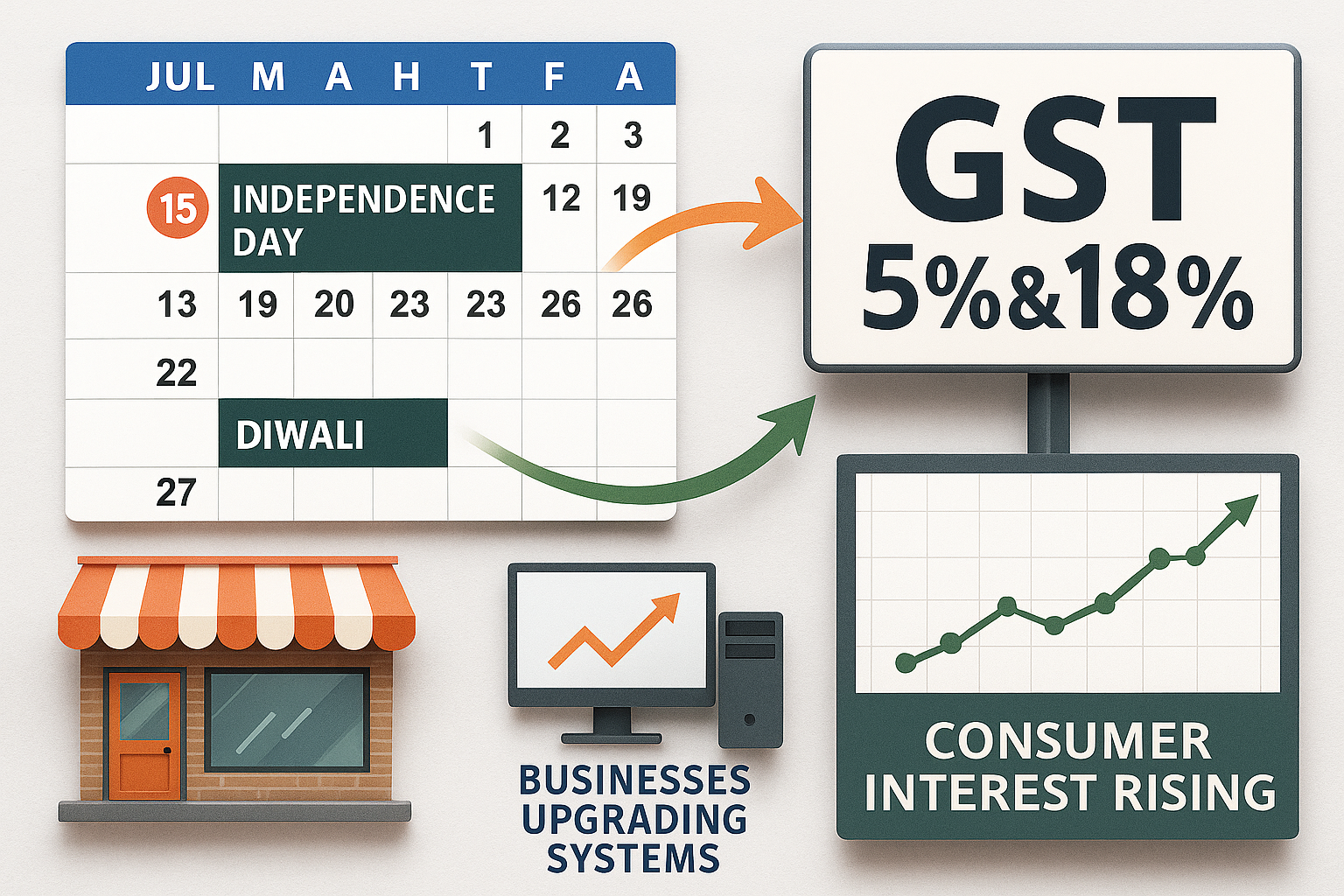

The latest ET Editorial — “GST 2.0: Great Sense (of) Timing” by MS Mani — applauds the government’s decision to launch comprehensive GST reforms right against the backdrop of tariff pressures and faltering export demand. By announcing a pivot to a streamlined, two-rate GST structure ahead of Diwali, the initiative is seen as a masterstroke aimed at rekindling domestic trade sentiment and offering businesses a stimulus of affordability.

Editorial Highlights

Market Reassurance Amid Trade Tensions

Recent uncertainties around tariffs had shaken export-dependent businesses. The announcement of tax relaxation has renewed optimism and encouraged a shift in strategy toward domestic markets.Fulfillment of Long-Awaited Reform

The move to a simpler two-rate system is a long-standing demand since GST’s 2017 rollout. This change is viewed not merely as rate adjustment, but as a critical decision to align the tax system with business realities.Massive Business Preparations Ahead

Companies must now overhaul pricing models, logistics, IT infrastructure, and compliance mechanisms to gear up for this sweeping transformation. This includes upgrades to the GST portal to manage a surge in transaction volumes and new rate mapping.Strategic Announcement Timing

Rolling out the reform around Independence Day, with implementation expected by Diwali, sends a powerful signal. It emphasizes both intent and urgency, ensuring the reform has immediate and visible economic impact.

What It Means for Stakeholders

| Stakeholders | Implications |

|---|---|

| Businesses & Industry | Accelerated overhaul of systems, pricing strategies, and supply chains. |

| Consumers | Expected relief from lower prices on everyday goods as GST rates compress. |

| Government & Policymakers | A forward-looking reform that stimulates consumption and strengthens economic governance. |

| Economy at Large | Likely to spur domestic demand, enhance fiscal clarity, and navigate external headwinds. |