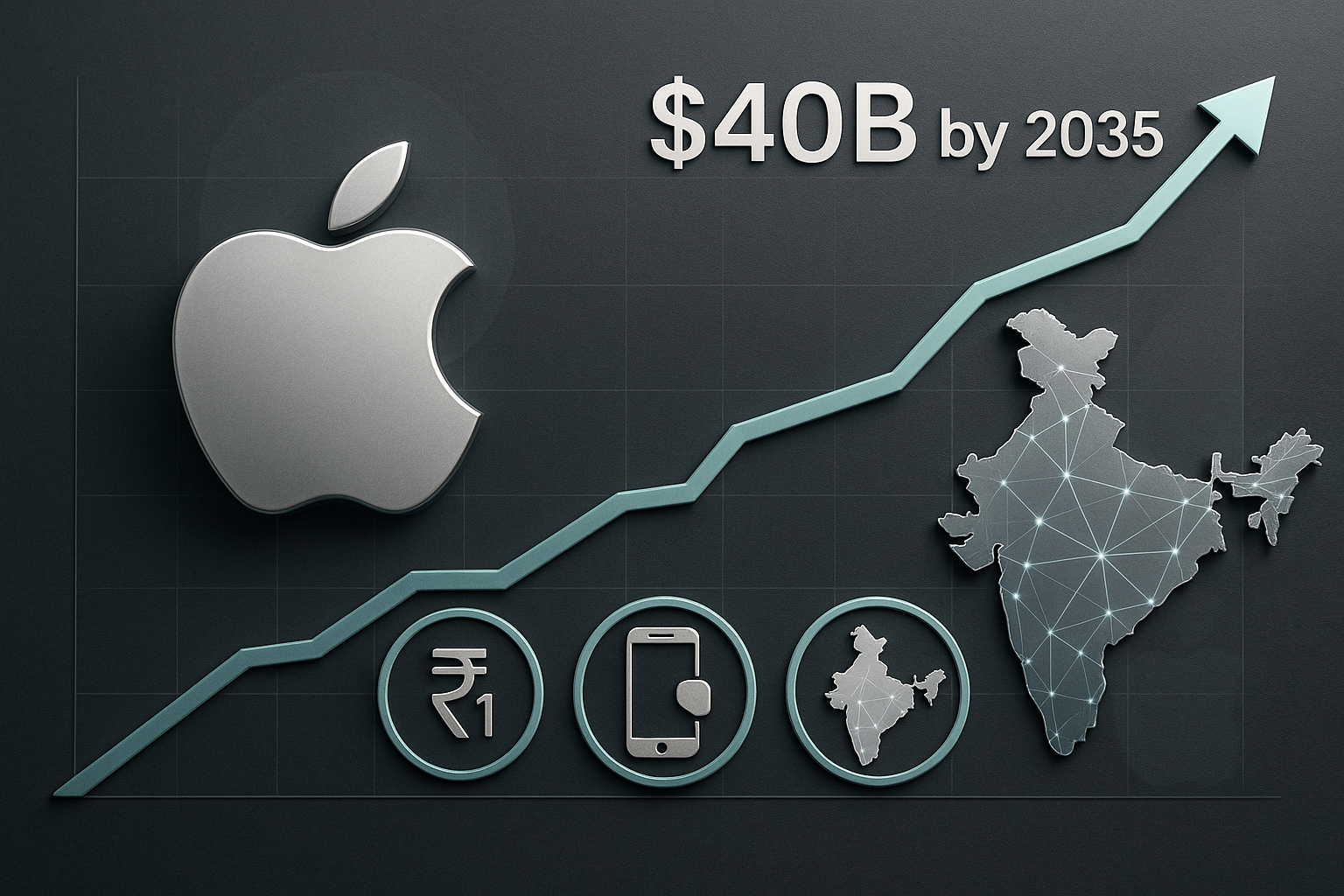

India’s rapid economic expansion is drawing unprecedented interest from global companies. From tech majors to consumer brands, firms see India not just as a sales market but as a growth engine for the next decade. Analysts highlight Apple as a prime example—its India revenues are projected to reach $40 billion in less than 10 years, underscoring the country’s rise as a global consumption hub.

Apple’s Big Bet on India

Apple’s success in India is symbolic of the broader trend. Rising incomes, urban demand, and a digital-first economy are pushing premium adoption.

Morgan Stanley projects $40 billion revenues by 2035.

Fractional stock platforms allow Indians to invest in Apple with as little as ₹1.

Expanding Global Footprint

India is becoming a magnet for companies across industries, not just technology.

E-commerce, digital services, and manufacturing are scaling fast.

Global companies now view India as a priority hub for both sales and sourcing.

Why India Stands Out

Unlike other emerging markets, India offers a mix of demand and supply advantages.

A young, tech-savvy population driving consumption.

Strong government push via Digital India, Make in India, and infrastructure reforms.

Implications for Investors

The global interest in India translates directly into opportunities for domestic investors.

Platforms offering global fractional investing allow exposure to multinational giants.

Diversification into global equities strengthens long-term wealth creation.

Why This Matters

India’s appeal is more than just numbers—it’s structural. For companies, it means a new growth frontier; for investors, it creates inclusive access to global wealth creation.

Global recognition of India as a $40B+ opportunity.

Rising consumer strength validating “India consumption” theme.

Democratization of investing via fractional ownership.

Reinforcement of India’s policy credibility as a global partner.