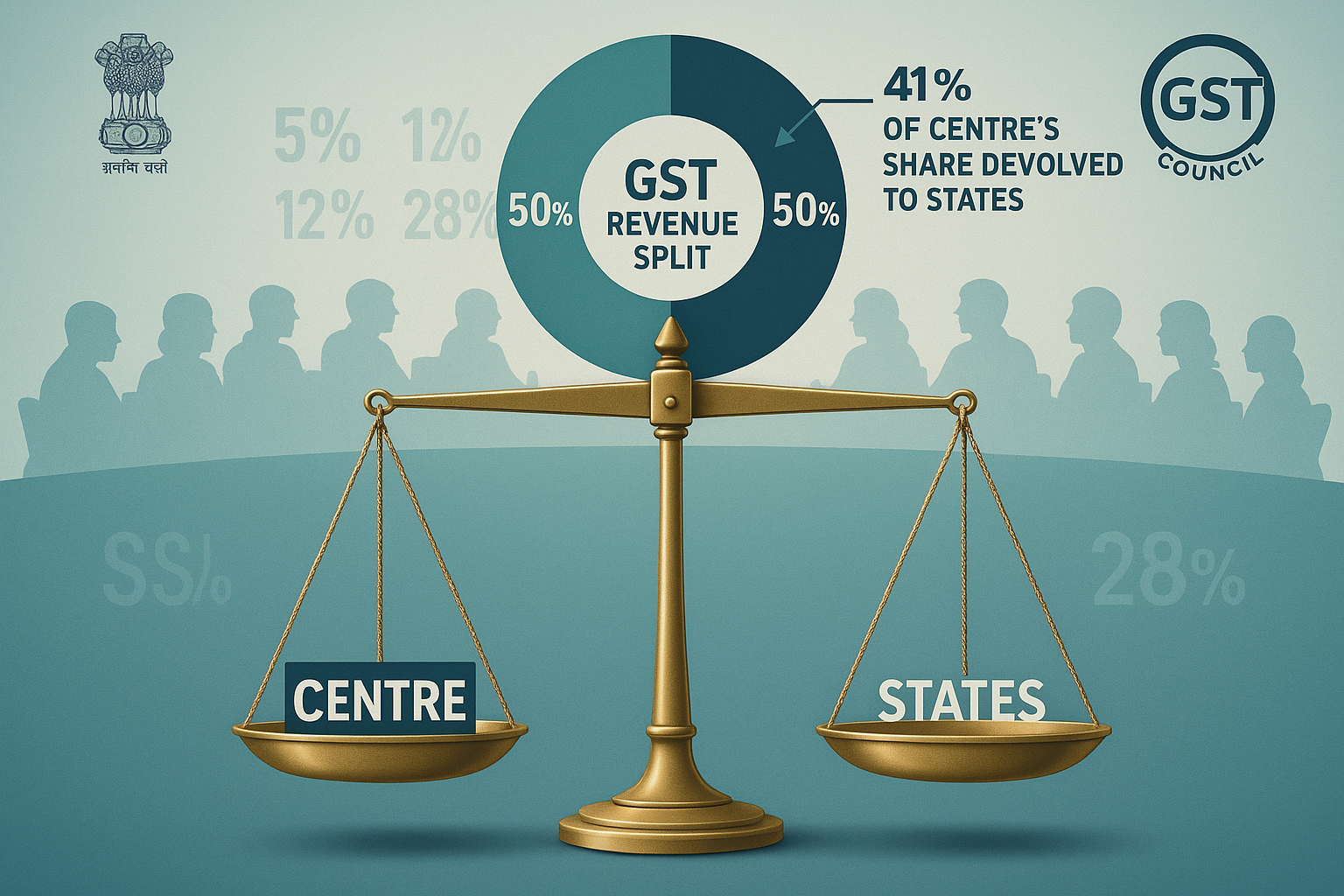

As India debates the upcoming “Next Gen GST” reforms, a senior government source has emphasized that the Centre and states remain equal partners in GST revenue sharing. Under the present system, GST revenues are split 50:50 between Centre and states, while 41% of the Centre’s share is additionally devolved to states under Finance Commission recommendations. The clarification comes at a crucial moment, as states voice concerns that the proposed rationalization of GST slabs could reduce their fiscal space.

Key Highlights

Equal Stake in GST Revenues

The government reiterated that the GST Council framework ensures parity between the Centre and states in tax collection.

Both levels of government share GST collections equally.

Beyond the 50-50 split, 41% of the Centre’s divisible pool is also distributed among states.

This revenue model was designed to uphold fiscal federalism and cooperative decision-making through the GST Council.

A senior official noted:

“The Centre is not a donor to the states. Both Centre and states are equal stakeholders in GST revenues and share equal responsibility for its collection, administration, and reforms.”

GST Rate Structure Today

India currently operates a four-slab GST system:

5% for essentials

12% for standard items

18% for most goods and services (major share of collections)

28% for luxury and sin goods

Revenue Contribution by Slabs:

5% → ~7% of total GST revenue

12% → ~5%

18% → ~65%

28% → ~11%

This makes the 18% slab the backbone of GST revenues.

Concerns Around “Next Gen GST”

The proposed Next Gen GST reforms aim to reduce slabs and simplify the tax structure, potentially merging rates into two or three tiers. While this may improve compliance and transparency, states have raised fears of short-term revenue loss.

Officials countered these concerns by stressing that:

Economic growth and higher consumption will expand the tax base, offsetting potential shortfalls.

Rate rationalization will reduce litigation and disputes, strengthening trust in GST.

Fiscal adjustments can be managed through Centre-state coordination without jeopardizing state finances.

Balancing Fiscal Federalism

The debate highlights the delicate balance between:

States’ dependence on GST as a revenue lifeline, and

The Centre’s objective to streamline GST into a more efficient, transparent, and business-friendly system.

By reinforcing equal revenue-sharing, the government seeks to assure states that federal trust remains intact, even as reforms progress.

Why This Matters

Reassurance for States: Confirms that GST remains a shared fiscal space and not tilted towards the Centre.

Strengthening Cooperative Federalism: Reinforces the role of the GST Council as a consensus-driven platform.

Fiscal Stability: Equitable revenue sharing ensures states can plan budgets confidently amid upcoming reforms.

Reform Continuity: Provides a foundation for smoother transition to Next Gen GST.

Investor Confidence: A stable and predictable tax-sharing framework signals policy certainty to businesses and global investors.