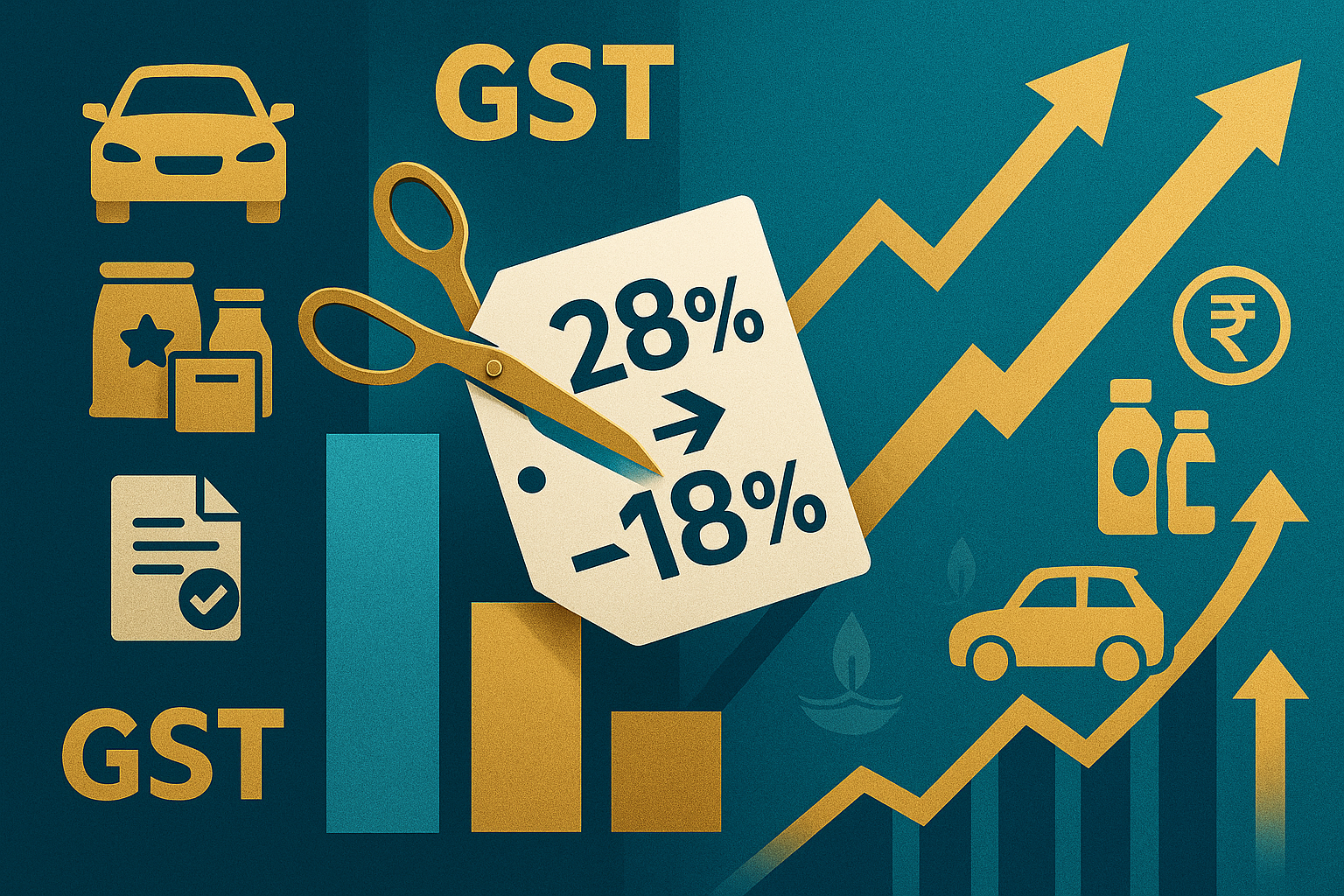

As India moves toward sweeping Goods and Services Tax (GST) reforms, investor confidence is soaring. The proposed cuts—lowering GST on small vehicles and key consumer goods—sent auto and FMCG stocks spiking. Markets are pricing in increased affordability, rising demand, and a consumption-led economic boost ahead of the festive season.

Main Content

GST Overhaul on the Horizon

The government is planning a substantial overhaul of the GST system, including:

Reducing GST on small petrol and diesel cars from 28% to 18%.

Slashing insurance premiums—from 18% down to as low as 0–5%.

Streamlining tax slabs to just 5% and 18%, eliminating the 12% and 28% tiers, while placing a 40% tax on luxury items.

Stocks Zoom on Expectations

Markets responded enthusiastically:

Auto stocks rallied nearly 5%, with marquee players like Maruti Suzuki and Hyundai logging 8–9% gains, reaching 10-month highs.

FMCG and consumer goods also saw a lift, gaining 4–7% on hopes of festive consumption momentum.

Insurance firms such as ICICI Prudential and SBI Life got a tailwind.

Financial stocks, including Bajaj Finance and Bajaj Housing Finance, jumped up to 7%, buoyed by broader GST reform optimism and India’s first sovereign rating upgrade in nearly 20 years.

Broader Market Response

The Nifty 50 hit its best day in three months, climbing 1.36%, while the Sensex rose 1.23%. This rally was driven by the predicted relief for essential goods and a broader consumption push.

Why This Matters

Stimulates Demand: GST reduction on essentials like cars, packaged goods, and insurance could rejuvenate discretionary spending just ahead of Diwali.

Sectoral Upside: Auto, FMCG, financial and consumer discretionary sectors stand to gain significantly.

Fiscal Trade-off: While tax cuts may impact revenues (estimated fiscal stimulus ~0.7–0.8% of GDP), the growth dividend could help offset the shortfall.

Positive Policy Signaling: These reforms underscore the government’s pro-growth intent and reinforce policy predictability—factor that nurtures investor trust.