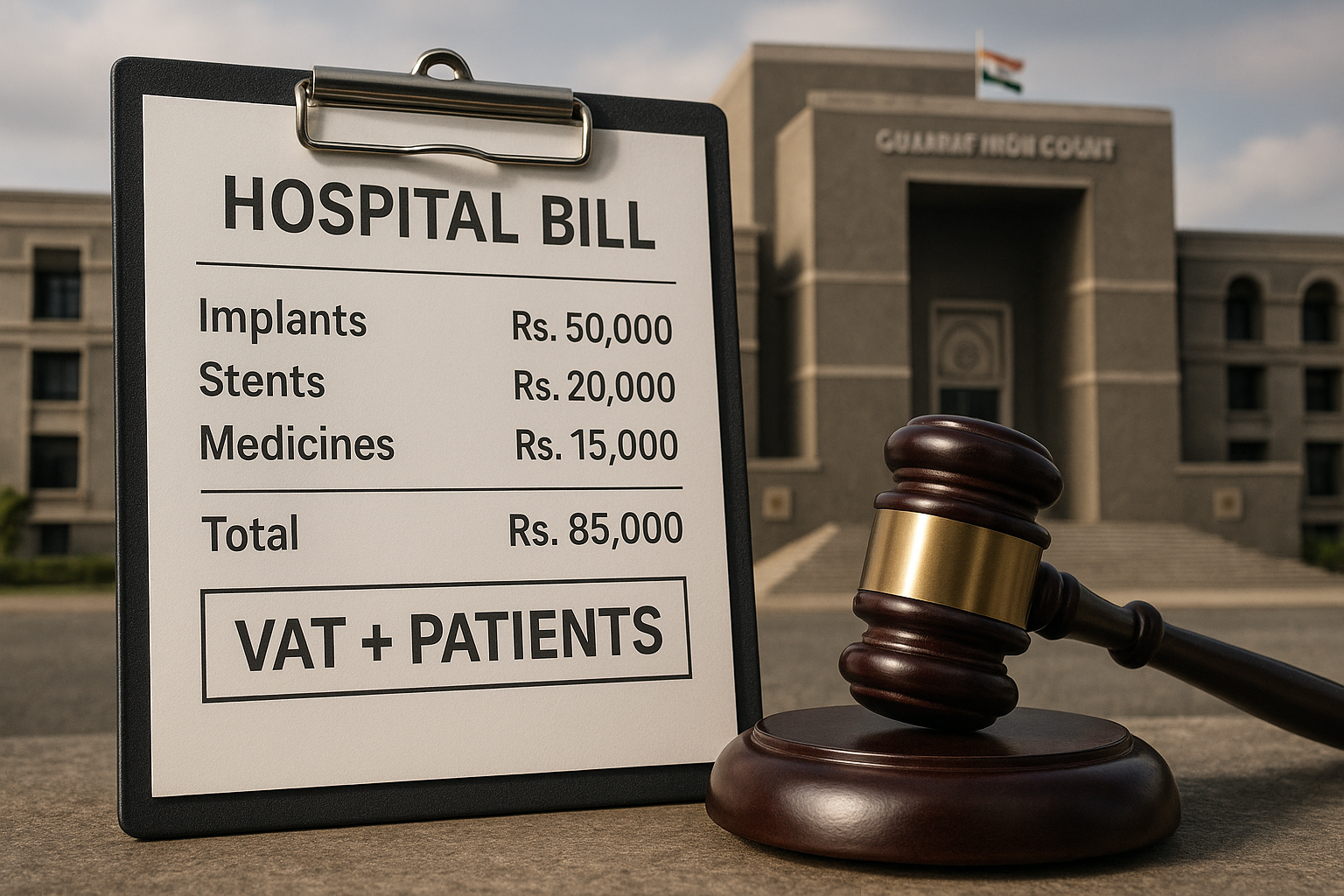

On July 26, 2025, the Gujarat High Court upheld a landmark policy: private hospitals must pay Value Added Tax (VAT) on the sale of medicines, implants, prosthetics, stents, and other consumables provided to in‑patients during treatment. The decision upholds the state tax authorities’ right to pursue recovery from hospital operators.

Case Background

Since 2011, several private hospitals challenged VAT notices demanding tax on consumables provided as part of medical services. The state contended that these constitute ‘sale’ of goods and are thus taxable—despite hospitals’ argument that such supplies are incidental to healthcare services, not discrete transactions.

Court’s Observations & Ruling

The Bench rejected the hospitals’ claims that consumables are bundled into a single “healthcare service”, not a sale. Key reasons:

-

The taxable items are supplied separately to admitted patients, treated as distinct goods transfers.

-

Hospitals act as dealers under VAT law when supplying these goods in the course of business—even to admitted patients.

-

Earlier judicial precedents limiting tax on charitable entities (like Bhailal Amin General Hospital) were distinguished: institutional players with significant service‑cost recovery obligations don’t qualify for exemption.

With this final ruling, VAT authorities may now recover amounts estimated up to ₹1,000 crore from affected hospitals.

Legal Context & Interpretative Shifts

-

Historically, states hesitated to levy VAT on medical goods when embedded within bundled charges.

-

Earlier judgments from other jurisdictions (Haryana, Punjab, Jharkhand) had excluded medical implants from sale classification when integral to a service contract.

-

However, Gujarat’s decision draws a firm line: supply of implantables or stents alone constitutes a taxable sale—not immune by virtue of being part of patient care.

Implications for Stakeholders

Private Hospital Operators

-

Need to review billing models: break out consumables explicitly, calculate VAT, and adjust invoicing accordingly.

-

Budget for retroactive tax liabilities, interest, and possible penalties tied to past non-compliance.

Patients & Insurers

-

Total treatment bills may increase.

-

Medical insurance claim systems may need to align coverage definitions with taxable value line-items.

Tax Authorities

-

Have precedent to pursue recovery from hospitals.

-

May issue clarifications or circulars to guide other states, or extend enforcement to other hospital chains.

Regulatory & Public Health

-

The ruling may spark debate over access and affordability—particularly in states where VAT payments could raise patient charges.

Expert Views

“The Gujarat High Court has decisively drawn the line: supplies cannot be bundled as healthcare services to avoid VAT. Hospitals must now segregate billable goods transparently,” said CA Manish Mishra, indirect tax advisor.

“This sets a precedent likely to impact VAT regimes in other states. Hospitals must ensure robust GST migration compliance along similar lines,” added CA Manoj Kumar Singh, tax strategy consultant.

Conclusion

The Gujarat High Court’s judgment marks an important shift in tax treatment of hospital-supplied medical consumables—mandating VAT even on items previously deemed a part of bundled healthcare services. As recovery actions loom, private hospitals must closely review tax compliance, invoice structuring, and financial provisioning. For patients, operators, and insurers alike, this ruling underscores the need for transparent billing and regulatory certainty in healthcare pricing.