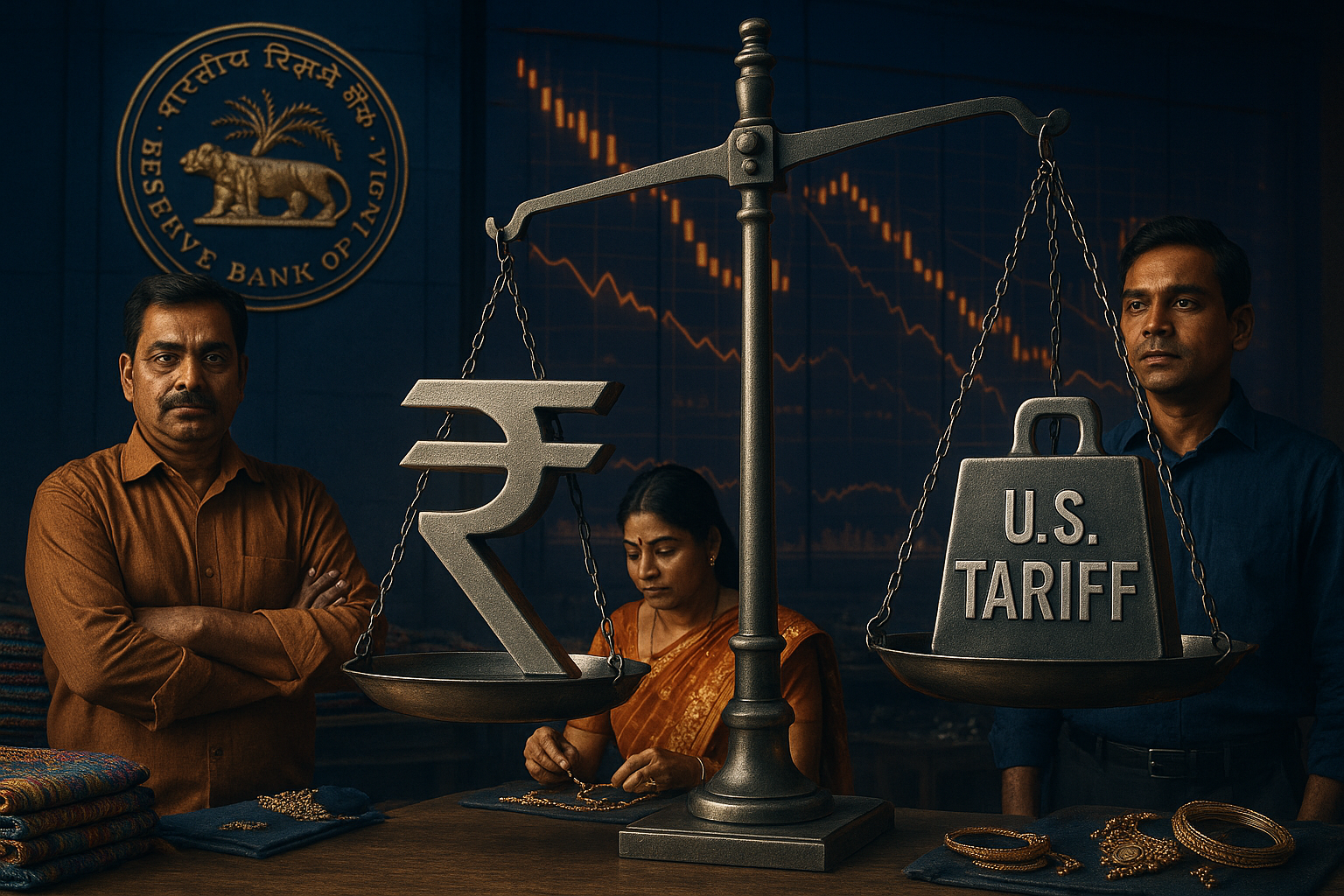

Indian exporters are lobbying the Reserve Bank of India (RBI) to allow a gradual weakening of the rupee as a buffer against the steep 50% tariffs imposed by the U.S. on Indian goods. With labour-intensive sectors such as textiles, gems & jewellery, and leather facing sharp competitiveness losses, exporters argue that a softer rupee could help preserve margins and protect jobs.

This demand comes at a time when policymakers are already grappling with inflation risks, capital flow volatility, and global trade uncertainties.

Core Development

The U.S. tariff shock has created fresh challenges for Indian exporters, particularly as the U.S. accounts for nearly 20% of India’s exports. Exporters contend that the only viable short-term cushion is a currency adjustment, allowing rupee depreciation to make Indian goods cheaper in global markets.

While the RBI has maintained its stance of preventing excessive volatility, exporters argue that calibrated depreciation is necessary to offset external shocks.

Key Drivers Behind the Lobby

-

Tariff Pressures: U.S. duties have directly raised landed costs of Indian exports.

-

Competitor Advantage: Countries like Bangladesh and Vietnam, not subject to such tariffs, are undercutting India in global supply chains.

-

Survival Imperative: Many MSME-driven export hubs face risks of order cancellations and layoffs without a price cushion.

Stakeholder Impact

-

Exporters: Relief through a weaker rupee could help retain competitiveness and sustain order books.

-

Policymakers: Balancing rupee depreciation with inflation control will be a major challenge.

-

Consumers: A weaker rupee could make imports costlier, raising input and fuel prices.

Industry & Policy Reactions

Industry bodies have formally approached the RBI, emphasizing that exchange rate flexibility is crucial in times of global trade disruption. Economists, however, warn that excessive depreciation could destabilize capital flows and worsen imported inflation.

This puts RBI in a delicate position — balancing exporter concerns with broader macroeconomic stability.

Challenges Ahead

Allowing a weaker rupee risks:

-

Imported Inflation: Higher costs for crude oil, machinery, and raw materials.

-

Investor Sentiment: Possible capital outflows if currency volatility rises.

-

Policy Credibility: A perception of managed depreciation may raise global concerns.

Strategic Outlook

Experts suggest that alongside currency management, India should accelerate efforts in:

-

Market Diversification: Expanding exports to Europe, Africa, and Southeast Asia.

-

Domestic Policy Support: Targeted subsidies or tax relief for affected exporters.

-

Structural Competitiveness: Investing in productivity, logistics, and technology for long-term gains.

Why This Matters

India’s response to the U.S. tariff shock will set the tone for its trade and currency management in the coming years. A calibrated rupee strategy could provide short-term relief, but sustainable solutions will depend on policy reforms, market diversification, and supply chain resilience.