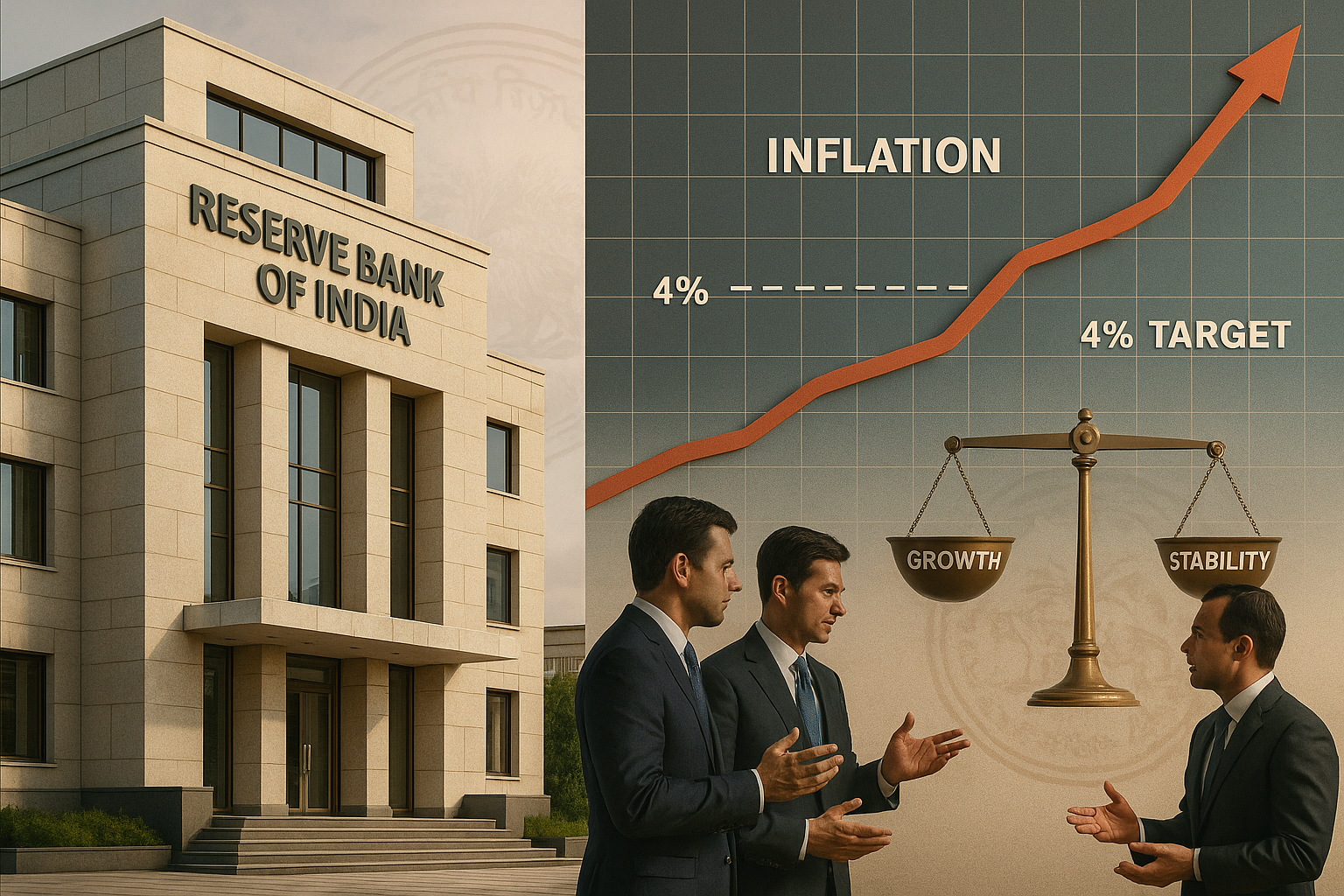

The Reserve Bank of India (RBI) has initiated a crucial debate on whether the country’s 4% inflation mandate truly reflects the evolving macroeconomic reality. While the framework has helped anchor expectations since its adoption in 2016, policymakers are now assessing if structural shifts in food prices, energy markets, and supply chains mean India’s “new normal” inflation could be higher.

This introspection comes at a time when global central banks are also reevaluating their inflation targets amid changing trade dynamics, climate risks, and geopolitical shocks. For India, the outcome could reshape monetary policy for the coming decade.

Why RBI is Reconsidering the Target

The 4% target has served as the nominal anchor for monetary policy, but persistent pressures have raised questions about its practicality.

Food and Energy Volatility: Frequent supply-side shocks — from erratic monsoons to global crude swings — keep inflation sticky above 4%.

Changing Consumption Patterns: Rising incomes have shifted demand towards protein-rich foods, often more inflation-prone.

Imported Inflation: A weaker rupee and global supply chain disruptions have amplified price pressures.

These trends suggest that keeping inflation strictly at 4% may require excessively tight monetary policy, potentially slowing growth.

The Mandate Since 2016

India formally adopted the Flexible Inflation Targeting (FIT) framework in 2016, with a 4% midpoint and tolerance band of 2–6%.

The system helped anchor expectations, improve transparency, and align India with global best practices.

However, inflation has frequently tested the upper bound, prompting debates on whether the target remains realistic.

For the RBI, the question is whether credibility lies in sticking to 4% at all costs or in adapting to structural realities.

Global Parallels and Lessons

India is not alone in facing this dilemma.

U.S. Fed and ECB are under pressure to balance low inflation targets with supply-side shocks.

Emerging economies like Brazil and Indonesia have adjusted targets upward to reflect structural inflation.

The RBI’s review is part of this global conversation — whether inflation targeting should be rigid or adaptive.

Implications for Policy and Markets

Revisiting the inflation mandate will have far-reaching effects:

For Monetary Policy: A higher target could give RBI more flexibility to support growth.

For Investors: Bond markets and FX players will watch closely, as even small shifts can impact yields and the rupee.

For Households: Anchoring inflation expectations is key to protecting savings and consumption power.

For the Government: Aligning fiscal and supply-side policies with the new framework will be crucial.

Why This Matters

The RBI’s reflection on the 4% target is not just a technical debate — it could reshape India’s economic strategy for years to come.

Ensures policy credibility in changing global conditions.

Balances growth vs. price stability in a more realistic framework.

Protects household purchasing power while avoiding over-tightening.

Aligns India’s inflation targeting with emerging market peers adapting to structural realities.