting different GST slabs.

The new reforms aim to simplify tax treatment, reduce compliance burden, and provide clarity to both businesses and consumers, while ensuring fairness in the GST structure.

Core Development

Under the revised framework, GST Council has introduced clearer definitions and uniform categorization for food items. Popcorn, paneer, and parathas — often treated differently by various state tax authorities — will now have standardized slab rates, removing ambiguity for manufacturers, restaurants, and retailers.

This step is part of the broader GST 2.0 initiative, which emphasizes simplification and predictability in India’s indirect tax system.

Key Drivers Behind the Move

Frequent Litigation: Tax disputes on whether certain foods are “processed” or “essential.”

Consumer Fairness: Ensuring consistent tax treatment regardless of packaging or preparation style.

Ease of Compliance: Simplified categories help businesses avoid unnecessary disputes.

Stakeholder Impact

Businesses: Food manufacturers and restaurant chains get clarity on tax liability, reducing legal costs and compliance complexity.

Consumers: Stable pricing as disputes over GST rates settle, making bills more predictable.

Policymakers: A move that strengthens the credibility of GST as a transparent tax system.

Industry & Policy Reactions

Tax experts welcomed the move as overdue, pointing out that inconsistent interpretations have hurt both MSMEs and larger food companies. Analysts believe the reforms will improve compliance while reducing the backlog of tax litigation.

Challenges Ahead

While the new rates bring clarity, challenges remain:

Businesses must quickly align billing and invoicing systems.

Monitoring implementation across states will be key to avoiding fresh disputes.

Ensuring consumer benefits (rate cuts passed on through lower prices) will require vigilance.

Strategic Outlook

The reform is expected to become a template for future GST rationalizations. By addressing everyday items that affect millions of households, the Council signals its intent to make GST simpler, fairer, and more consumer-centric.

Why This Matters

GST reforms are not just about numbers — they directly affect household budgets, small businesses, and consumer trust. By solving the “popcorn, paratha, and paneer puzzle,” policymakers aim to reinforce GST as a tax system that works for both growth and fairness.