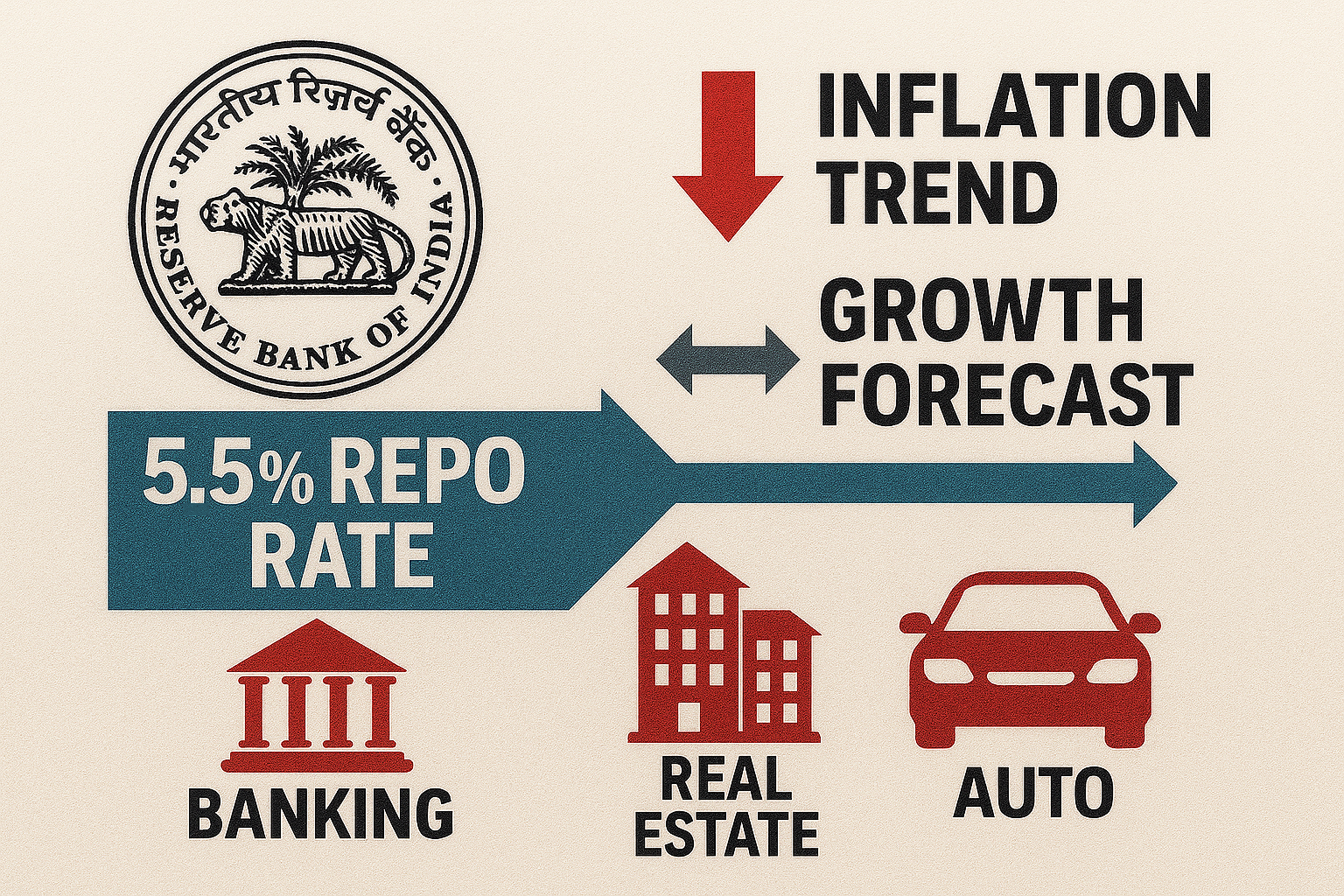

At its August 6 meeting, the Reserve Bank of India’s Monetary Policy Committee (MPC) unanimously maintained the repo rate at 5.5% and retained a neutral stance. This marks the first pause after three consecutive rate cuts totaling 100 basis points this year. The central bank cited ongoing concerns around global uncertainties—particularly U.S.–India trade tensions—and slowed transmission of earlier cuts as the rationale for holding rates core.

Terminal Rate Set at 5.5% for Now

According to Bank of Baroda economist Jahnavi Prabhakar, 5.5% is now the effective terminal or steady-state repo rate, unlikely to change materially in the near term. She notes that further rate cuts may only happen in Q3 FY26, and even then, conditional on sustained inflation below 4% into Q4 FY26 or Q1 FY27.

Growth & Inflation Forecast: Soft but Stable

Inflation Outlook: RBI lowered its FY26 CPI inflation forecast from 3.7% to 3.1%, citing easing food prices and robust monsoon-led crop supply. Core inflation is expected to stay in the 4.0–4.4% range.

Growth Forecast: GDP growth projected at 6.5% for FY26, with quarterly projections spanning—Q1: 6.5%, Q2: 6.7%, Q3: 6.6%, Q4: 6.3%, and Q1 FY27 at 6.6%. Risks are viewed as balanced.

Market & Sector Reaction

The decision triggered mixed equity reactions:

Rate-sensitive sectors—including banking, NBFCs, real estate, and autos—saw share prices fall up to 4%.

Analysts note that investors had priced in more aggressive easing; the pause reversed short-term optimism and fueled liquidity concerns.

The RBI is slowly watching the transmission of earlier rate cuts into credit growth and lending spreads. tight bank margins have yet to fully translate into economic stimulus.

Context: Why Rate Cuts Are on Hold

In June 2025, RBI delivered a surprise 50 bps repo cut and 100 bps CRR cut, shifting from accommodative to neutral policy. That front-loaded easing aimed at accelerating credit growth.

However, given the uncertainty around U.S. trade tariffs, weakening rupee, and external demand fragility, policymakers opted to pause and assess macro transmission fully.

Expert Commentary & Forward View

Anand Rathi’s Sujan Hajra suggests the terminal rate may eventually settle at around 5% if inflation remains comfortably below 4% for several quarters. However, further cuts will depend on resilient growth performance.

DBS Bank’s Radhika Rao and Kotak’s Upasna Bhardwaj agree the bank has limited headroom for additional easing unless growth weakens sharply or inflation decelerates more than anticipated.

Key Takeaways

Repo Rate Held at 5.5%: RBI remains cautious amid global uncertainties despite disinflation.

Data-Dependent Approach: Any further easing contingent on inflation trends and credit transmission.

Next Rate Move Likely in Q3 FY26: If inflation stays below 4%, a 25–50 bps reduction is possible.

Financial Stocks Under Pressure: Real estate, autos, and BFSI stocks reacted negatively due to rate-sensitive outlook.