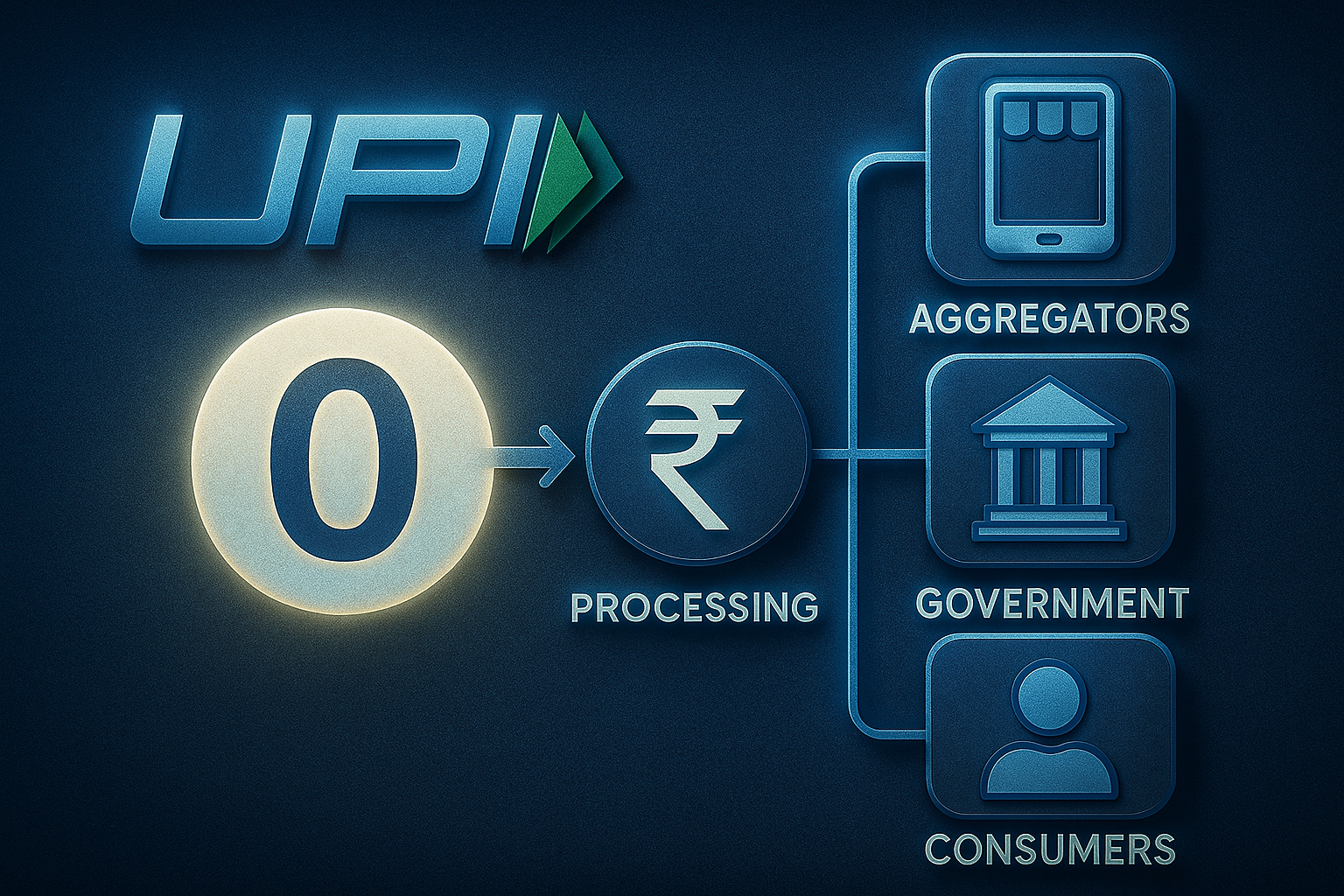

Reserve Bank of India Governor Sanjay Malhotra emphasized that while the Unified Payments Interface (UPI) has delivered transformative results, the cost of sustaining it can’t be ignored. He clarified that, although UPI transactions remain free for users, someone must ultimately bear the operational costs—whether it’s the government, banks, aggregators, or users.

Background & Context

UPI’s zero-cost model has stimulated billions of digital payments, contributing to its status as a global fintech phenomenon. The digital infrastructure behind this system—maintained by NPCI, banks, and PSPs—remains heavily subsidized by the government. With daily volumes crossing 700 million, the sustainability of this model is increasingly under scrutiny.

What RBI Governor Said

At a Monetary Policy Committee (MPC) press briefing, Governor Malhotra remarked:

-

“I never said UPI cannot stay free forever… There are costs. They have to be paid by someone.”

-

The key takeaway: Who pays is secondary—the priority is ensuring someone does.

Signs of Change: Banks Begin Imposing Fees

ICICI Bank became the first to introduce specific charges:

-

2 bps (₹0.02 per ₹100) per transaction capped at ₹6 for aggregators with escrow accounts.

-

4 bps (₹0.04 per ₹100) capped at ₹10 for other aggregators.

-

No charges apply if routed via merchants’ ICICI accounts.

This move underscores the strain on UPI infrastructure and suggests cost pass-through may begin in select channels.

Sustainability Concerns

-

UPI’s subsidy commitment has grown significantly—from ₹957 crore (FY 2021–22) to ₹3,268 crore (FY 2023–24), with ₹2,000 crore allocated for FY 2024–25.

-

The zero MDR policy continues to bolster UPI adoption, but long-term subsidy scaling raises fiscal and financial stability concerns.

Implications for Stakeholders

| Stakeholder | Implication |

|---|---|

| Consumers & Merchants | For now, UPI remains free—but minor transaction costs could emerge for specific use cases. |

| Banks & PSPs | May seek cost recovery, particularly from aggregators handling bulk UPI flows. |

| Government & Policymakers | Must balance access, affordability, and the fiscal burden of sustaining UPI. |

| Fintech Ecosystem | Charging models may reshape how UPI-based services are priced and delivered. |