The Securities and Exchange Board of India (SEBI) has proposed easing IPO norms for mega-cap companies, allowing smaller initial public offerings (IPOs) and staggered compliance with public shareholding requirements. The proposal includes reduced minimum public offer thresholds based on post-listing market capitalization and extended timelines for meeting minimum public shareholding (MPS) obligations. SEBI has retained the retail investor quota at 35% and is inviting public comments on the framework.

Key Highlights

Tiered IPO Floats for Big Issuers

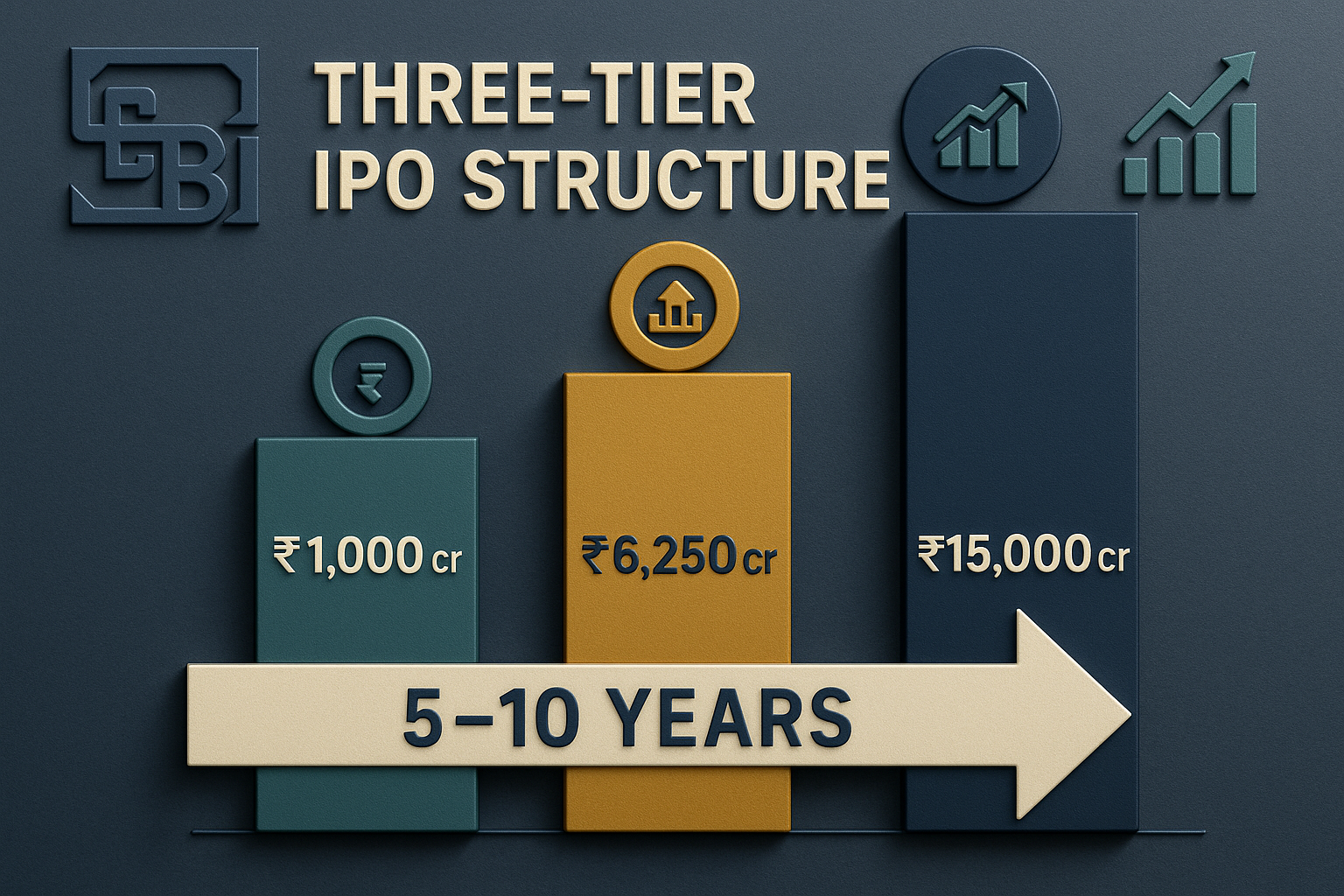

SEBI’s draft framework proposes a tiered structure:

₹50,000–₹1 lakh crore market cap: Minimum Public Offer (MPO) of ₹1,000 crore and at least 8% dilution, with 25% MPS due within five years.

₹1 lakh–₹5 lakh crore: MPO of ₹6,250 crore and 2.75% equity dilution. If public shareholding is under 15%, firms have up to 10 years to reach 25%; otherwise, five years.

Above ₹5 lakh crore: MPO of ₹15,000 crore and 1% post-issue capital dilution (minimum 2.5%); similar 15% to 25% MPS timelines apply.

Gradual Compliance to Ease Market Absorption

The proposed revisions address concerns related to large upfront dilution, which can depress valuations and overburden market liquidity. The staggered compliance model aims to make IPOs more manageable and sustainable for issuers and investors.

Retail Quota Retained, Flexibility Enhanced

Contrary to earlier proposals, SEBI will maintain the 35% retail investor allocation in IPOs, preserving participation for leverage retail markets.

Limited Immediate Impact

Market expert Pranav Haldea notes that only a handful of mega IPOs will benefit immediately, as there are currently just about 10 companies with market caps above ₹5 lakh crore. However, the move aligns Indian regulations with global norms and supports future large listings.

Why This Matters

Boosts IPO Pipeline: Enables phased capital raising and smoother entry for mega firms like NSE or Reliance Jio.

Softens Short-Term Dilution Pressure: Protects valuations and avoids liquidity glut from large offer sizes.

Sustains Retail Engagement: Ensures continued retail investor involvement with no reduction in allocation.

Adds Flexibility to Governance: Sustainable timelines help companies comply without compromising strategic objectives.

Enhances Market Depth: Prepares domestic capital markets to handle a diverse set of listings, encouraging broader participation.