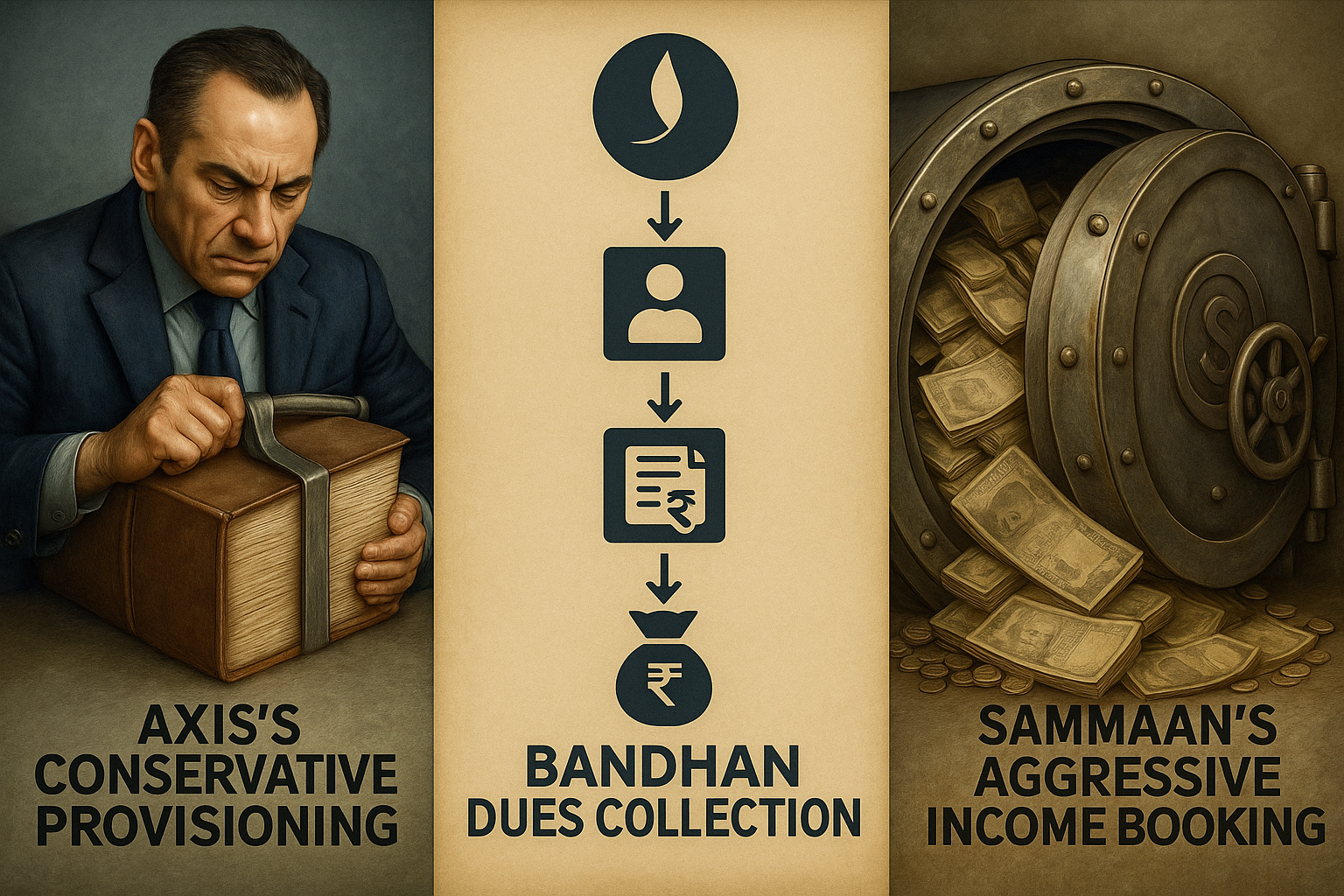

In a notable divergence of accounting strategies for Q1 FY26, Axis Bank, Bandhan Bank, and Sammaan Capital have adopted distinct approaches—ranging from prudence to opportunism—in their financial reporting. This “policy tweak” reflects a blend of conservatism and aggressiveness aligned with institutional priorities.

Company-Wise Breakdown

| Institution | Policy Shift & Financial Impact |

|---|---|

| Sammaan Capital | Switched from an actuarial model to a contracted-tenor model for recognition of income from securitized loans (~₹20,229 crore). This aggressive stance generated impressive ₹661.6 crore in reported gains. |

| Axis Bank | Opted for tighter provisioning, adding ₹614 crore to reserves, reducing its earnings accordingly. |

| Bandhan Bank | Adjusted its dues collection process, resulting in a slight increase in stressed loans, though this hasn’t yet affected its profitability. |

Why It Matters

Diverging Accounting Strategies:

These adjustments highlight how accounting policies can materially influence lender earnings and perceptions. While Sammaan Capital’s approach warmed up its books, Axis Bank prioritized caution, and Bandhan Bank took measured procedural steps.Investor Impact:

Both equity and debt investors must understand these nuances. Sammaan’s reported gains may raise optimism, but Axis’s enhanced provisioning signals careful risk management.Policy Implications:

These moves underscore the need for analysts and regulators to focus on the substance and fairness of accounting policies—not merely headline figures.