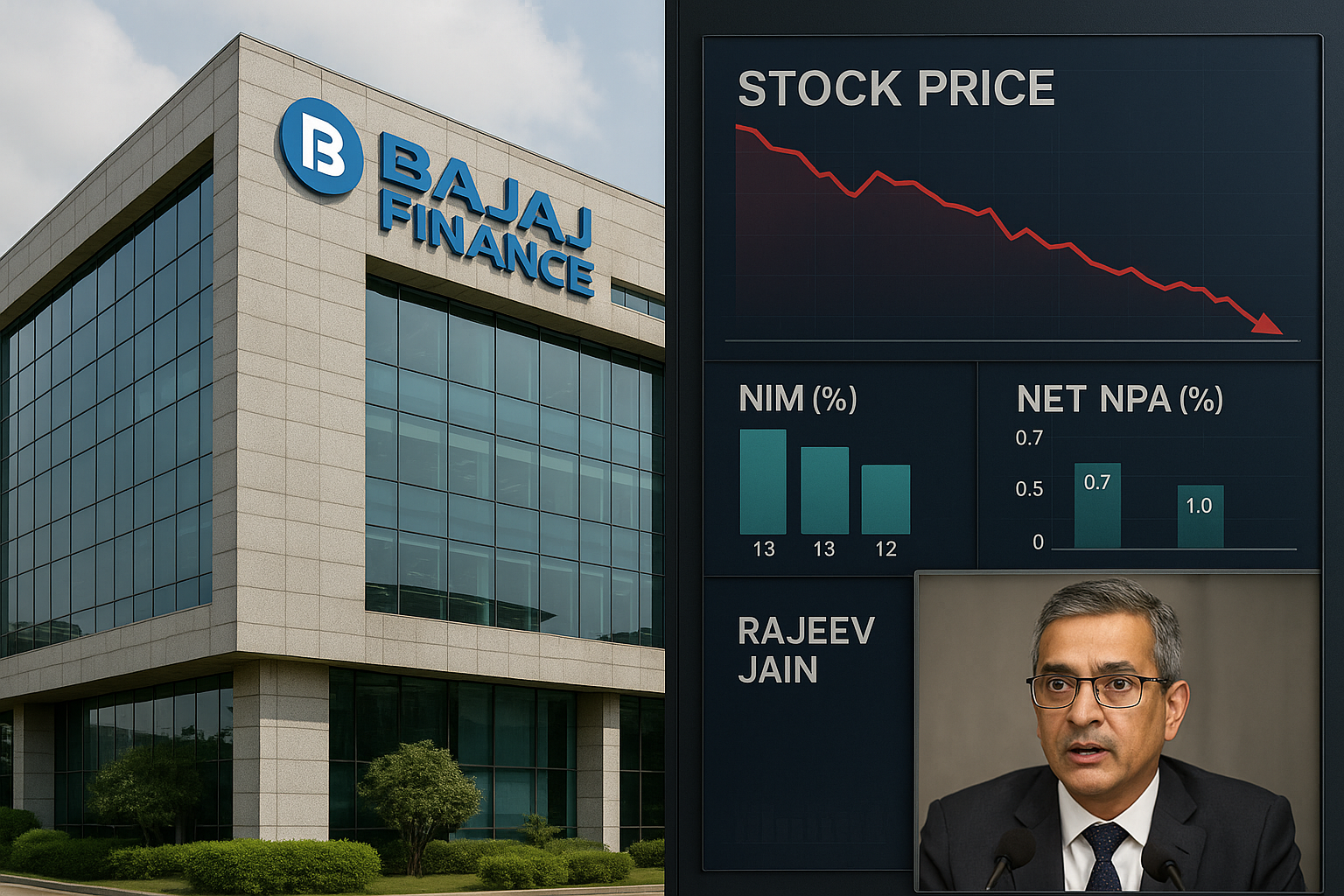

Bajaj Finance Ltd., one of India’s most closely tracked non-banking financial companies (NBFCs), posted its Q1 FY25 earnings, triggering a mild market correction despite reporting double-digit growth. While topline performance was solid, analysts flagged concerns over net interest margins (NIMs) and asset quality metrics, leading to a sharp investor reaction.

Yet, with Rajeev Jain and Anup Saha reaffirming the company’s strategic direction, the long-term thesis around Bajaj Finance’s digital lending engine remains compelling.

Q1 FY25 Key Financial Highlights

| Metric | Q1 FY25 | YoY Growth |

|---|---|---|

| Net Profit | ₹3,439 crore | +4.9% |

| Net Interest Income (NII) | ₹8,013 crore | +22.4% |

| Loan Book | ₹3.14 lakh crore | +31% |

| Customer Franchise | 83.64 million | +22% |

| Gross NPA | 0.87% | ↑ 10 bps |

| Net NPA | 0.31% | ↑ 4 bps |

While the loan book expansion and NII growth were in line with Street expectations, the subdued PAT growth raised eyebrows.

Market Reaction

Post-results, Bajaj Finance stock fell over 5% intraday, reflecting concerns over pressure on margins and the increasing cost of funds. The NIM compression, although not alarming, signaled tighter spreads in a rising rate environment.

“Markets had priced in a stronger beat. Even a small miss gets punished when expectations are sky-high,” said a senior analyst at a Mumbai-based brokerage.

Management Commentary & Strategy

Rajeev Jain (MD) acknowledged that the quarter saw normalizing growth trends as the company adapts to the rising cost of borrowing. Anup Saha (Deputy MD) highlighted their continued focus on digital ecosystem expansion, including the Bajaj Finserv App and EMI card business.

Key Strategic Updates:

-

B2B & EMI segment remains strong despite macro headwinds.

-

Investments in data-led underwriting and AI-driven collections to scale operations efficiently.

-

Continued expansion in tier-2 and tier-3 cities, supported by the “phygital” model.

Analyst Views

“Bajaj Finance remains a high-quality compounder, but valuations leave little room for error,”

– CA Manish Mishra.

“NIM compression was expected, but rising NPAs—though modest—will be closely watched next quarter,”

– CA Manoj Kumar Singh.

Outlook and Valuation

Despite the Q1 miss, the management’s long-term commentary and diversified portfolio strength maintain positive sentiment among institutional investors. However, any further deterioration in margins or asset quality could weigh on near-term stock performance.

-

Stock Valuation (as of July 23, 2025):

-

Price: ₹7,480

-

PE (TTM): ~34x

-

12-month Target Range: ₹7,300–₹8,200

-

Conclusion

Bajaj Finance’s Q1FY25 results highlight the fine balance between aggressive growth and risk management. As India’s lending landscape becomes increasingly competitive and regulated, maintaining margin resilience while scaling digitally will define future earnings quality. For now, investors may need to recalibrate expectations—without losing sight of the company’s long-term trajectory.