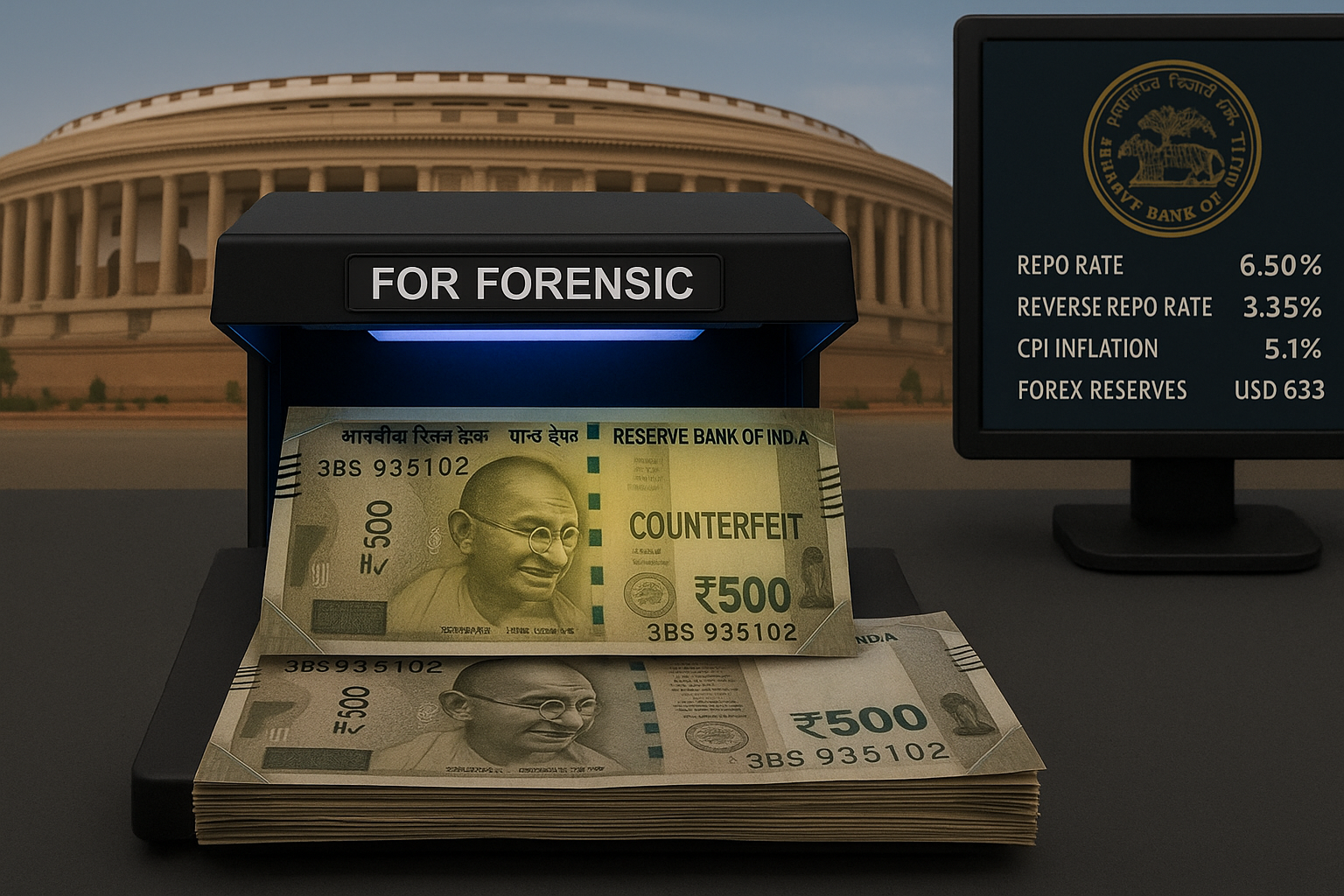

RBI Governor Sanjay Malhotra informed the Parliamentary Standing Committee on Finance that 1.12 lakh fake ₹500 currency notes were detected during FY 2024–25, marking a 37% increase from the previous year. While overall counterfeit detection has declined slightly, the surge in high-denomination fakes has raised concerns within regulatory and political circles.

Background and Context

During a high-level session chaired by BJP MP Bhartruhari Mahtab, the RBI governor presented key data from the RBI’s Annual Report 2024–25, offering insights into currency security, note circulation, and the central bank’s evolving role.

Malhotra clarified that although ₹2,000 notes are out of circulation, they remain legal tender—a topic that drew questions from several Members of Parliament (MPs).

Key Highlights from RBI’s Annual Report & Panel Session

Counterfeit ₹500 Notes Soar

FY24–25: 1.18 lakh fake ₹500 notes detected

FY23–24: 85,711 fake notes

YoY Spike: +37%

Overall Fake Notes Decline Slightly

2024–25: 2.18 lakh pieces

2023–24: 2.23 lakh pieces

Other Denominations Affected

₹100 notes: 51,069 fake

₹200 notes: 32,660 fake

₹2,000 notes: 3,508 fake

Parliamentary Panel Reactions & Criticism

Multiple Roles of RBI Questioned

Congress MP Manish Tewari flagged potential “conflicts of interest,” suggesting RBI should focus strictly on core banking regulation rather than spreading into various functions.

Rural Banking Challenges

Concerns raised over the declining number of Banking Correspondents (BCs) in rural areas.

Issues cited: poor internet access, lack of laptops/tablets, and tech readiness.

Oversight on Ombudsman Mechanism

MPs also recommended that RBI enhance its monitoring of bank ombudsmen, ensuring that customer grievances are addressed across all states effectively.

RBI’s Stand on ₹2,000 Notes

Malhotra reiterated that ₹2,000 notes, although withdrawn from circulation, are not invalid. They continue to be legal tender, but their active use is minimal after the central bank’s withdrawal announcement in May 2023.

Expert Opinion

Sudeep Bandyopadhyay, Chairman, Inditrade Capital:

“The spike in counterfeit high-value notes is alarming, especially in an age of digital payments. It calls for tighter currency surveillance and faster shift to digital ecosystems.”

Anupam Gupta, Economist:

“The ₹500 denomination remains the most transacted note in the Indian economy. Naturally, it’s the most targeted by counterfeiters. But the declining overall fake notes suggest that RBI’s detection systems are improving.”

Implications for the BFSI Sector

Banks will likely face heightened compliance audits on cash management and counterfeit detection systems.

Fintech and payment companies may be nudged to deepen penetration in rural India to reduce cash dependence.

NBFCs and microfinance institutions could also be impacted by the withdrawal of BC agents in remote areas due to digital infrastructure gaps.

Conclusion

While the overall number of fake notes fell, the 37% surge in counterfeit ₹500 notes underscores continuing security risks in India’s cash economy. Combined with the phasing out of ₹2,000 notes and the challenges faced in rural banking outreach, the RBI has its work cut out in balancing monetary stability, security, and inclusion.