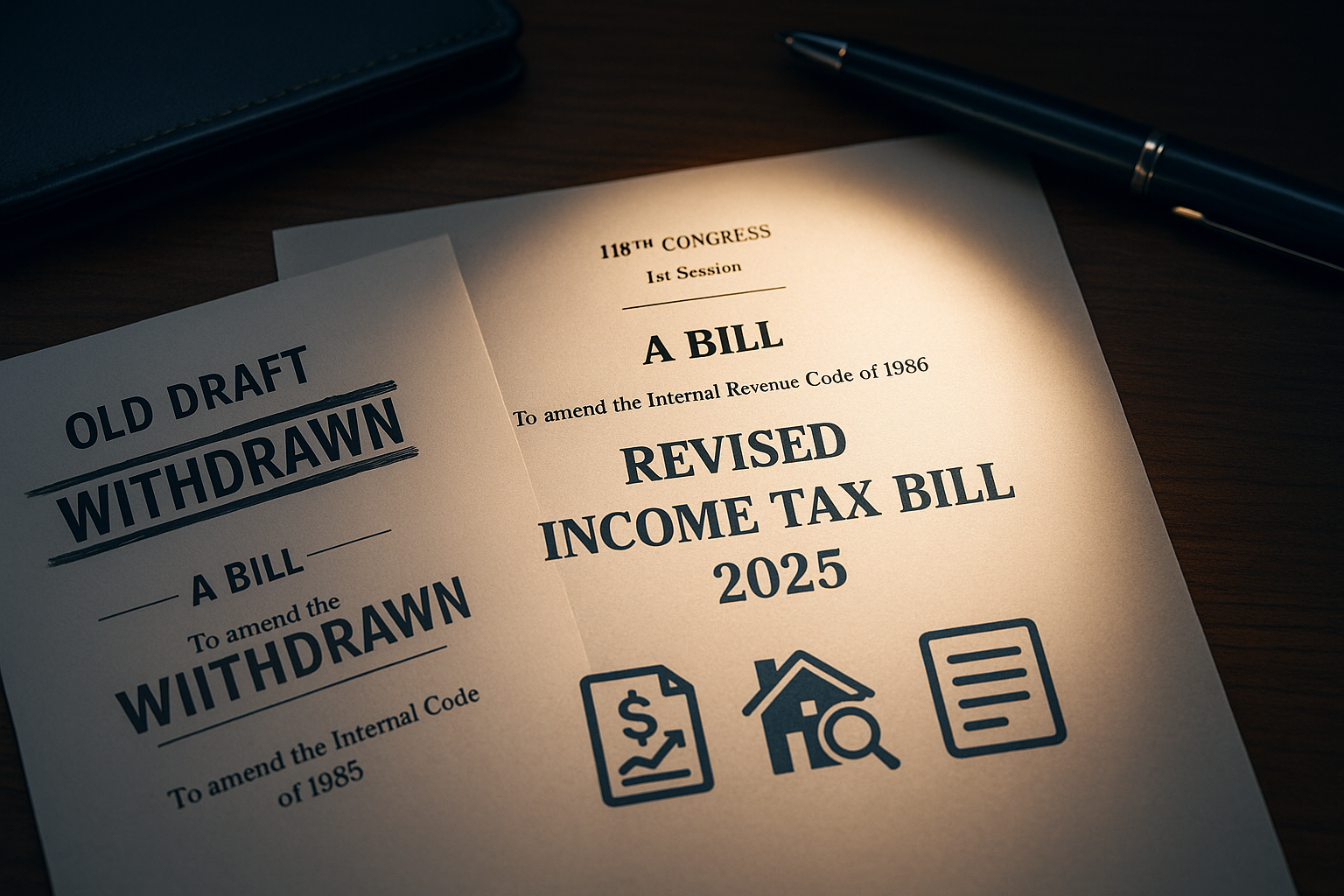

After withdrawing the original Income Tax Bill, 2025 due to drafting errors and ambiguities, the Government of India will reintroduce a revised version in the Lok Sabha today. The updated Bill addresses key concerns—particularly around tax refunds, house property valuation, and legislative clarity—with the aim of simplifying tax compliance and reducing litigation risks.

Background

The Income Tax Bill, 2025 was originally tabled in the Lok Sabha on February 13, 2025, aiming to replace the antiquated Income Tax Act, 1961. However, following scrutiny by a Select Committee, several critical clauses—such as those governing house property valuation and refund eligibility—were found to be ambiguous or potentially unfair, prompting the government to withdraw the Bill on August 8. The revised version integrates over 285 recommendations from the committee, stakeholder inputs, and necessary drafting corrections to ensure clarity and alignment with legal intent.

Key Changes in the Revised Bill

Refunds for Late Filers

The earlier Bill denied tax refunds if Income Tax Returns (ITRs) were filed past the due date.

The revised Bill removes this restrictive clause, enabling eligible taxpayers to claim refunds even after filing late.

Clarity in House Property Valuation

The original draft included the vague phrase “in normal course” to determine annual value of properties, resulting in ambiguity.

The revised version removes this phrase and reinstates clarity by ensuring valuation allows comparison between actual rent received and deemed rent.

Simplified Legal Language & Structure

The Bill’s language, presentation, and cross-referencing have been streamlined to reduce confusion and litigation potential. It aims to simplify compliance for salaried individuals, business owners, and property holders.

Broader Implications

For Taxpayers: A clearer, more accessible law with fairer treatment for inadvertent late filers.

For Businesses & Property Owners: Greater certainty around tax interpretations and compliance.

For Government & Parliament: A smoother legislative process with reduced back-and-forth and improved public trust.

What to Expect Next

The revised Income Tax Bill is scheduled for reintroduction today (August 11). Post-introduction, it will undergo further parliamentary review, potential debate, and recommendations from the Select Committee before final passage.